- Hong Kong

- /

- Oil and Gas

- /

- SEHK:386

A Closer Look at Sinopec (SEHK:386) Valuation Following Recent Earnings Growth

Reviewed by Simply Wall St

China Petroleum & Chemical (SEHK:386) delivered fourth quarter earnings that drew interest across the energy space. The company reported a steady uptick in annual revenue and solid double-digit annual net income growth, giving investors a closer look at its recent performance.

See our latest analysis for China Petroleum & Chemical.

Despite a recent earnings boost, China Petroleum & Chemical’s share price has experienced choppy trading this year, closing at HK$4.21 and posting a year-to-date decline of 4.97%. However, looking at the longer-term picture, total shareholder returns remain robust, with a strong 57.5% three-year and 117.5% five-year gain. This suggests that momentum remains in place for patient investors.

If you’re interested in what else is making waves in the sector, why not seize this moment to explore fast growing stocks with high insider ownership

Given the company's notable gains over the past several years and its current share price sitting below analyst targets, the key question for investors is whether China Petroleum & Chemical is genuinely undervalued, or if the market has already accounted for the company's future growth potential.

Price-to-Earnings of 13.1x: Is it justified?

China Petroleum & Chemical is trading at a price-to-earnings (P/E) ratio of 13.1x, placing its shares above both peer and industry averages. As of the last close at HK$4.21, this figure suggests the market has priced in a premium for the stock compared to others in the sector.

The P/E ratio highlights how much investors are willing to pay for a unit of earnings. In the energy industry, this multiple helps gauge whether future profit prospects are being overvalued or discounted. For China Petroleum & Chemical, the elevated P/E prompts the question of whether the company's growth outlook warrants such optimism.

Currently, the company's 13.1x P/E is noticeably higher than the peer average of 9x and also exceeds the Hong Kong oil and gas industry average of 9.3x. However, the fair P/E level, estimated at 14.2x, indicates there could be room for the market to re-rate the stock in line with what fair value modeling suggests.

Explore the SWS fair ratio for China Petroleum & Chemical

Result: Price-to-Earnings of 13.1x (OVERVALUED)

However, risks such as fluctuating global oil prices and regulatory changes could pose challenges to China Petroleum & Chemical’s growth outlook in the months ahead.

Find out about the key risks to this China Petroleum & Chemical narrative.

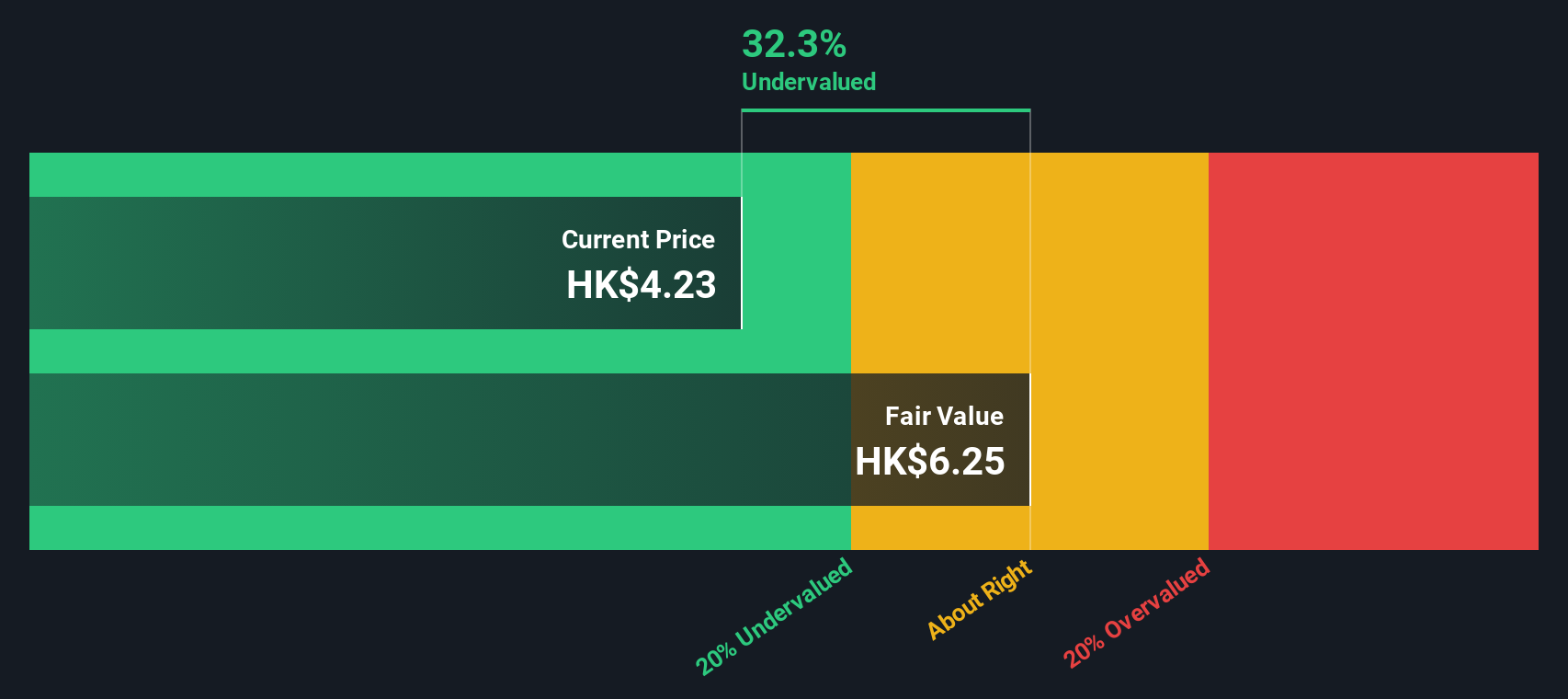

Another View: Discounted Cash Flow Tells a Different Story

While the earlier analysis based on price-to-earnings suggests China Petroleum & Chemical may be trading at a premium, our DCF model puts things in a different light. According to this approach, the company's current share price sits well below its estimated fair value, which hints at significant undervaluation. Does this mean the market is overlooking the company’s true long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Petroleum & Chemical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Petroleum & Chemical Narrative

If you’d like to dig into the numbers yourself and form your own perspective, you can build a personalized take in just a few minutes. Do it your way

A great starting point for your China Petroleum & Chemical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one opportunity. Make your next move count by tapping into curated lists that could spark your next big win.

- Tap into tomorrow’s healthcare breakthroughs by reviewing these 33 healthcare AI stocks, which blends advanced medical technology with artificial intelligence for remarkable innovation potential.

- Get ahead on long-term income by targeting these 17 dividend stocks with yields > 3%, offering attractive yields above 3% for stronger portfolio stability.

- Ride the momentum of the digital financial revolution by analyzing these 80 cryptocurrency and blockchain stocks, where blockchain and cryptocurrency stocks lead in next-generation payment solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:386

China Petroleum & Chemical

An energy and chemical company, engages in the oil and gas and chemical operations in Mainland China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives