- Hong Kong

- /

- Oil and Gas

- /

- SEHK:8631

Sun Kong Holdings Limited (HKG:8631) Not Doing Enough For Some Investors As Its Shares Slump 30%

The Sun Kong Holdings Limited (HKG:8631) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 16% in that time.

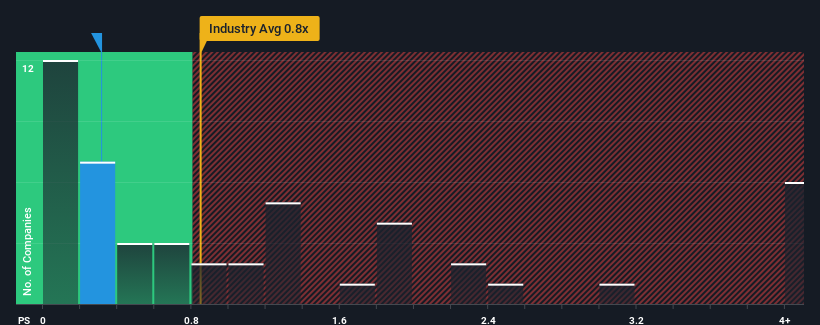

Since its price has dipped substantially, Sun Kong Holdings may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Oil and Gas industry in Hong Kong have P/S ratios greater than 0.8x and even P/S higher than 3x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sun Kong Holdings

What Does Sun Kong Holdings' P/S Mean For Shareholders?

For example, consider that Sun Kong Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sun Kong Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Sun Kong Holdings' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 57%. As a result, revenue from three years ago have also fallen 76% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 5.0% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

In light of this, it's understandable that Sun Kong Holdings' P/S sits below the majority of other companies. However, when revenue shrink rapidly P/S often shrinks too, which could set up shareholders for future disappointment regardless. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

The southerly movements of Sun Kong Holdings' shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Sun Kong Holdings revealed its sharp three-year contraction in revenue is contributing to its low P/S, given the industry is set to shrink less severely. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. In the meantime, unless the company's relative performance improves, the share price will hit a barrier around these levels.

It is also worth noting that we have found 4 warning signs for Sun Kong Holdings (3 don't sit too well with us!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8631

Yufengchang Holdings

An investment holding company, engages in the energy industry chain and e-commerce sales in mainland Chinese and Hong Kong.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives