- Hong Kong

- /

- Oil and Gas

- /

- SEHK:9689

December 2024 Penny Stocks To Monitor For Potential Opportunities

Reviewed by Simply Wall St

As global markets continue to experience a divergence, with major U.S. indexes hitting record highs while smaller-cap stocks face declines, investors are keenly observing the shifting landscape. In this context, penny stocks—often seen as relics of past trading days—remain an intriguing area for potential opportunities. These smaller or newer companies can offer significant value when backed by strong financials, allowing investors to uncover hidden gems in the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £813.81M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$44.27B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,698 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Qingci Games (SEHK:6633)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qingci Games Inc. is an investment holding company that develops, publishes, and operates mobile games across various international markets including China, Japan, the US, and others, with a market cap of approximately HK$1.73 billion.

Operations: The company's revenue from the Computer Graphics segment is CN¥914.42 million.

Market Cap: HK$1.73B

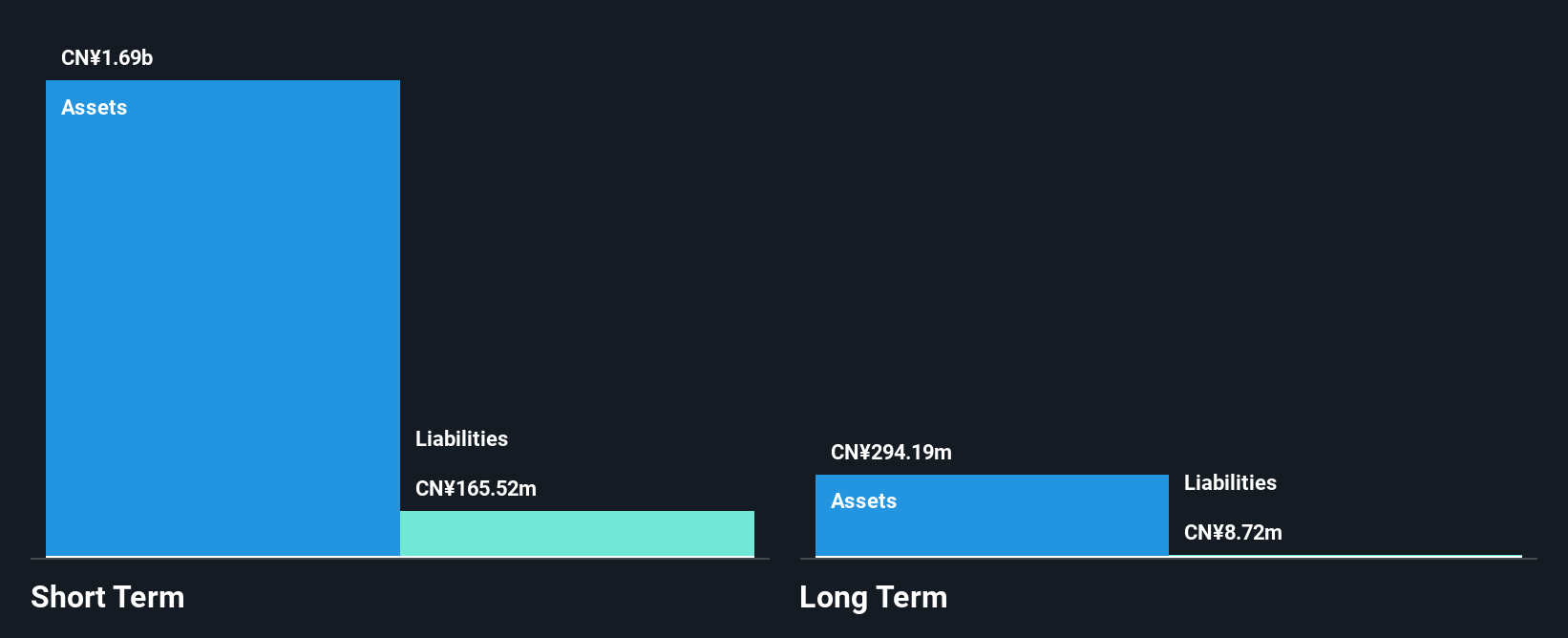

Qingci Games has a market cap of approximately HK$1.73 billion and generates CN¥914.42 million in revenue from its Computer Graphics segment. The company is currently unprofitable, with losses increasing by 0.3% annually over the past five years, but it maintains a strong financial position with short-term assets exceeding both short and long-term liabilities significantly. Qingci Games' cash reserves surpass its total debt, providing a cash runway for more than three years even if free cash flow declines at historical rates. The management team and board are experienced, with average tenures of 4.7 and 3.5 years respectively.

- Take a closer look at Qingci Games' potential here in our financial health report.

- Explore Qingci Games' analyst forecasts in our growth report.

JTF International Holdings (SEHK:9689)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: JTF International Holdings Limited is an investment holding company that focuses on blending and selling fuel oil in the People's Republic of China, with a market capitalization of HK$418.50 million.

Operations: The company's revenue is primarily derived from the blending and sale of fuel oil, as well as the sale of refined oil and other petrochemicals, totaling CN¥1.26 billion.

Market Cap: HK$418.5M

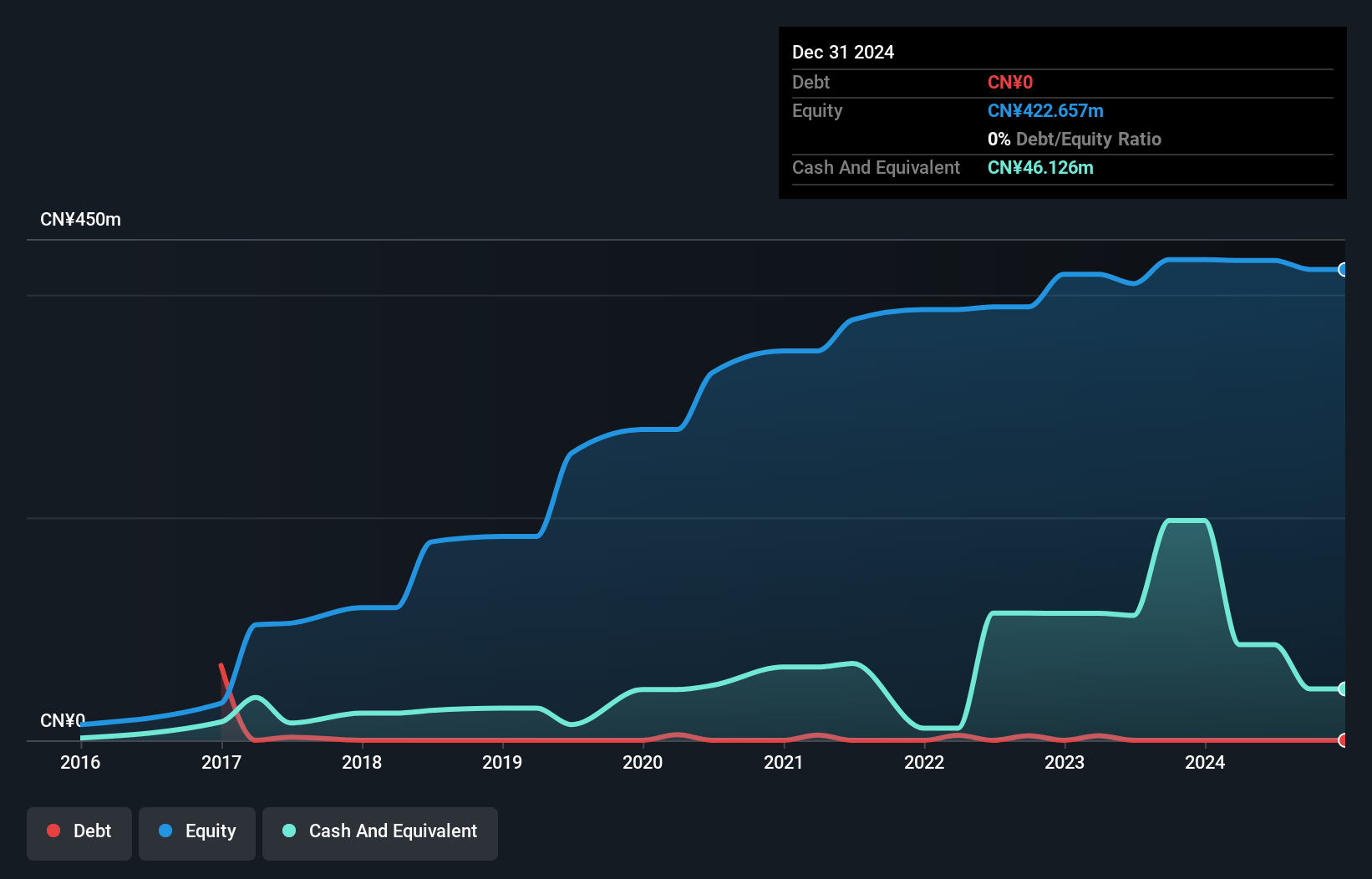

JTF International Holdings, with a market cap of HK$418.50 million, primarily generates revenue from blending and selling fuel oil in China, totaling CN¥1.26 billion. The company is debt-free, alleviating concerns over interest payments and debt coverage. However, it faces challenges with declining earnings growth at an average annual rate of 20.6% over the past five years and negative earnings growth of -69.9% last year compared to industry averages. Despite stable weekly volatility at 10%, its profit margins have decreased to 0.5%. The management team is experienced with an average tenure of eight years.

- Click here and access our complete financial health analysis report to understand the dynamics of JTF International Holdings.

- Gain insights into JTF International Holdings' past trends and performance with our report on the company's historical track record.

Micro-Mechanics (Holdings) (SGX:5DD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Micro-Mechanics (Holdings) Ltd. is a company that designs, manufactures, and markets high precision parts and tools for the semiconductor industry's wafer-fabrication, assembly, and testing processes across various international markets with a market cap of SGD236.35 million.

Operations: The company's revenue is derived from several key markets, including China (SGD19.26 million), Singapore (SGD20.06 million), Malaysia (SGD11.44 million), the United States of America (SGD10.24 million), and the Philippines (SGD3.83 million).

Market Cap: SGD236.35M

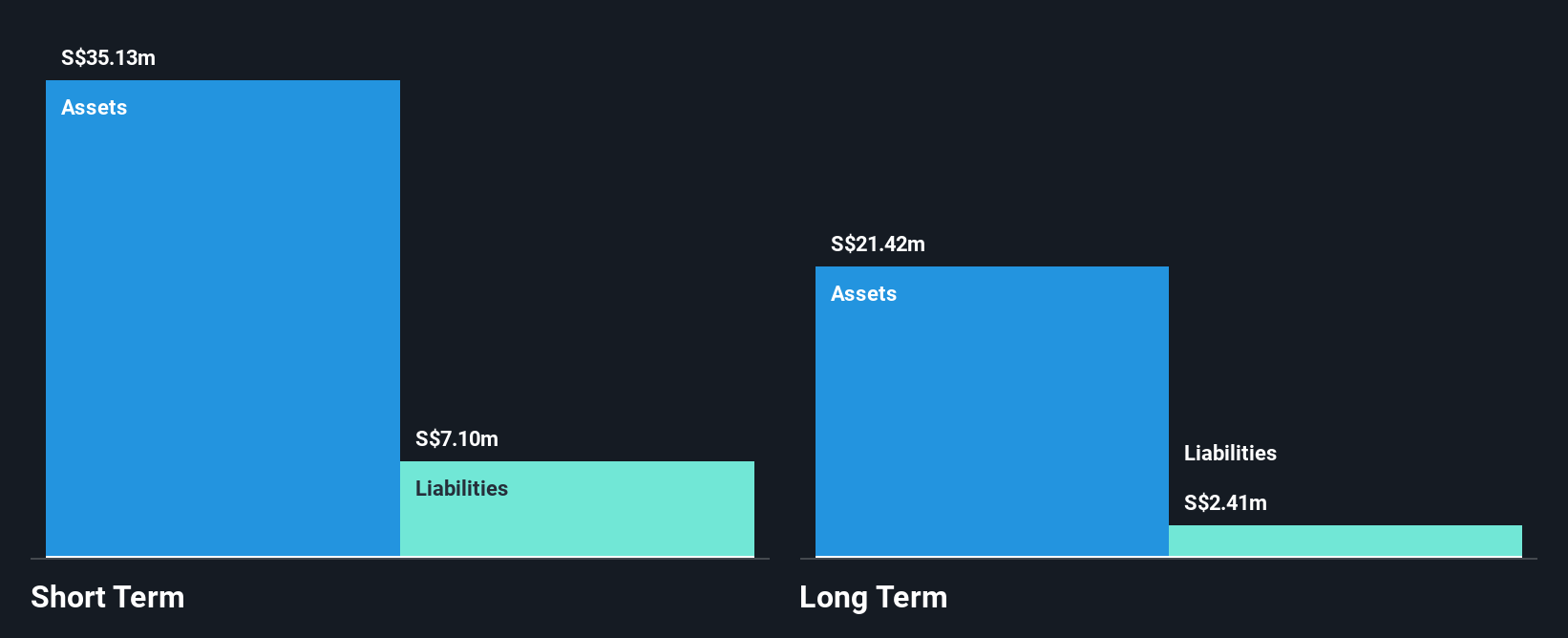

Micro-Mechanics (Holdings) Ltd., with a market cap of SGD236.35 million, operates debt-free, eliminating interest payment concerns. The company reported first-quarter sales of SGD16.24 million and net income of SGD3.08 million, showing slight growth from the previous year. Despite a low return on equity at 17.2%, its profit margins improved to 14.4%. However, earnings have declined by an average of 9.7% annually over five years, though recent growth shows some acceleration at 2.4%. The management and board are relatively new with an average tenure of under two years, suggesting potential for strategic shifts following recent executive changes.

- Navigate through the intricacies of Micro-Mechanics (Holdings) with our comprehensive balance sheet health report here.

- Assess Micro-Mechanics (Holdings)'s previous results with our detailed historical performance reports.

Next Steps

- Investigate our full lineup of 5,698 Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9689

JTF International Holdings

An investment holding company, engages in the blending and selling of fuel oil in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.