- Hong Kong

- /

- Semiconductors

- /

- SEHK:650

Productive Technologies Company Limited's (HKG:650) Share Price Matching Investor Opinion

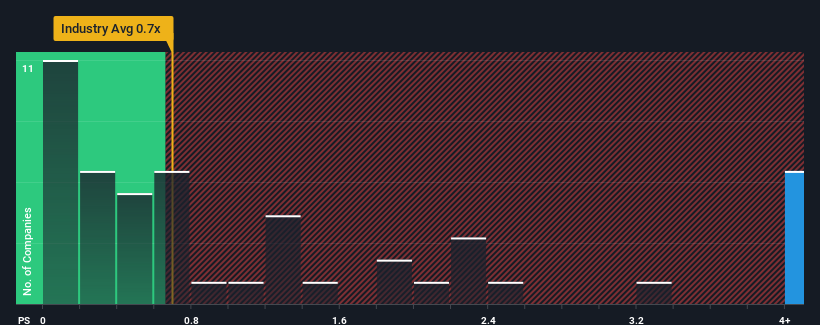

When close to half the companies in the Oil and Gas industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.7x, you may consider Productive Technologies Company Limited (HKG:650) as a stock to avoid entirely with its 10.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Productive Technologies

What Does Productive Technologies' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Productive Technologies has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Productive Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Productive Technologies?

The only time you'd be truly comfortable seeing a P/S as steep as Productive Technologies' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Pleasingly, revenue has also lifted 203% in aggregate from three years ago, thanks to the last 12 months of explosive growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 4.7% shows it's a great look while it lasts.

With this information, we can see why Productive Technologies is trading at a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As detailed previously, the strength of Productive Technologies' recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Productive Technologies that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:650

Productive Technologies

An investment holding company, engages in the manufacture of equipment applied in semiconductor and solar power businesses in the People’s Republic of China.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.