Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Tibet Water Resources Ltd. (HKG:1115) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Tibet Water Resources

What Is Tibet Water Resources's Debt?

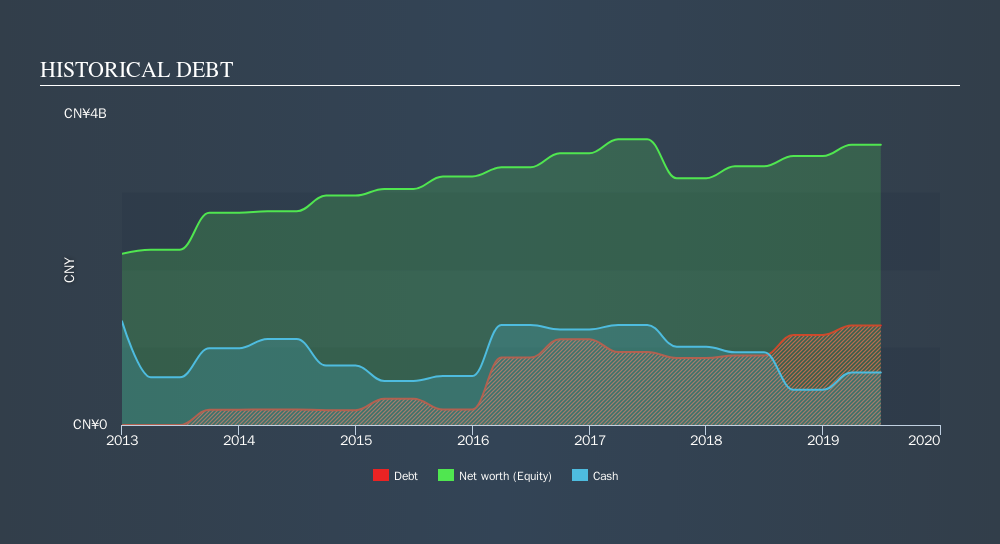

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Tibet Water Resources had CN¥1.28b of debt, an increase on CN¥894.2m, over one year. On the flip side, it has CN¥675.5m in cash leading to net debt of about CN¥605.4m.

A Look At Tibet Water Resources's Liabilities

Zooming in on the latest balance sheet data, we can see that Tibet Water Resources had liabilities of CN¥1.46b due within 12 months and liabilities of CN¥290.1m due beyond that. Offsetting these obligations, it had cash of CN¥675.5m as well as receivables valued at CN¥1.18b due within 12 months. So it actually has CN¥108.5m more liquid assets than total liabilities.

This short term liquidity is a sign that Tibet Water Resources could probably pay off its debt with ease, as its balance sheet is far from stretched.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that Tibet Water Resources's moderate net debt to EBITDA ratio ( being 1.6), indicates prudence when it comes to debt. And its strong interest cover of 35.6 times, makes us even more comfortable. But the bad news is that Tibet Water Resources has seen its EBIT plunge 15% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But it is Tibet Water Resources's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Tibet Water Resources generated free cash flow amounting to a very robust 86% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Tibet Water Resources's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But we must concede we find its EBIT growth rate has the opposite effect. Taking all this data into account, it seems to us that Tibet Water Resources takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. Over time, share prices tend to follow earnings per share, so if you're interested in Tibet Water Resources, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1115

Tibet Water Resources

An investment holding company, engages in the production and sale of water and beer products in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives