As global markets navigate a landscape marked by geopolitical tensions and economic uncertainties, investors are increasingly turning their attention to smaller-cap opportunities in Asia. Penny stocks, while often considered a relic of past trading days, remain relevant for those seeking growth potential at lower price points. These stocks typically represent smaller or newer companies that can offer significant upside when backed by strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.28 | HK$807.62M | ✅ 4 ⚠️ 1 View Analysis > |

| KPa-BM Holdings (SEHK:2663) | HK$0.335 | HK$186.57M | ✅ 2 ⚠️ 4 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.14 | HK$1.9B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.173 | SGD34.46M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.10 | SGD850.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.76 | HK$54.53B | ✅ 3 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,016 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Tibet Water Resources (SEHK:1115)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tibet Water Resources Ltd. is an investment holding company involved in the production and sale of water and beer products in the People’s Republic of China, with a market cap of HK$1.44 billion.

Operations: The company generates revenue from two primary segments: beer, contributing CN¥137.33 million, and water, accounting for CN¥87.52 million.

Market Cap: HK$1.44B

Tibet Water Resources Ltd. is currently unprofitable, with a reported net loss of CN¥573.95 million for 2024, up from CN¥352.87 million in the previous year, primarily due to significant impairment losses on investments. Despite this, the company maintains a satisfactory net debt to equity ratio of 15.7%, and its operating cash flow covers its debt well at 48.3%. Additionally, short-term assets exceed both short and long-term liabilities, providing some financial stability amidst challenges in profitability and revenue decline from CN¥314.43 million to CN¥225.81 million year-on-year.

- Click here to discover the nuances of Tibet Water Resources with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Tibet Water Resources' track record.

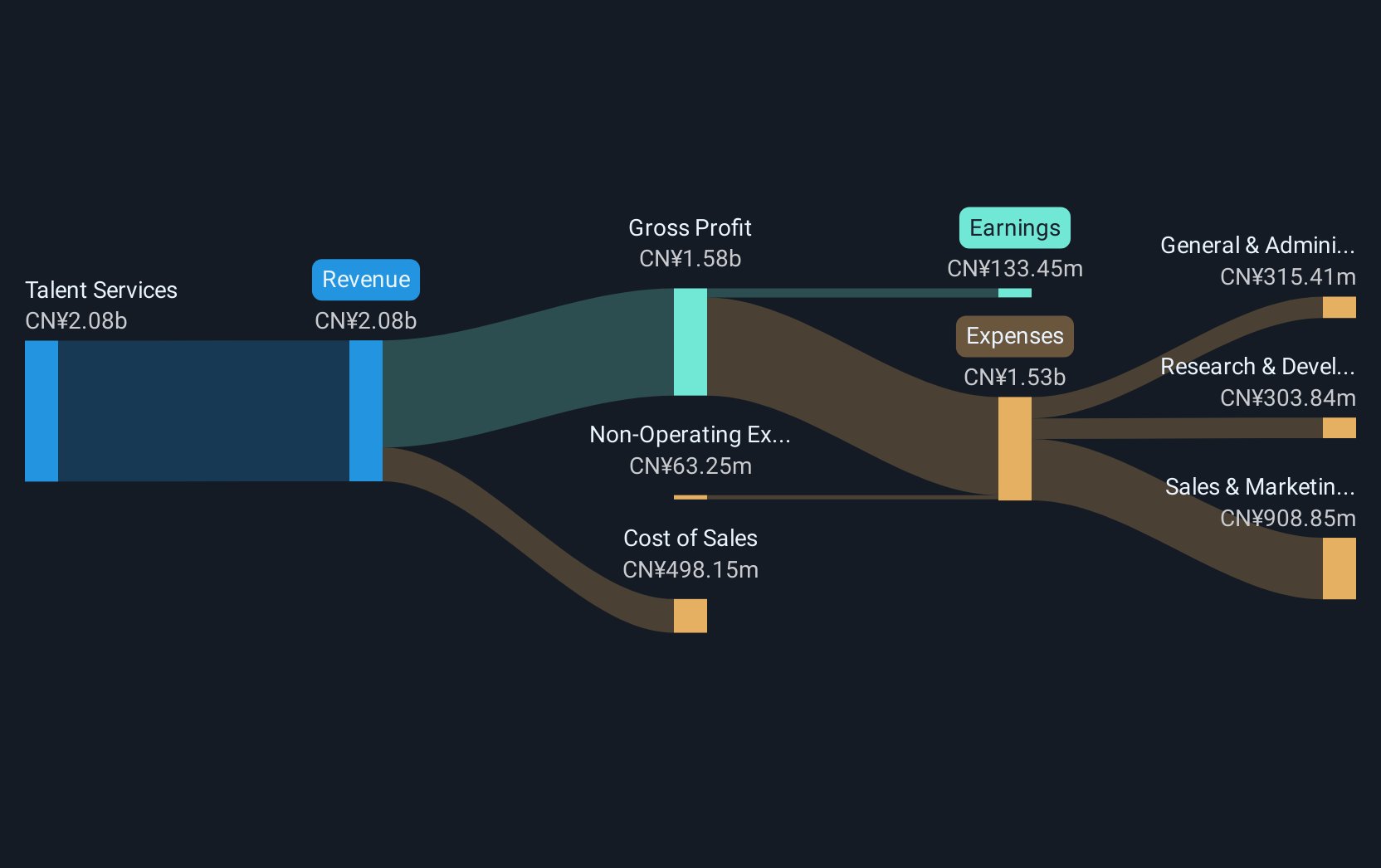

Tongdao Liepin Group (SEHK:6100)

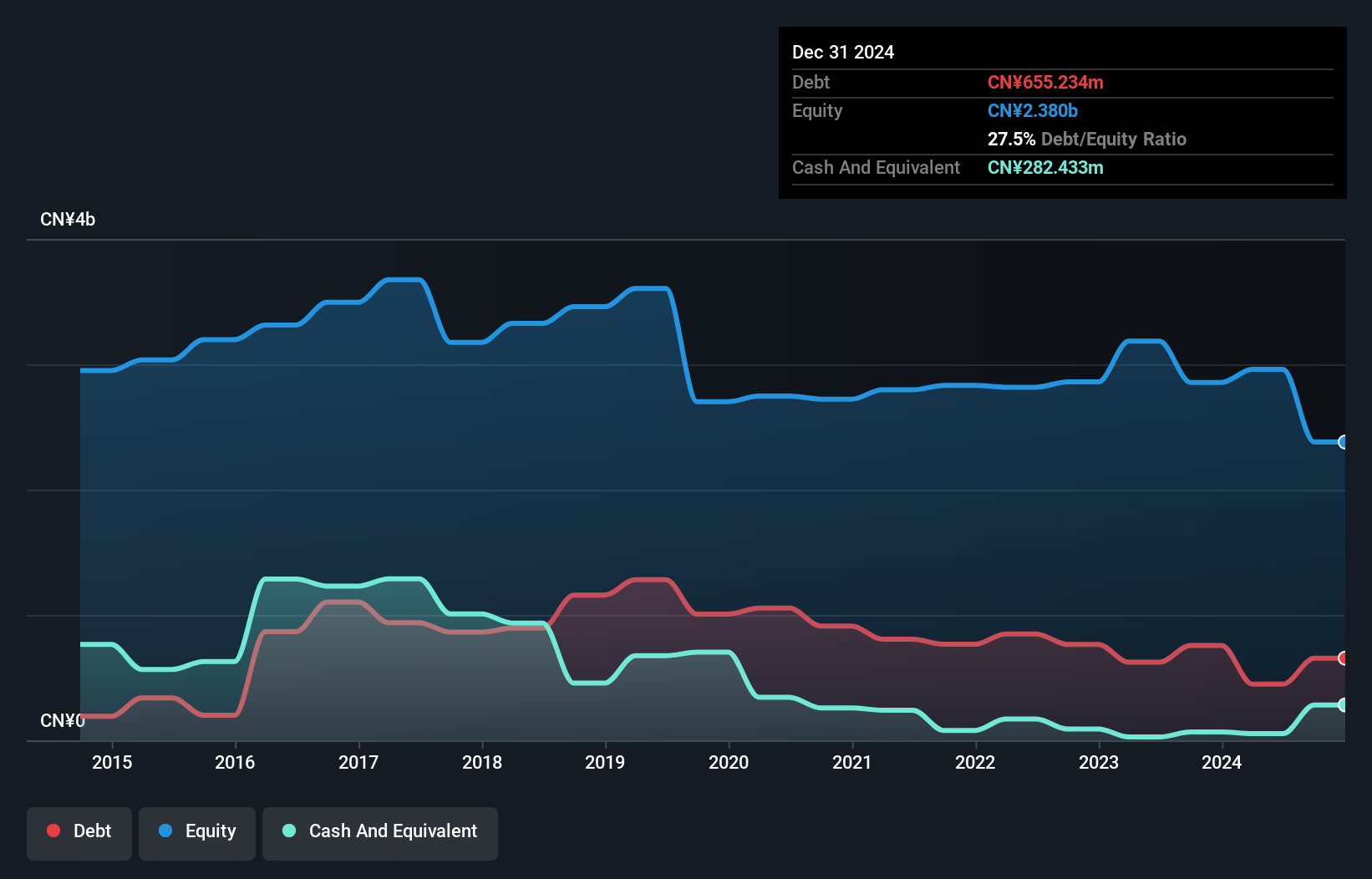

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tongdao Liepin Group, with a market cap of HK$1.97 billion, is an investment holding company that offers talent acquisition services in the People’s Republic of China.

Operations: The company generates revenue through its talent services segment, which amounted to CN¥2.08 billion.

Market Cap: HK$1.97B

Tongdao Liepin Group has demonstrated significant earnings growth, with net income rising to CN¥133.45 million from CN¥0.75 million the previous year, indicating a substantial improvement in profitability. The company's strong financial position is underscored by its cash reserves exceeding total debt and a robust operating cash flow that covers debt obligations effectively. Despite experiencing high share price volatility recently, Tongdao Liepin maintains stable short-term assets surpassing both short and long-term liabilities, ensuring financial resilience. Additionally, the company declared a special dividend of HK$0.42 per share, reflecting shareholder value creation amidst market fluctuations.

- Jump into the full analysis health report here for a deeper understanding of Tongdao Liepin Group.

- Gain insights into Tongdao Liepin Group's outlook and expected performance with our report on the company's earnings estimates.

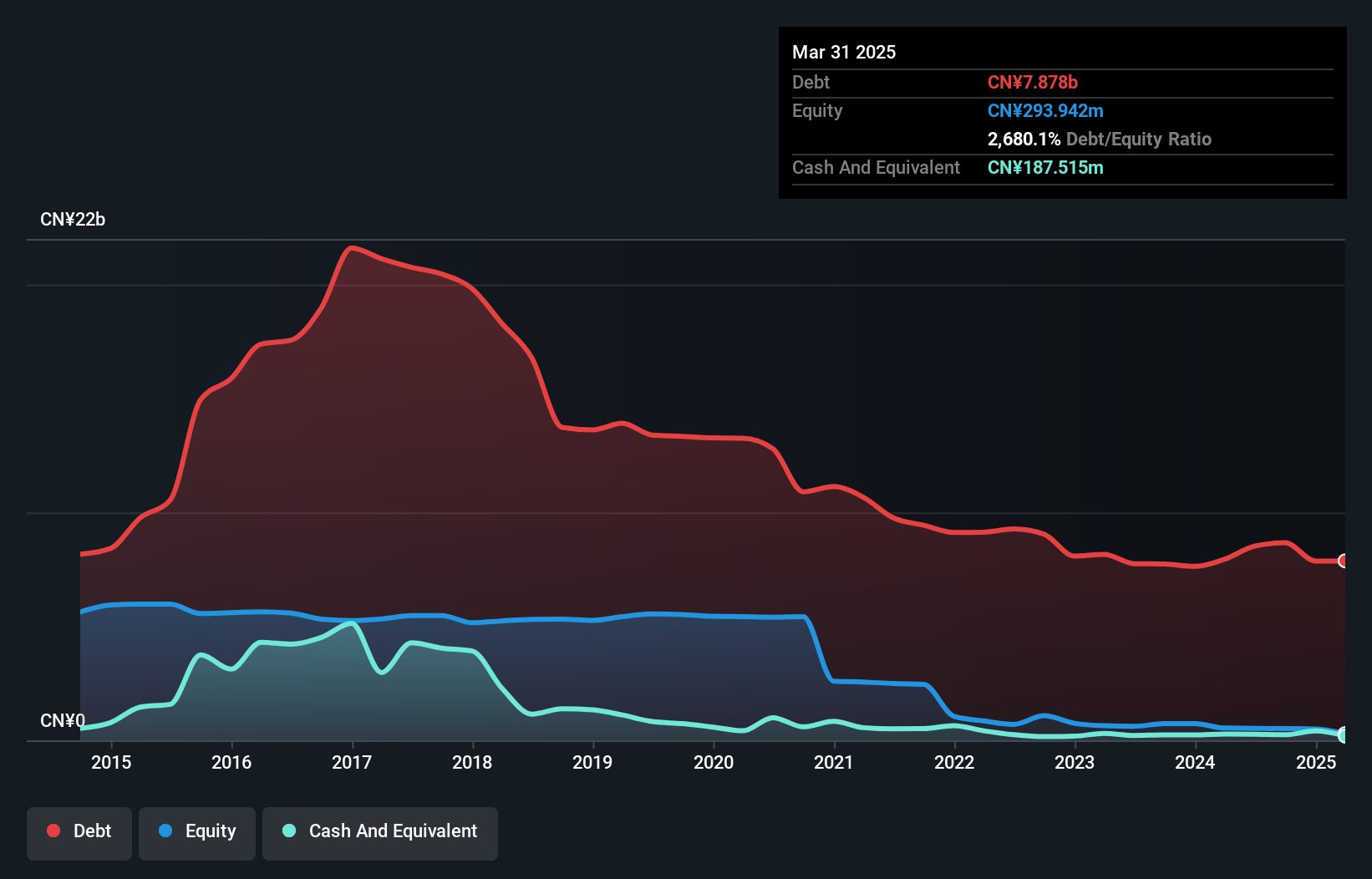

Tianjin Jintou State-owned Urban Development (SHSE:600322)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tianjin Jintou State-owned Urban Development Co., Ltd. operates in the urban development sector and has a market capitalization of CN¥3.32 billion.

Operations: The company generates revenue of CN¥2.72 billion from its operations within China.

Market Cap: CN¥3.32B

Tianjin Jintou State-owned Urban Development faces challenges with a high net debt to equity ratio of 2616.3%, yet it maintains a stable cash runway exceeding three years due to positive free cash flow. Despite being unprofitable, the company has reduced its losses by 34.2% annually over five years and trades at nearly half its estimated fair value. Recent activities include a private placement raising CN¥197.54 million, reflecting efforts to bolster capital amid financial pressures. The board and management are seasoned, with average tenures of 4.3 and 2.1 years respectively, contributing stability in navigating market conditions.

- Unlock comprehensive insights into our analysis of Tianjin Jintou State-owned Urban Development stock in this financial health report.

- Gain insights into Tianjin Jintou State-owned Urban Development's past trends and performance with our report on the company's historical track record.

Where To Now?

- Dive into all 1,016 of the Asian Penny Stocks we have identified here.

- Looking For Alternative Opportunities? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Water Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1115

Tibet Water Resources

An investment holding company, engages in the production and sale of water and beer products in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives