- Hong Kong

- /

- Oil and Gas

- /

- SEHK:632

What CHK Oil Limited's (HKG:632) 28% Share Price Gain Is Not Telling You

Despite an already strong run, CHK Oil Limited (HKG:632) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 233% following the latest surge, making investors sit up and take notice.

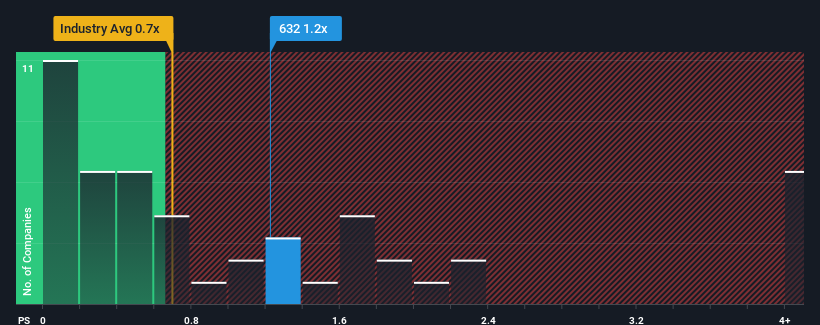

Following the firm bounce in price, when almost half of the companies in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider CHK Oil as a stock probably not worth researching with its 1.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for CHK Oil

How CHK Oil Has Been Performing

Recent times have been quite advantageous for CHK Oil as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on CHK Oil's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as CHK Oil's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. However, this wasn't enough as the latest three year period has seen the company endure a nasty 88% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 1.8% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that CHK Oil's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From CHK Oil's P/S?

CHK Oil shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of CHK Oil revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You need to take note of risks, for example - CHK Oil has 2 warning signs (and 1 which is concerning) we think you should know about.

If these risks are making you reconsider your opinion on CHK Oil, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:632

CHK Oil

An investment holding company, engages in the exploration, exploitation, and sale of oil and natural gas in Hong Kong, the United States, and the People Republic of China.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives