Even With A 117% Surge, Cautious Investors Are Not Rewarding Huisheng International Holdings Limited's (HKG:1340) Performance Completely

Huisheng International Holdings Limited (HKG:1340) shareholders would be excited to see that the share price has had a great month, posting a 117% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.4% in the last twelve months.

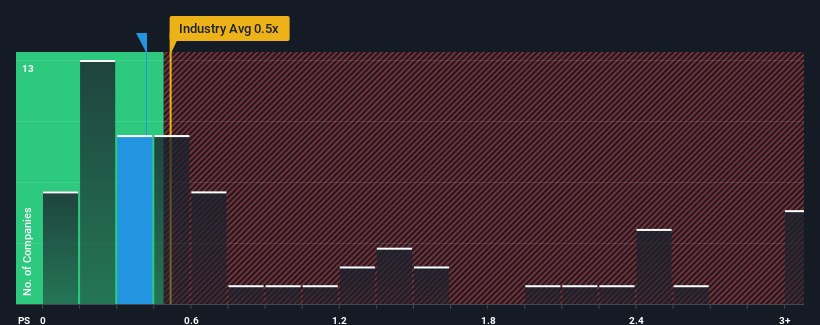

Although its price has surged higher, you could still be forgiven for feeling indifferent about Huisheng International Holdings' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Food industry in Hong Kong is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Huisheng International Holdings

How Huisheng International Holdings Has Been Performing

Huisheng International Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Huisheng International Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Huisheng International Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 101%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 6.6%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Huisheng International Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Huisheng International Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Huisheng International Holdings currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Huisheng International Holdings that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Huisheng International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1340

Huisheng International Holdings

An investment holding company, engages in breeding, farming, and slaughtering of hogs in the People’s Republic of China and Japan.

Flawless balance sheet very low.

Market Insights

Community Narratives