- Hong Kong

- /

- Oil and Gas

- /

- SEHK:883

A Look at CNOOC (SEHK:883) Valuation Following Latest Earnings Report and Profit Decline

Reviewed by Simply Wall St

CNOOC (SEHK:883) just released its earnings report for the first nine months of 2025, highlighting a decline in both revenue and net income compared to the previous year. This development is catching investors’ attention.

See our latest analysis for CNOOC.

CNOOC's shares have had an impressive run, with a 20.7% share price return over the past month and a strong 44.4% total shareholder return for the past year, despite the recent earnings disappointment. Momentum remains solid, suggesting investors are still optimistic about the company’s long-term potential. However, risks are coming into sharper focus following the dip in earnings.

If energy sector moves have your attention, it might be time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares still outperforming even after a dip in earnings, the big question is whether CNOOC is trading below its fair value or if the market has already factored in all the future growth. Is there a buying opportunity here?

Most Popular Narrative: Fairly Valued

With CNOOC’s fair value narrative estimate at HK$22.46 almost matching the last close price of HK$22.48, the market and narrative are now closely aligned. Attention is now focused on whether expectations for production growth and rising Asia-Pacific demand can sustain their premium.

Robust investment in reserve expansion and accelerated project development, including multiple new discoveries and rapid project turnarounds (for example, Bozhong 26-6 going from discovery to production in 3 years), positions CNOOC to sustain double-digit production growth, directly supporting higher long-term revenue and cash flow.

Want to know what numbers drive this finely balanced valuation? The narrative hints at aggressive production strategies, surging demand, and a bold profit outlook, all woven together to justify the current price. Uncover the details shaping this fair value verdict; one unexpected financial forecast could flip everything.

Result: Fair Value of $22.46 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, CNOOC’s narrow focus on oil and gas, along with ongoing exposure to regulatory and environmental changes, could quickly shift this fair value outlook.

Find out about the key risks to this CNOOC narrative.

Another Perspective: Multiple vs. Fair Value

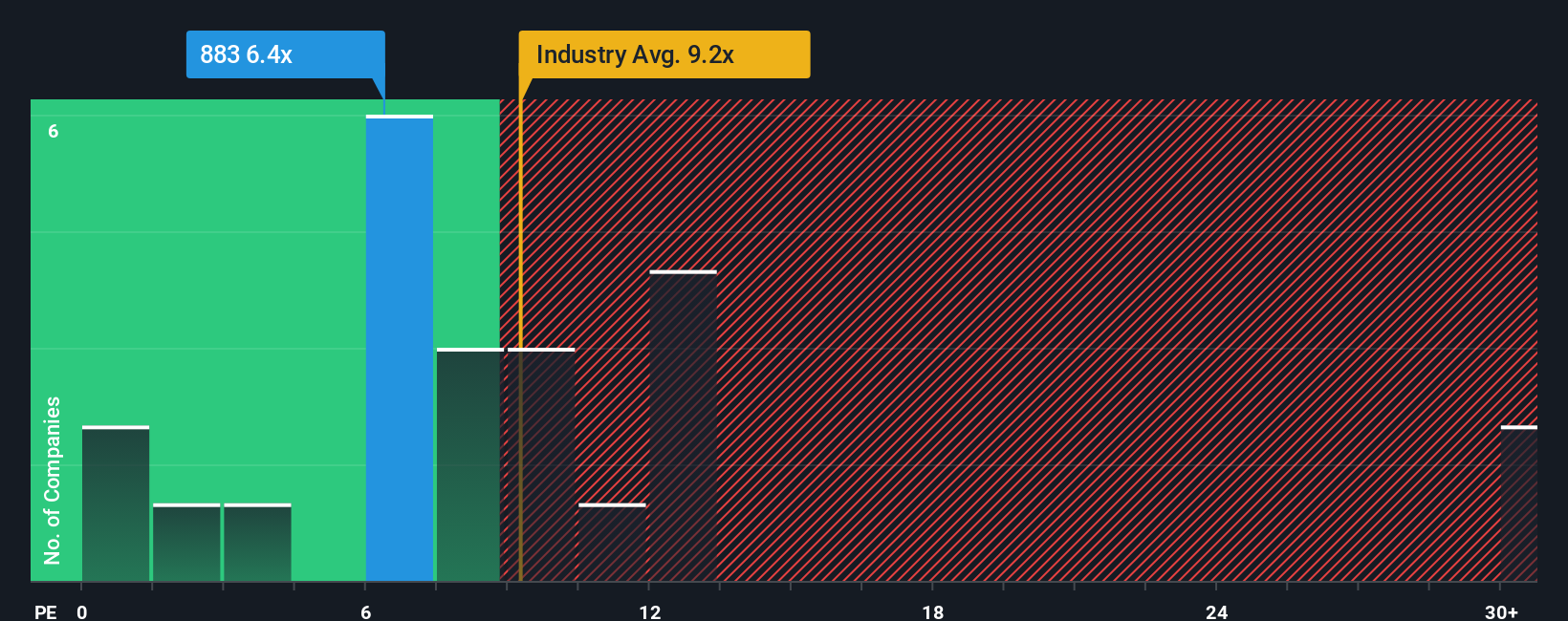

While the fair value narrative suggests CNOOC is priced about right, looking at its price-to-earnings ratio presents a different picture. At 7.9x, CNOOC trades well below both its peer average of 11.9x and the industry average of 10.3x. It is also much lower than the fair ratio of 13x, which may indicate potential undervaluation. This gap could signal either an undervalued opportunity or reflect caution from the market. Could sentiment shift or industry changes help close this gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CNOOC Narrative

If you think there’s another side to the story or want to dig into the numbers for yourself, you can quickly build your own perspective in minutes. Do it your way.

A great starting point for your CNOOC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your strategy and maximize your upside by targeting stocks aligned with breakthrough trends, healthy income, or deep market value. Don't let standout opportunities pass you by, as the next big winner could be just a click away.

- Tap into reliable income streams with attractive yields by checking out these 14 dividend stocks with yields > 3%, which are rewarding shareholders right now.

- Ride the innovation wave and spark your portfolio's growth with exposure to artificial intelligence through these 27 AI penny stocks, connecting you directly with companies shaping tomorrow.

- Capture value where others might overlook it by browsing these 883 undervalued stocks based on cash flows, and gain an edge with stocks that show real potential for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:883

CNOOC

An investment holding company, engages in the exploration, development, production, and sale of crude oil and natural gas in worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives