- Hong Kong

- /

- Energy Services

- /

- SEHK:1938

These 4 Measures Indicate That Chu Kong Petroleum and Natural Gas Steel Pipe Holdings (HKG:1938) Is Using Debt In A Risky Way

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Chu Kong Petroleum and Natural Gas Steel Pipe Holdings Limited (HKG:1938) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Chu Kong Petroleum and Natural Gas Steel Pipe Holdings

What Is Chu Kong Petroleum and Natural Gas Steel Pipe Holdings's Net Debt?

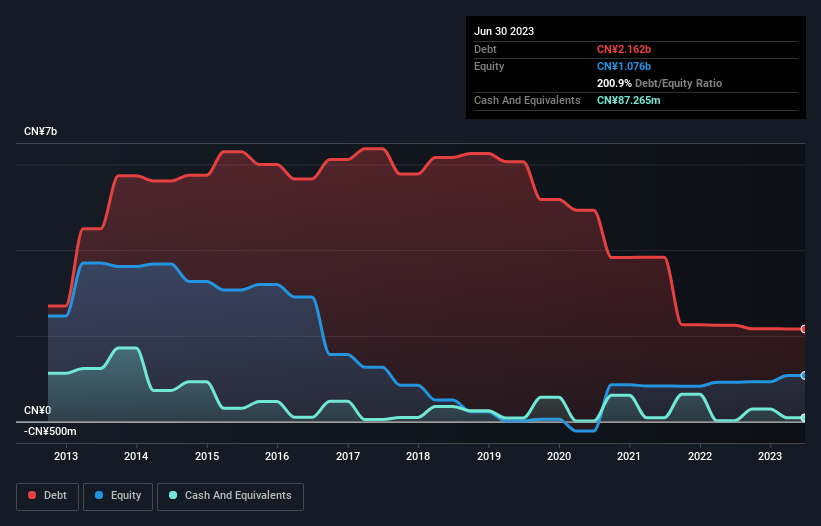

The chart below, which you can click on for greater detail, shows that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings had CN¥2.16b in debt in June 2023; about the same as the year before. However, it also had CN¥87.3m in cash, and so its net debt is CN¥2.07b.

A Look At Chu Kong Petroleum and Natural Gas Steel Pipe Holdings' Liabilities

According to the last reported balance sheet, Chu Kong Petroleum and Natural Gas Steel Pipe Holdings had liabilities of CN¥4.08b due within 12 months, and liabilities of CN¥1.76b due beyond 12 months. On the other hand, it had cash of CN¥87.3m and CN¥510.1m worth of receivables due within a year. So it has liabilities totalling CN¥5.24b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CN¥254.3m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Chu Kong Petroleum and Natural Gas Steel Pipe Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 0.50 times and a disturbingly high net debt to EBITDA ratio of 20.7 hit our confidence in Chu Kong Petroleum and Natural Gas Steel Pipe Holdings like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Worse, Chu Kong Petroleum and Natural Gas Steel Pipe Holdings's EBIT was down 67% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Chu Kong Petroleum and Natural Gas Steel Pipe Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last two years, Chu Kong Petroleum and Natural Gas Steel Pipe Holdings burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Chu Kong Petroleum and Natural Gas Steel Pipe Holdings's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And even its interest cover fails to inspire much confidence. Considering everything we've mentioned above, it's fair to say that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings is carrying heavy debt load. If you harvest honey without a bee suit, you risk getting stung, so we'd probably stay away from this particular stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Chu Kong Petroleum and Natural Gas Steel Pipe Holdings is showing 3 warning signs in our investment analysis , and 1 of those is significant...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1938

Chu Kong Petroleum and Natural Gas Steel Pipe Holdings

An investment holding company, manufactures and sells longitudinal welded steel pipes in Mainland China, Africa, Europe, the Middle East, rest of Asia, South America, and North America.

Good value with proven track record.

Market Insights

Community Narratives