Mi Zhang is the CEO of Honghua Group Limited (HKG:196), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also assess whether Honghua Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Honghua Group

Comparing Honghua Group Limited's CEO Compensation With the industry

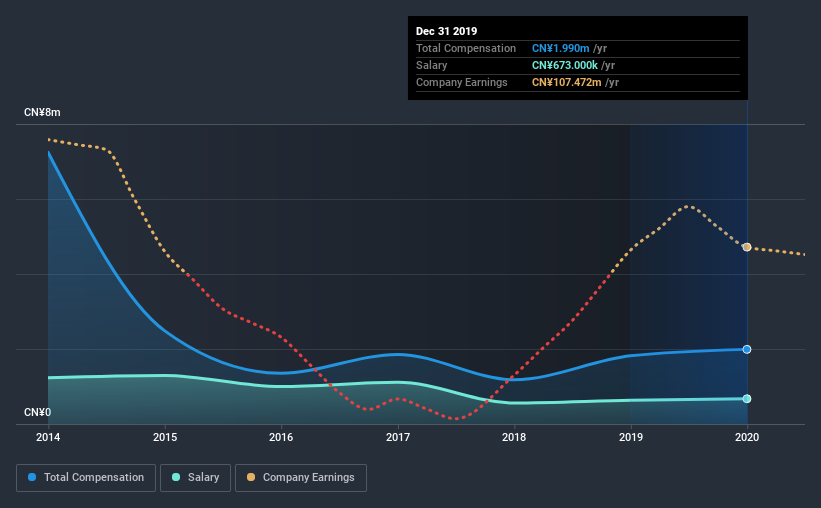

At the time of writing, our data shows that Honghua Group Limited has a market capitalization of HK$1.1b, and reported total annual CEO compensation of CN¥2.0m for the year to December 2019. We note that's an increase of 9.5% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥673k.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥1.7m. This suggests that Honghua Group remunerates its CEO largely in line with the industry average. Moreover, Mi Zhang also holds HK$1.1m worth of Honghua Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥673k | CN¥631k | 34% |

| Other | CN¥1.3m | CN¥1.2m | 66% |

| Total Compensation | CN¥2.0m | CN¥1.8m | 100% |

On an industry level, roughly 63% of total compensation represents salary and 37% is other remuneration. It's interesting to note that Honghua Group allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Honghua Group Limited's Growth

Honghua Group Limited has seen its earnings per share (EPS) increase by 122% a year over the past three years. It saw its revenue drop 18% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Honghua Group Limited Been A Good Investment?

Since shareholders would have lost about 69% over three years, some Honghua Group Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we touched on above, Honghua Group Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. At the same time, the company has logged negative shareholder returns over the last three years. But EPS growth is moving in a favorable direction, certainly a positive sign. It's tough for us to say CEO compensation is too generous when EPS growth is positive, but negative investor returns will irk shareholders and reduce any chances of a raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 3 warning signs (and 1 which makes us a bit uncomfortable) in Honghua Group we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Honghua Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Honghua Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:196

Honghua Group

An investment holding company, engages in the research, design, manufacture, setting, and sale of land rigs, and related parts and components.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives