In a period where global markets are experiencing mixed performances, with large-cap stocks showing resilience while small caps face challenges, investors remain attentive to economic indicators and central bank policies that could influence market dynamics. Amidst these fluctuations, identifying promising opportunities in the small-cap sector requires a keen eye for companies with robust fundamentals and growth potential that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

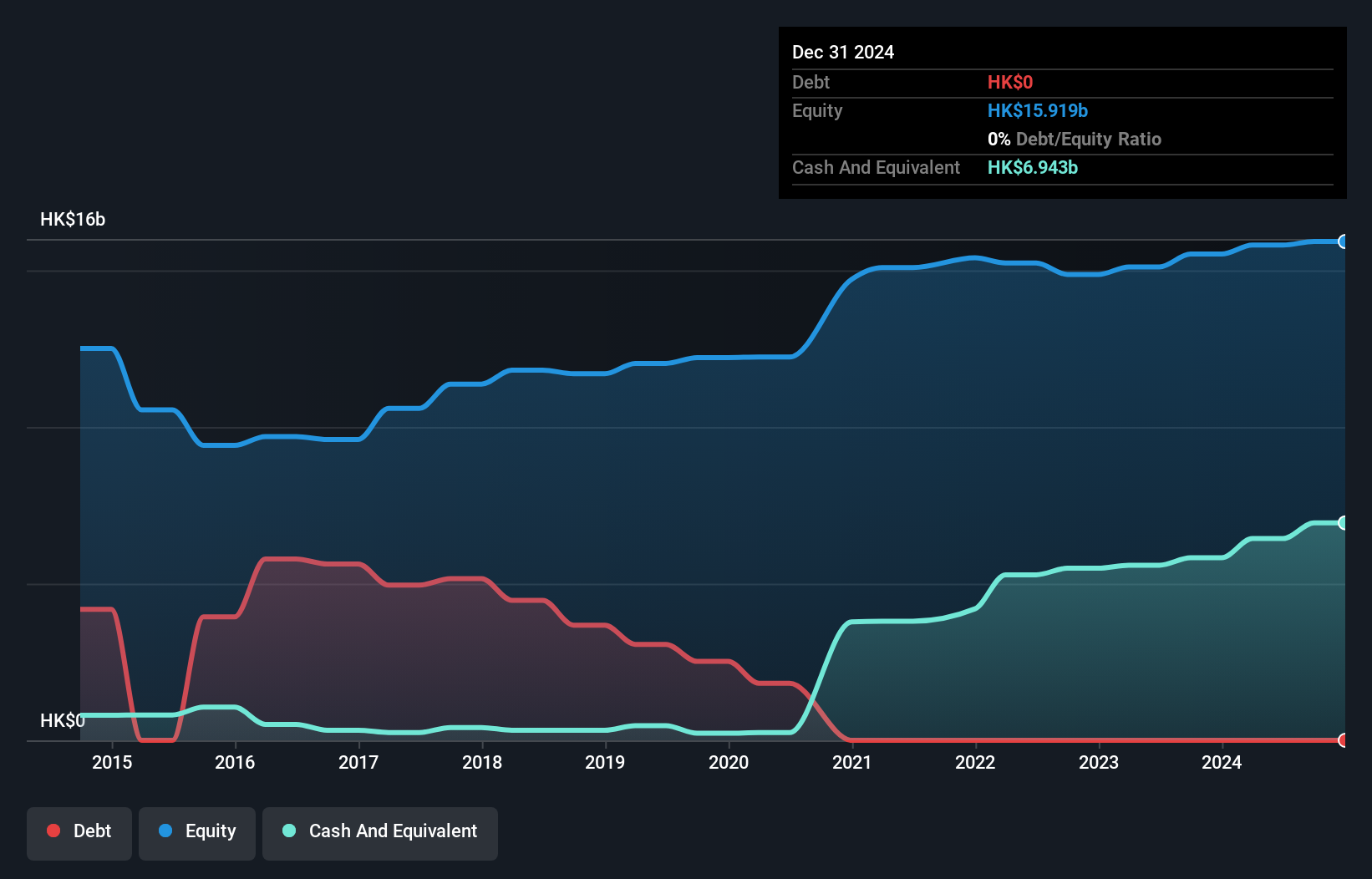

Overview: Sinopec Kantons Holdings Limited is an investment holding company that offers crude oil jetty services, with a market capitalization of approximately HK$11.71 billion.

Operations: The company generates revenue primarily from crude oil jetty and storage services, amounting to HK$632.38 million.

Sinopec Kantons Holdings, a small cap player in the oil and gas sector, has shown impressive financial resilience. With no debt on its books, it stands out for having reduced its debt from a 25.5% debt-to-equity ratio five years ago. Its earnings have surged by 50.8% over the past year, significantly outperforming the industry average of -0.9%. Moreover, it's trading at 60.4% below estimated fair value, suggesting potential undervaluation in the market. The company is also free cash flow positive and forecasts indicate an annual earnings growth of 5.83%, highlighting promising future prospects.

- Delve into the full analysis health report here for a deeper understanding of Sinopec Kantons Holdings.

Understand Sinopec Kantons Holdings' track record by examining our Past report.

Guomai Technologies (SZSE:002093)

Simply Wall St Value Rating: ★★★★★★

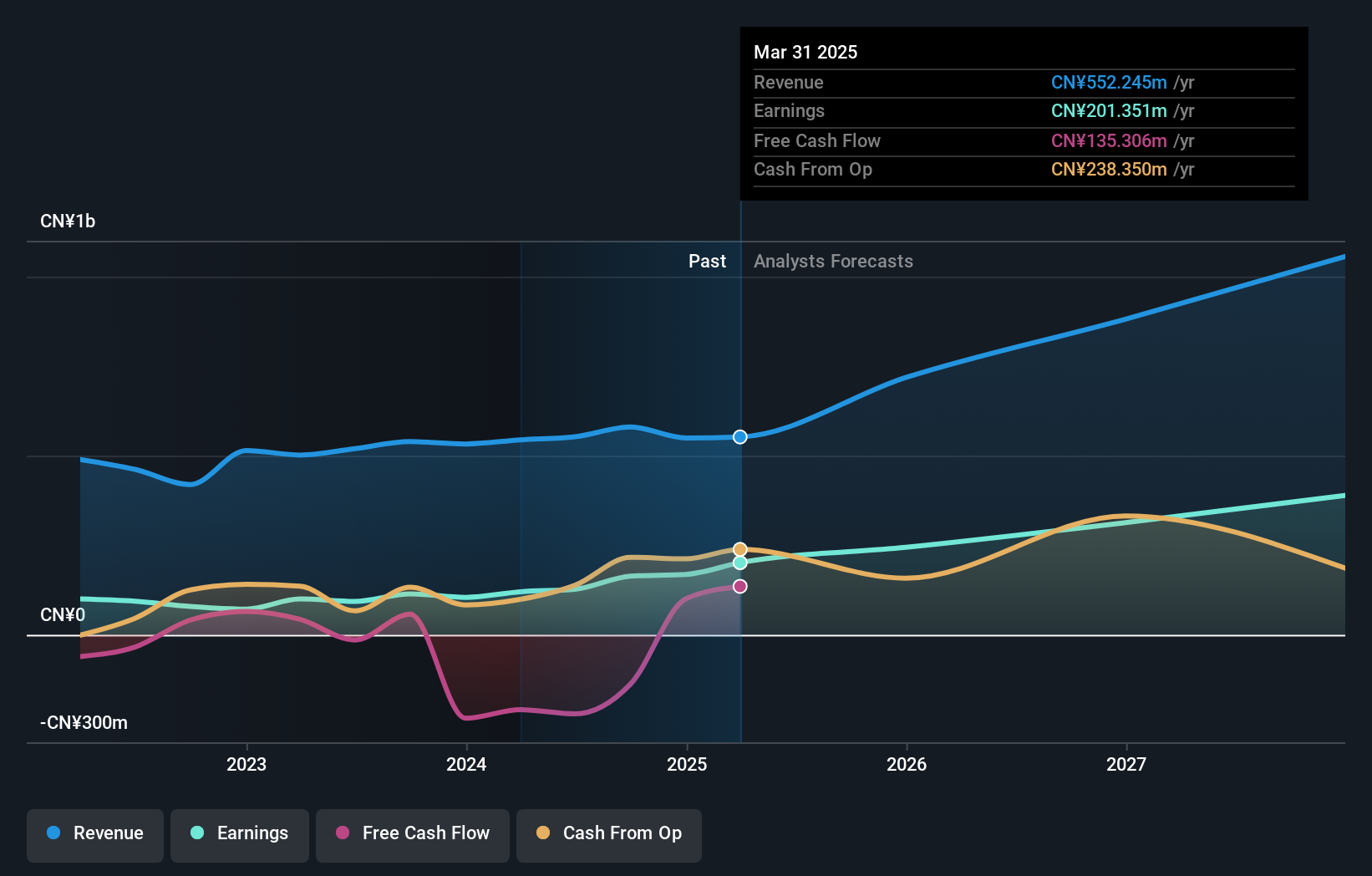

Overview: Guomai Technologies, Inc. operates in China offering internet of things technology services, consulting and design services, science park operation and development services, as well as education services, with a market cap of CN¥8.54 billion.

Operations: Guomai Technologies generates revenue through its internet of things technology services, consulting and design services, science park operation and development services, and education services. The company's market capitalization stands at CN¥8.54 billion.

Guomai Technologies shows a promising profile with its earnings growth of 43.7% over the past year, significantly outpacing the IT industry's -8.1%. The company reported net income of CN¥148.11 million for the nine months ending September 30, 2024, compared to CN¥88.69 million a year earlier, indicating robust performance despite a large one-off gain of CN¥78 million impacting results. Its price-to-earnings ratio stands at 52x, lower than the industry average of 76x, suggesting potential value for investors. With more cash than total debt and reduced debt-to-equity from 10.2% to 5.5% in five years, Guomai appears financially sound and poised for future growth at an expected rate of around 22.86% annually.

Avant Group (TSE:3836)

Simply Wall St Value Rating: ★★★★★★

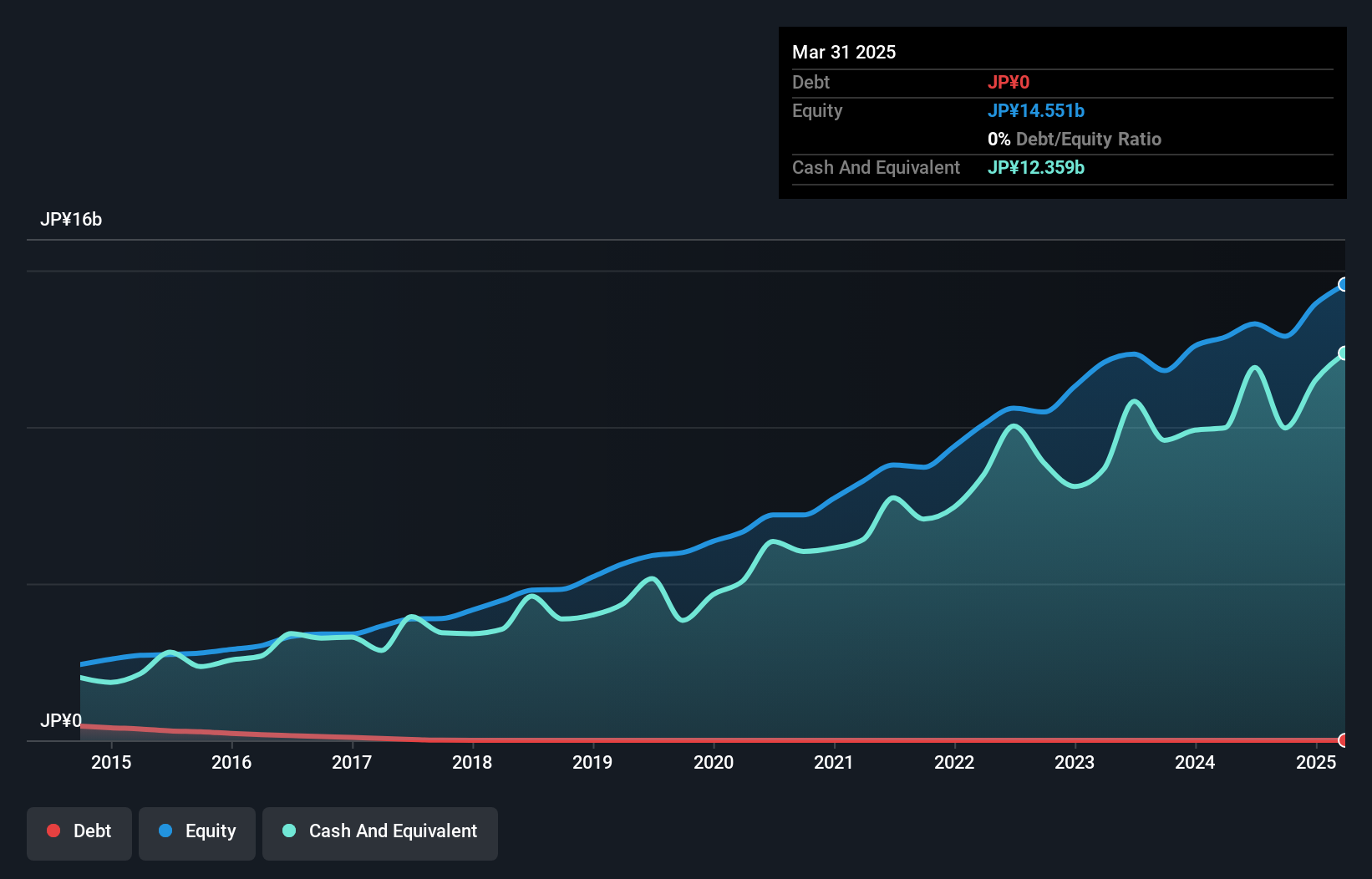

Overview: Avant Group Corporation, with a market cap of ¥75.71 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: Avant Group generates revenue primarily from its Management Solutions Business, Digital Transformation Promotion Business, and Group Governance Business, with the latter contributing ¥7.88 billion. The Digital Transformation Promotion segment leads with ¥9.16 billion in revenue.

Avant Group stands out with a notable earnings growth of 35% over the past year, surpassing the IT industry's 10% benchmark. Trading at 44% below its estimated fair value, it offers an attractive proposition for investors seeking undervalued opportunities. The company is debt-free, enhancing its financial stability and eliminating concerns over interest coverage. Despite a volatile share price in recent months, Avant's high-quality earnings and positive free cash flow highlight its operational strength. Recently, it completed a share buyback of 615,600 shares for ¥828 million, reflecting confidence in its intrinsic value and future prospects.

Taking Advantage

- Delve into our full catalog of 4495 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002093

Guomai Technologies

Provides internet of things technology services, internet of things consulting and design services, internet of things science park operation and development services, and education services in China.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives