Stock Analysis

COFCO Joycome Foods (HKG:1610 investor three-year losses grow to 29% as the stock sheds HK$412m this past week

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term COFCO Joycome Foods Limited (HKG:1610) shareholders have had that experience, with the share price dropping 38% in three years, versus a market decline of about 18%. More recently, the share price has dropped a further 13% in a month. But this could be related to poor market conditions -- stocks are down 6.2% in the same time.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for COFCO Joycome Foods

COFCO Joycome Foods wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years COFCO Joycome Foods saw its revenue shrink by 15% per year. That's definitely a weaker result than most pre-profit companies report. With revenue in decline, the share price decline of 11% per year is hardly undeserved. It would probably be worth asking whether the company can fund itself to profitability. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

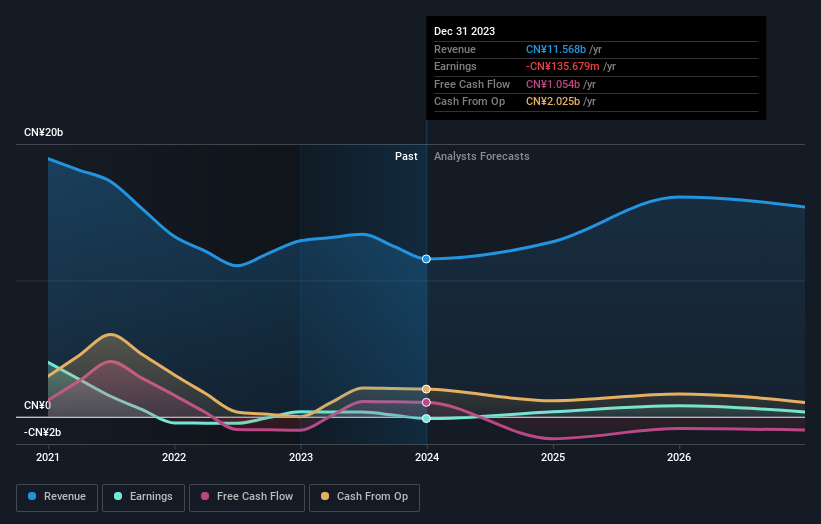

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at COFCO Joycome Foods' financial health with this free report on its balance sheet.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. In some ways, TSR is a better measure of how well an investment has performed. COFCO Joycome Foods' TSR over the last 3 years is -29%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

While the broader market gained around 3.0% in the last year, COFCO Joycome Foods shareholders lost 3.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of COFCO Joycome Foods' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like COFCO Joycome Foods better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether COFCO Joycome Foods is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether COFCO Joycome Foods is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1610

COFCO Joycome Foods

An investment holding company, engages in the production and sales of hog, and livestock slaughtering businesses in Mainland China.

Reasonable growth potential with adequate balance sheet.