- Hong Kong

- /

- Oil and Gas

- /

- SEHK:65

Grand Ocean Advanced Resources Company Limited's (HKG:65) P/S Is On The Mark

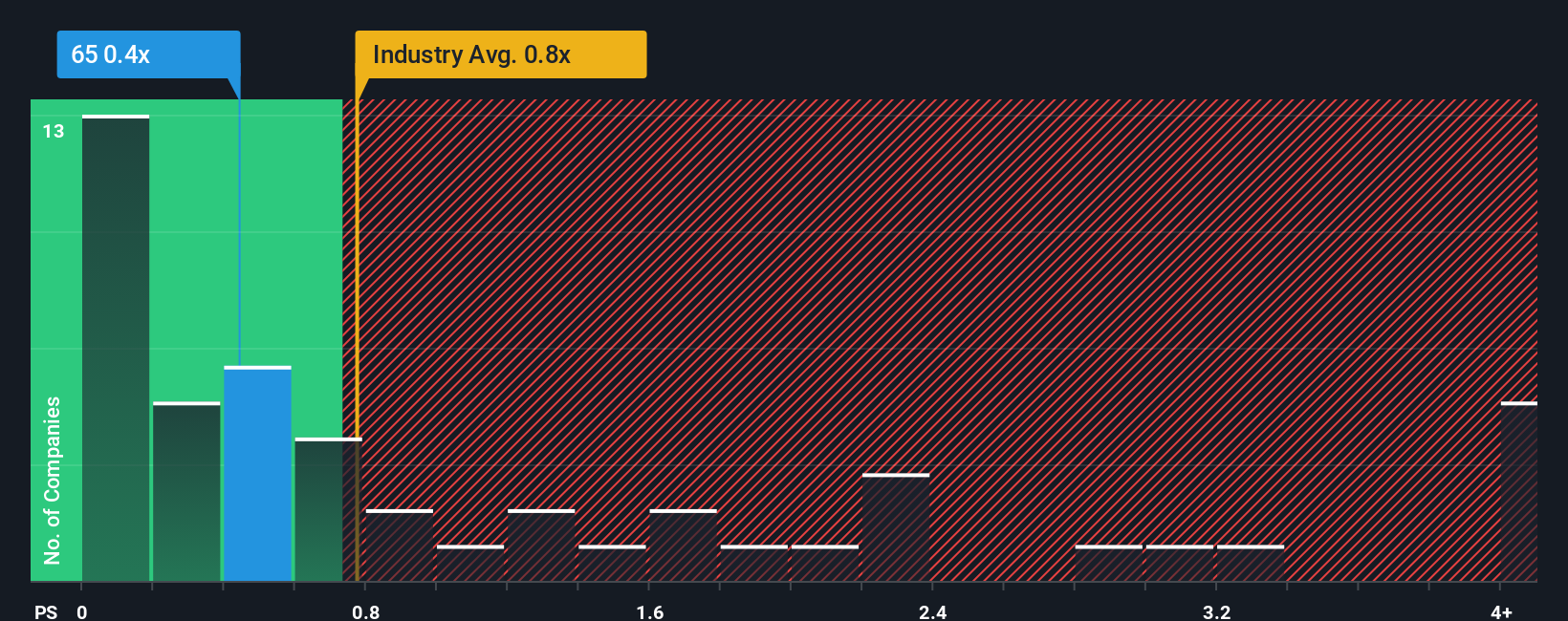

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Oil and Gas industry in Hong Kong, you could be forgiven for feeling indifferent about Grand Ocean Advanced Resources Company Limited's (HKG:65) P/S ratio of 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Grand Ocean Advanced Resources

What Does Grand Ocean Advanced Resources' Recent Performance Look Like?

For example, consider that Grand Ocean Advanced Resources' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Grand Ocean Advanced Resources will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Grand Ocean Advanced Resources' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 3.7% decrease to the company's top line. As a result, revenue from three years ago have also fallen 1.1% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

It turns out the industry is also predicted to shrink 2.3% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised revenue results.

With this information, it might not be too hard to see why Grand Ocean Advanced Resources is trading at a fairly similar P/S in comparison. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down in unison. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What Does Grand Ocean Advanced Resources' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Grand Ocean Advanced Resources confirms that the company's contraction in revenue over the past three-year years is a major contributor to its industry-matching P/S, given the industry is set to decline in a similar fashion. It would appear as though shareholders are comfortable with the current P/S ratio, as they seem to have confidence that future revenue will not result in any unfavourable surprises. However, we're slightly cautious about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. In the meantime, unless the company's relative performance changes, the share price should find support at these levels.

Before you take the next step, you should know about the 2 warning signs for Grand Ocean Advanced Resources (1 is significant!) that we have uncovered.

If you're unsure about the strength of Grand Ocean Advanced Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:65

Grand Ocean Advanced Resources

An investment holding company, produces and sells coal and minerals in Hong Kong and the People’s Republic of China.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026