- Hong Kong

- /

- Oil and Gas

- /

- SEHK:467

United Energy Group (SEHK:467): Valuation Insights After Credit Rating and Egypt Acquisition Moves

Reviewed by Simply Wall St

United Energy Group (SEHK:467) has received a ‘BB-’ credit rating from Fitch for its proposed US dollar notes, shortly after acquiring Apex International Energy’s Egypt assets for USD150 million. These moves reflect management’s focus on expansion and refining its capital structure.

See our latest analysis for United Energy Group.

Following the acquisition news and Fitch's rating, investor sentiment appears to be shifting. United Energy Group boasts a robust year-to-date share price return of 50.72%. The impressive 1-year total shareholder return of 94.22% also stands out. This sustained performance, combined with recent strategic moves, suggests that momentum is building and the market is responding to the company’s bolder growth ambitions.

If United Energy Group's expanding footprint has you interested in what’s next, now’s the perfect moment to discover fast growing stocks with high insider ownership.

But with shares already surging nearly 95 percent in a year, investors face a key question: Is United Energy Group still trading at an attractive value, or has the market already priced in all its future growth potential?

Price-to-Earnings of 10.4x: Is it justified?

United Energy Group's shares currently trade at a price-to-earnings (P/E) ratio of 10.4x, slightly higher than the Hong Kong Oil and Gas industry average of 10.3x. This places the stock at a premium compared to its closest sector peers, raising the question of whether the market's optimism about recent performance is already reflected in the price.

The price-to-earnings ratio compares a company's share price to its earnings per share. This is a key metric investors use to gauge how the market values a firm's current profitability. In cyclical industries such as oil and gas, this measure often reflects investor expectations about future commodity cycles and earnings stability.

At 10.4x, United Energy Group is more costly than the average industry peer, which may signal investor confidence in its growth plans or recent return to profitability. However, in absolute terms, this premium is marginal, and it may not fully capture the company's improved earnings quality after becoming profitable in the last year.

Compared against the industry average, United Energy Group's valuation stands out. If the stock's premium holds, it suggests the market anticipates continued outperformance. It also means buyers today are paying slightly more for each unit of current earnings.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.4x (ABOUT RIGHT)

However, slowing multi-year returns and uncertain revenue growth could quickly shift sentiment if upcoming results or macro trends disappoint investor expectations.

Find out about the key risks to this United Energy Group narrative.

Another View: What Does the DCF Suggest?

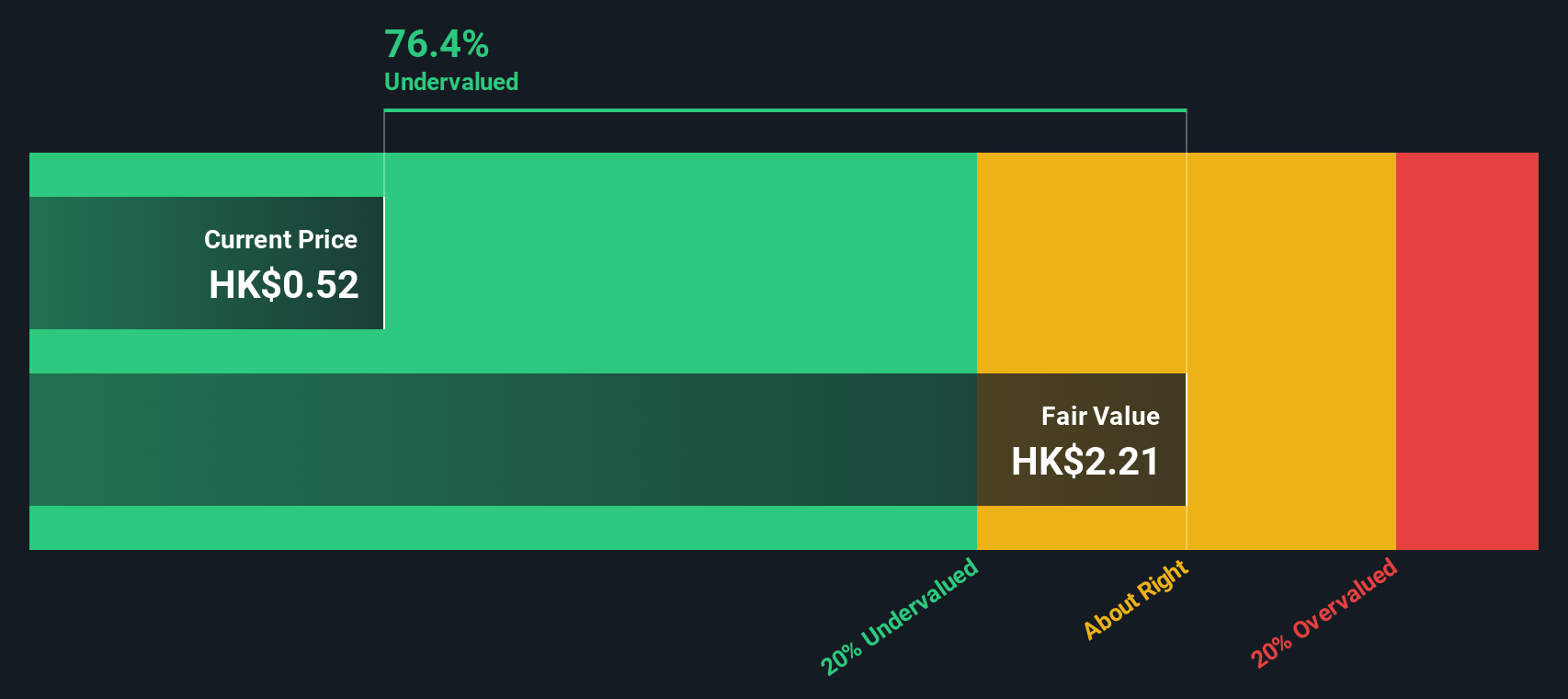

Taking a different tack, our SWS DCF model estimates United Energy Group’s fair value at HK$2.21 per share, well above the current price of HK$0.52. This suggests the stock may be substantially undervalued by the market. Does this signal an opportunity, or does it hint at risks investors are overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United Energy Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own United Energy Group Narrative

If you see things differently or want to dive into the numbers for yourself, you can build your own take in just a few minutes, or Do it your way.

A great starting point for your United Energy Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Now is the time to strengthen your investment strategy with new possibilities. Don’t let top performers slip by while others catch the next big winners first.

- Spot the potential for big gains by checking out these 3580 penny stocks with strong financials, which features financially robust companies trading at attractive prices.

- Fuel your portfolio’s edge and uncover rapid innovation within these 32 healthcare AI stocks, where healthcare and artificial intelligence combine for breakthrough growth.

- Capture reliable income and smart growth by reviewing these 14 dividend stocks with yields > 3%, which showcases businesses with yields greater than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:467

United Energy Group

An investment holding company, engages in the investment and operation of upstream oil, natural gas, clean energy, and energy trading businesses in Pakistan, South Asia, the Middle East, and North Africa.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives