A Look at Health and Happiness (H&H) International Holdings (SEHK:1112) Valuation After Revenue Growth and Product Launch

Reviewed by Simply Wall St

Health and Happiness (H&H) International Holdings (SEHK:1112) just announced its revenue jumped 12% in the first nine months of 2025, with every business segment on the rise. The company also rolled out Biostime Kids Fruity Bites, which is another step forward in their children’s nutrition lineup.

See our latest analysis for Health and Happiness (H&H) International Holdings.

The recent uptick in revenue and new product launches seems to have energized investor sentiment, with the share price climbing 18.1% over the past month and a remarkable year-to-date share price return of 67.3%. Momentum is clearly building, underscored by a one-year total shareholder return of 54.6%, which is a strong signal even when factoring in some longer-term volatility.

If H&H’s growth story has you on the lookout for other rising opportunities, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With such a strong rally and ongoing product innovation, the key question now is whether H&H shares still offer hidden value for new investors, or if the market has already priced in the next phase of growth.

Price-to-Sales of 0.6x: Is it justified?

The latest market data shows Health and Happiness (H&H) International Holdings is trading at a price-to-sales ratio of 0.6x, which stands out as a discount compared to both industry peers and our fair value benchmarks at the last close price of HK$14.59.

The price-to-sales (P/S) ratio compares a company’s market value to its revenue. This metric is particularly meaningful for businesses in sectors such as food, beverage, and tobacco, where profits may be volatile but sales growth is key. A low P/S may suggest the market is underestimating future sales growth or improvements in profitability.

For H&H, this 0.6x ratio is considered attractive against the peer average of 1.4x in the sector. It also compares favorably to the Hong Kong Food industry average of 0.7x and our estimated fair P/S of 2.1x. This level highlights significant potential for a market rerating if the company delivers on expected growth or profitability milestones.

Explore the SWS fair ratio for Health and Happiness (H&H) International Holdings

Result: Price-to-Sales of 0.6x (UNDERVALUED)

However, market volatility and recent net losses could challenge the sustainability of H&H’s growth momentum in the coming quarters.

Find out about the key risks to this Health and Happiness (H&H) International Holdings narrative.

Another View: What Does the SWS DCF Model Say?

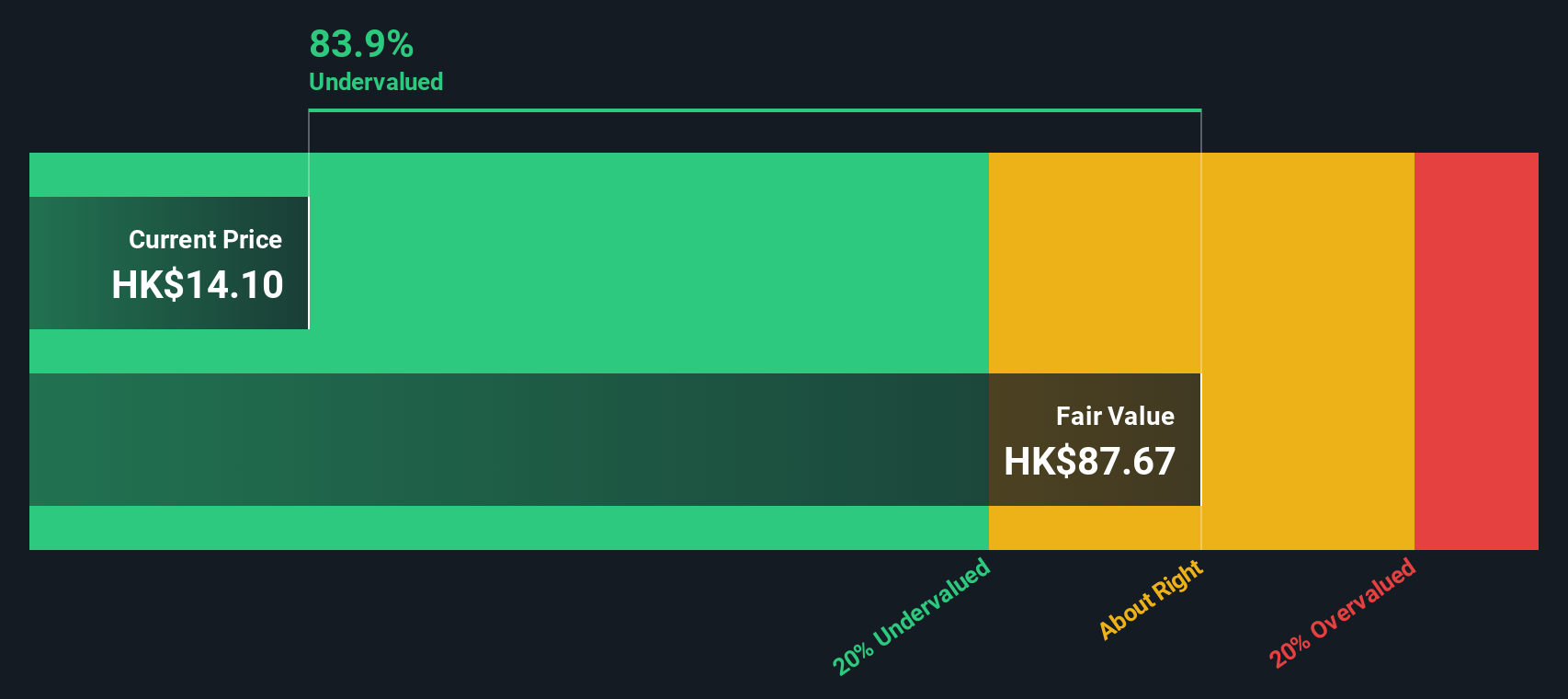

While the current price-to-sales ratio presents H&H as undervalued, our DCF model provides a different perspective. According to this cash flow-based approach, H&H shares are trading at a significant 83% discount to estimated fair value. This may indicate a potential opportunity that the market has not fully recognized, or it could reflect risks that merit careful consideration.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Health and Happiness (H&H) International Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Health and Happiness (H&H) International Holdings Narrative

If you see the numbers differently or want to uncover your own unique angle, you can assemble a personalized narrative in just a few minutes. Do it your way

A great starting point for your Health and Happiness (H&H) International Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Seize Your Next Investing Opportunity

Ready to spot what others might miss? The right tools can help you uncover companies making big moves in the market before everyone else catches on.

- Capitalize on unique growth potential by checking out these 3576 penny stocks with strong financials with proven financial strength and surprising resilience.

- Boost your income strategy by pursuing these 15 dividend stocks with yields > 3% paying out yields above 3% and add consistency to your portfolio.

- Ride the artificial intelligence wave and connect with these 25 AI penny stocks poised to shape the next technology revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Health and Happiness (H&H) International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1112

Health and Happiness (H&H) International Holdings

An investment holding company, manufactures and sells pediatric nutrition, baby care, adult nutrition and care, and pet nutrition and care products in Mainland China, Australia, New Zealand, North America, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.