- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1738

Feishang Anthracite Resources' (HKG:1738) Shareholders Are Down 17% On Their Shares

While not a mind-blowing move, it is good to see that the Feishang Anthracite Resources Limited (HKG:1738) share price has gained 24% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 17% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Feishang Anthracite Resources

Feishang Anthracite Resources wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Feishang Anthracite Resources grew revenue at 8.2% per year. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 5% per year, for three years. So the market has definitely lost some love for the stock. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

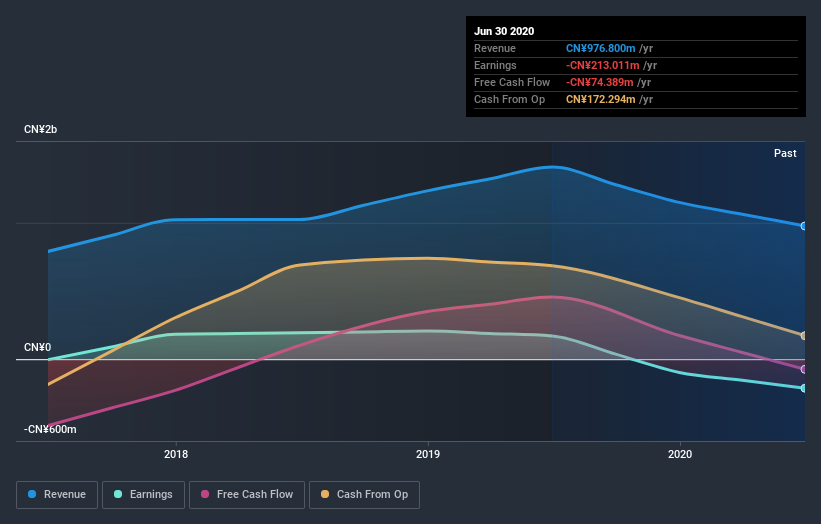

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Feishang Anthracite Resources' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Feishang Anthracite Resources shareholders have received a total shareholder return of 14% over the last year. There's no doubt those recent returns are much better than the TSR loss of 1.4% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Feishang Anthracite Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1738

Feishang Anthracite Resources

An investment holding company, engages in the extraction, sale, and trade of anthracite coal in the People’s Republic of China.

Fair value with low risk.

Market Insights

Community Narratives