If You Had Bought YuanShengTai Dairy Farm (HKG:1431) Stock A Year Ago, You Could Pocket A 203% Gain Today

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! Take, for example YuanShengTai Dairy Farm Limited (HKG:1431). Its share price is already up an impressive 203% in the last twelve months. On top of that, the share price is up 49% in about a quarter. Also impressive, the stock is up 176% over three years, making long term shareholders happy, too.

View our latest analysis for YuanShengTai Dairy Farm

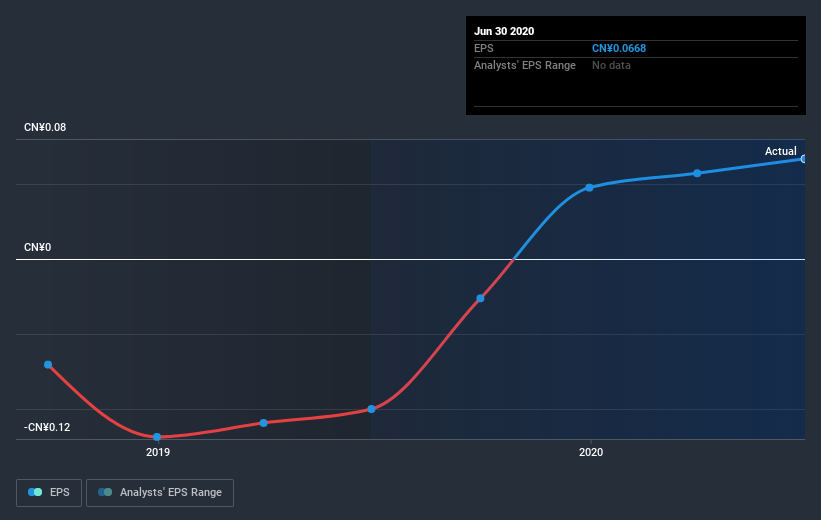

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year YuanShengTai Dairy Farm grew its earnings per share, moving from a loss to a profit.

We think the growth looks very prospective, so we're not surprised the market liked it too. Inflection points like this can be a great time to take a closer look at a company.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on YuanShengTai Dairy Farm's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that YuanShengTai Dairy Farm shareholders have received a total shareholder return of 203% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 14% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with YuanShengTai Dairy Farm (including 1 which is potentially serious) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading YuanShengTai Dairy Farm or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1431

YuanShengTai Dairy Farm

A dairy farming company, engages in the production and sale of raw cow and goat milk in the People’s Republic of China.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives