David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Kaisun Holdings Limited (HKG:8203) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Kaisun Holdings

What Is Kaisun Holdings's Net Debt?

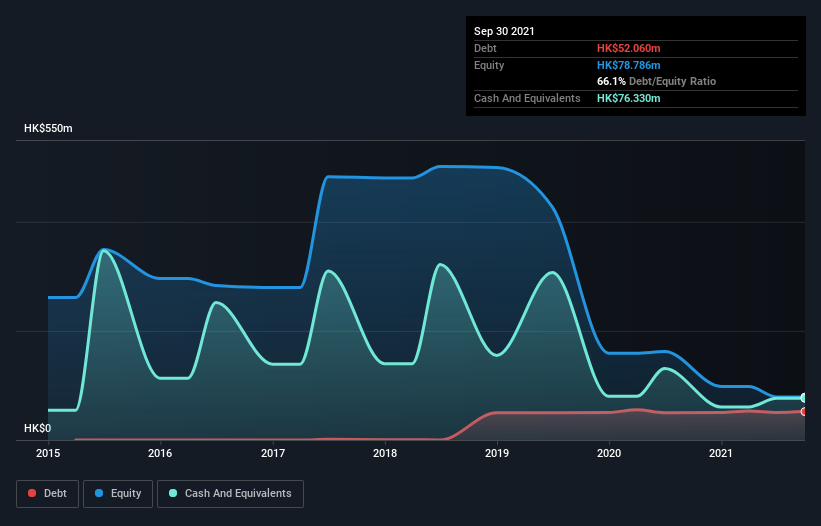

You can click the graphic below for the historical numbers, but it shows that as of June 2021 Kaisun Holdings had HK$52.1m of debt, an increase on HK$50.0m, over one year. However, its balance sheet shows it holds HK$76.3m in cash, so it actually has HK$24.3m net cash.

A Look At Kaisun Holdings' Liabilities

The latest balance sheet data shows that Kaisun Holdings had liabilities of HK$235.1m due within a year, and liabilities of HK$47.6m falling due after that. Offsetting this, it had HK$76.3m in cash and HK$41.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$164.9m.

This is a mountain of leverage relative to its market capitalization of HK$170.1m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Despite its noteworthy liabilities, Kaisun Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Kaisun Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Kaisun Holdings reported revenue of HK$112m, which is a gain of 225%, although it did not report any earnings before interest and tax. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

So How Risky Is Kaisun Holdings?

Although Kaisun Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of HK$10m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. One positive is that Kaisun Holdings is growing revenue apace, which makes it easier to sell a growth story and raise capital if need be. But we still think it's somewhat risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Kaisun Holdings has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Kaisun Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8203

Kaisun Holdings

An investment holding company, engages in the mining, exploitation, processing, production, and sale of coal in Hong Kong, the People’s Republic of China, Vietnam, and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives