June 2024 Insight On Undervalued Small Caps With Insider Buys In Hong Kong

Amidst a backdrop of fluctuating global markets, the Hong Kong small-cap sector presents unique opportunities for discerning investors. With recent insider buying signaling potential undervalued gems, this article explores three such stocks poised for attention in June 2024.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Xtep International Holdings | 11.2x | 0.8x | 40.40% | ★★★★★☆ |

| Tian Lun Gas Holdings | 7.2x | 0.4x | 22.22% | ★★★★★☆ |

| Far East Consortium International | NA | 0.3x | 36.63% | ★★★★★☆ |

| Nissin Foods | 15.3x | 1.4x | 35.02% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.7x | 0.7x | 28.65% | ★★★★☆☆ |

| China Lesso Group Holdings | 4.2x | 0.3x | 5.22% | ★★★★☆☆ |

| Transport International Holdings | 11.0x | 0.6x | 45.53% | ★★★★☆☆ |

| Abbisko Cayman | NA | 96.3x | 35.86% | ★★★★☆☆ |

| Giordano International | 8.8x | 0.8x | 35.02% | ★★★☆☆☆ |

| China Overseas Grand Oceans Group | 3.1x | 0.1x | -11.41% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Nissin Foods (SEHK:1475)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nissin Foods is a manufacturer and distributor of instant noodles and other food products, primarily serving markets in Mainland China, Hong Kong, and other parts of Asia.

Operations: Mainland China and Hong Kong, along with other Asian regions, significantly contribute to the revenue, generating HK$2.47 billion and HK$1.68 billion respectively. The company's gross profit margin has shown an upward trend over recent periods, reaching approximately 34.16% by mid-2024.

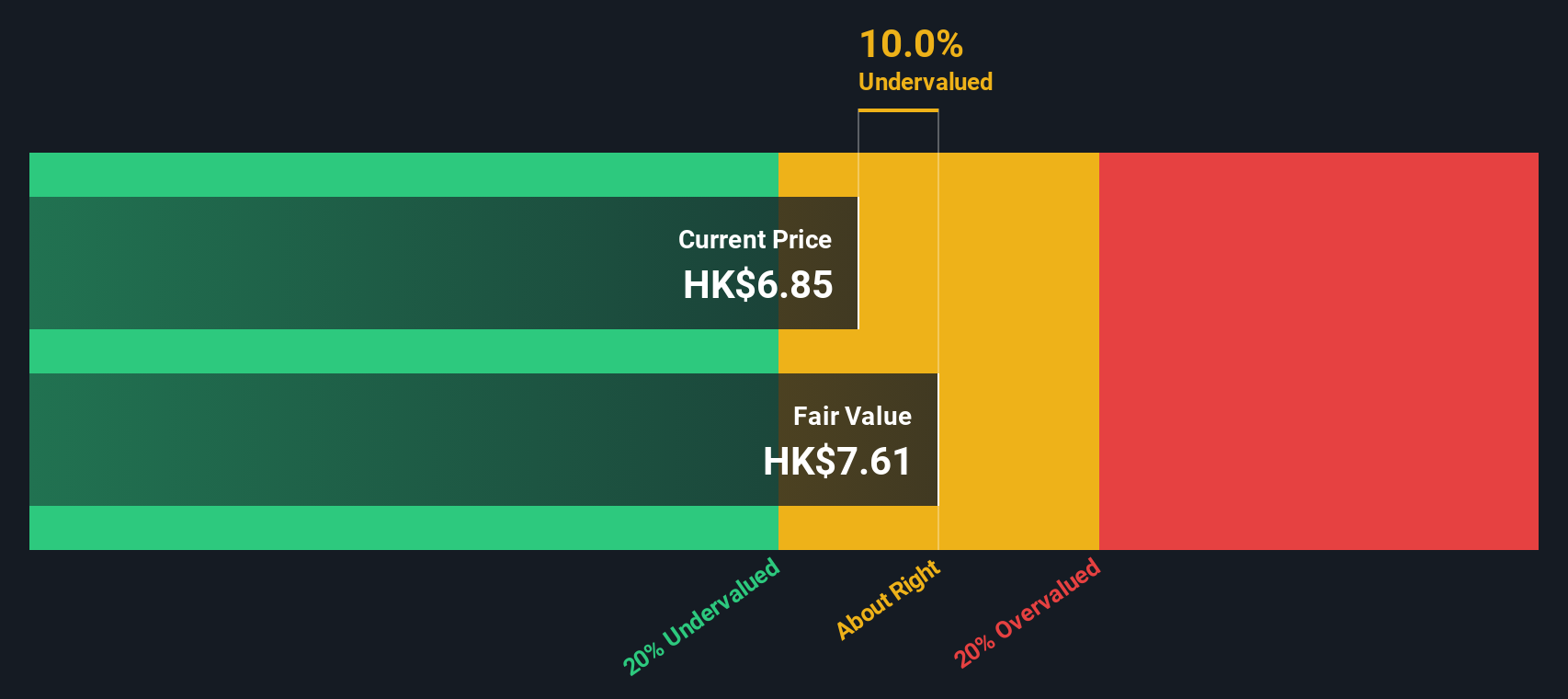

PE: 15.3x

Nissin Foods, a lesser-known entity in Hong Kong's financial landscape, recently showcased insider confidence with Kiyotaka Ando acquiring 155,430 shares. This move signals strong belief in the company’s prospects amidst a challenging environment marked by a slight revenue dip to HK$963.02 million in Q1 2024 from HK$1,036.6 million the previous year. Despite this, net income rose to HK$117.95 million, reflecting resilient operational efficiencies and strategic management adaptations under new executive leadership set for July 2024.

- Take a closer look at Nissin Foods' potential here in our valuation report.

-

Gain insights into Nissin Foods' historical performance by reviewing our past performance report.

Abbisko Cayman (SEHK:2256)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Abbisko Cayman is a company focused on the development of innovative medicines, with a market capitalization of approximately CN¥19.06 billion.

Operations: The entity consistently records a gross profit margin of 100%, indicating that it incurs no cost of goods sold. However, substantial operating expenses, primarily driven by research and development costs which recently amounted to CN¥433.74 million, significantly impact its financial performance, reflected in a net income margin improvement from -79.24% in early 2022 to -22.64% as of mid-2024.

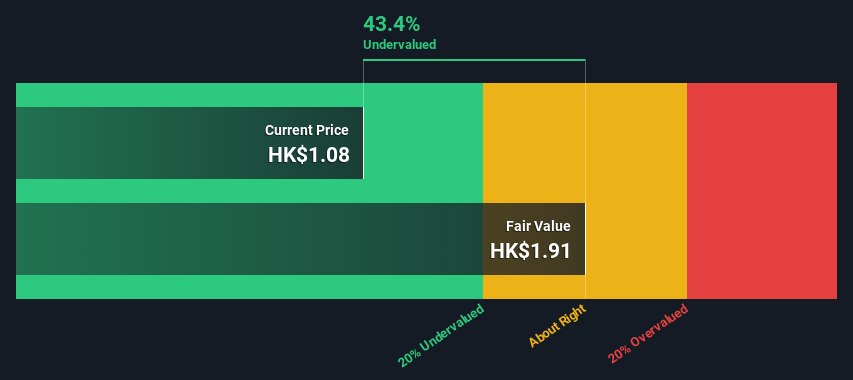

PE: -4.3x

Recently, Abbisko Cayman demonstrated insider confidence through strategic leadership changes, enhancing its governance structure. With a modest revenue of CN¥19M and no immediate path to profitability, the firm remains a speculative yet intriguing prospect within Hong Kong's small-cap arena. The company's innovative FGFR4 inhibitor, irpagratinib, received Orphan Drug Designation from the FDA for treating Hepatocellular Carcinoma—a notable milestone that could pivot its market stance. Despite financial challenges and an average earnings forecast decline of 32.5% annually over the next three years, these developments suggest a potential for future growth driven by specialized therapeutic advancements.

- Get an in-depth perspective on Abbisko Cayman's performance by reading our valuation report here.

-

Review our historical performance report to gain insights into Abbisko Cayman's's past performance.

Far East Consortium International (SEHK:35)

Simply Wall St Value Rating: ★★★★★☆

Overview: Far East Consortium International is a diversified company primarily engaged in property development and investment across various regions including Hong Kong, Australia, the UK, and Singapore, with additional operations in hotel management and gaming.

Operations: The company's gross profit margin has shown variability over the observed periods, ranging from 32.61% to 54.81%, reflecting changes in cost of goods sold and revenue dynamics. Notably, significant revenue contributors include Property Development in Australia and Singapore, generating HK$3.32 billion and HK$2.07 billion respectively, which underscores a strong geographical focus in these markets for real estate activities.

PE: -18.1x

Recently, Far East Consortium International demonstrated a strong vote of confidence from insiders, with Chairman & CEO Tat Cheong Chiu acquiring 5.89 million shares for HK$70.32 million, signaling potential underappreciation in the market. This move aligns with a financial strategy reliant on external borrowing, which carries its risks but suggests an aggressive pursuit of growth opportunities. While the company has experienced shareholder dilution over the past year, these insider purchases may hint at promising future prospects yet to be recognized by the broader market.

Taking Advantage

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 13 more companies for you to explore.Click here to unveil our expertly curated list of 16 Undervalued Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissin Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1475

Nissin Foods

Engages in manufacturing and selling instant noodles in Hong Kong, Mainland China, Canada, Australia, the United States, Taiwan, Macau, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives