- Hong Kong

- /

- Oil and Gas

- /

- SEHK:956

Can Monthly Volatility Reveal Hidden Strengths in China Suntien Green Energy's (SEHK:956) Operations?

Reviewed by Sasha Jovanovic

- China Suntien Green Energy reported that its consolidated power generation for October 2025 was 950,402.12 MWh, reflecting a 20.97% year-on-year decline for the month, while accumulated power generation through October 31, 2025, reached 11,718,263.28 MWh, a 6.15% increase year-on-year.

- This contrast between a monthly drop and sustained yearly growth highlights potential variability in operational performance or external conditions affecting output.

- We'll explore how October's steep downturn in monthly power generation figures may shape perceptions of China Suntien Green Energy's operational resilience.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is China Suntien Green Energy's Investment Narrative?

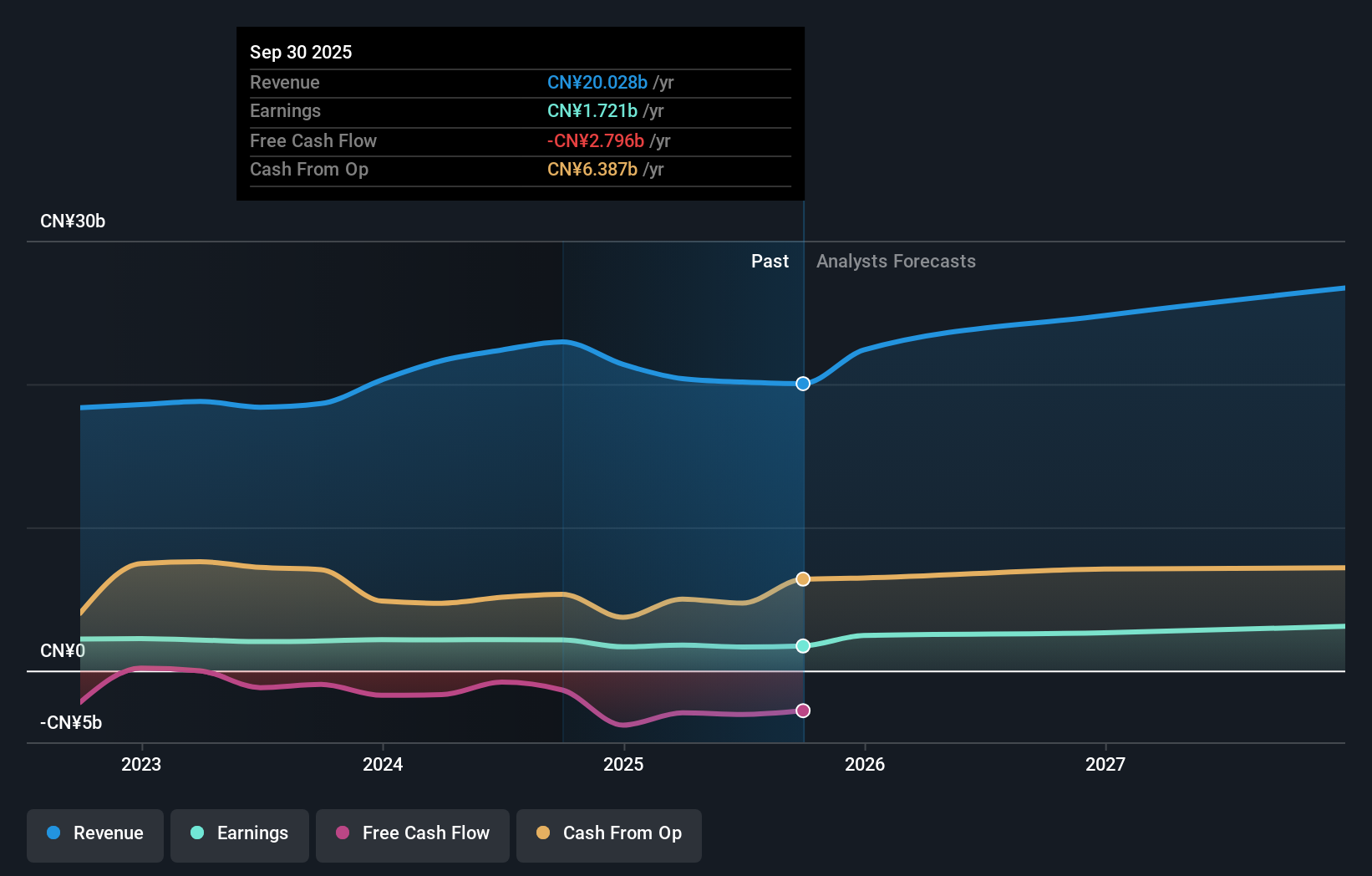

For a shareholder of China Suntien Green Energy, the essential belief hinges on the company’s ability to deliver steady growth against temporary headwinds. The October result, a 21% year-on-year dip in monthly power generation, brings fresh attention to short term catalysts, especially operational reliability and energy demand trends. Yet, the year-to-date production still posts a 6% annual increase, which tempers concerns for now. Key risks, including lower sales versus last year, board turnover, and challenges covering debt with operating cash flows, are more relevant as this recent decline points to possible volatility rather than a material shift. The recent news will likely reinforce caution around monthly output swings as a monitoring point, but, given ongoing full-year growth and persistent industry themes, the event does not rewrite the big-picture risks or immediate outlook at this stage. On the other hand, persistent board changes remain a point investors should not ignore.

China Suntien Green Energy's shares are on the way up, but they could be overextended by 14%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on China Suntien Green Energy - why the stock might be worth as much as HK$4.77!

Build Your Own China Suntien Green Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Suntien Green Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Suntien Green Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Suntien Green Energy's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:956

China Suntien Green Energy

Develops and utilizes clean energy in Mainland China.

Moderate growth potential second-rate dividend payer.

Market Insights

Community Narratives