- Hong Kong

- /

- Energy Services

- /

- SEHK:3303

Jutal Offshore Oil Services Limited (HKG:3303) May Have Run Too Fast Too Soon With Recent 28% Price Plummet

The Jutal Offshore Oil Services Limited (HKG:3303) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 31%, which is great even in a bull market.

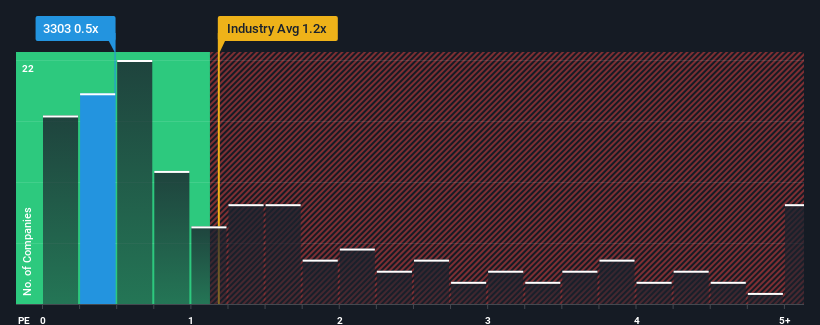

In spite of the heavy fall in price, it's still not a stretch to say that Jutal Offshore Oil Services' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Hong Kong, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Jutal Offshore Oil Services

How Jutal Offshore Oil Services Has Been Performing

With revenue growth that's exceedingly strong of late, Jutal Offshore Oil Services has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Jutal Offshore Oil Services, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jutal Offshore Oil Services' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 48% last year. Still, revenue has fallen 29% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 14% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Jutal Offshore Oil Services' P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Following Jutal Offshore Oil Services' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Jutal Offshore Oil Services currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Plus, you should also learn about these 3 warning signs we've spotted with Jutal Offshore Oil Services (including 1 which can't be ignored).

If you're unsure about the strength of Jutal Offshore Oil Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3303

Jutal Offshore Oil Services

An investment holding company, engages in the fabrication of facilities and provision of integrated services for oil and gas, new energy, and refining and chemical industries.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives