- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

Here's Why Kinetic Development Group (HKG:1277) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Kinetic Development Group (HKG:1277). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Kinetic Development Group

How Quickly Is Kinetic Development Group Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Kinetic Development Group has managed to grow EPS by 23% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

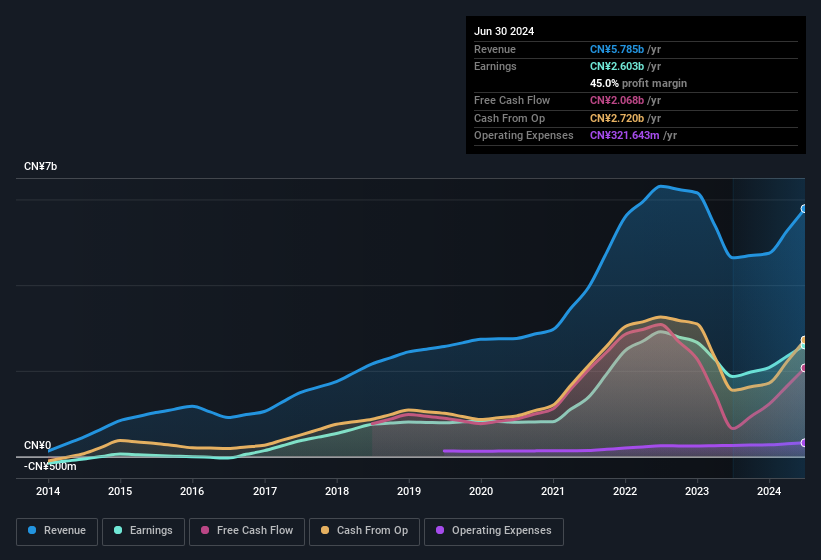

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Kinetic Development Group shareholders can take confidence from the fact that EBIT margins are up from 52% to 56%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Kinetic Development Group's balance sheet strength, before getting too excited.

Are Kinetic Development Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The real kicker here is that Kinetic Development Group insiders spent a staggering CN¥14m on acquiring shares in just one year, without single share being sold in the meantime. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. We also note that it was the company insider, Li Zhang, who made the biggest single acquisition, paying HK$11m for shares at about HK$1.15 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Kinetic Development Group will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 74% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. CN¥8.3b This is an incredible endorsement from them.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Kinetic Development Group's CEO, Bo Li, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Kinetic Development Group with market caps between CN¥7.3b and CN¥23b is about CN¥3.5m.

Kinetic Development Group offered total compensation worth CN¥2.4m to its CEO in the year to December 2023. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Kinetic Development Group Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Kinetic Development Group's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Kinetic Development Group that you should be aware of.

The good news is that Kinetic Development Group is not the only stock with insider buying. Here's a list of small cap, undervalued companies in HK with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kinetic Development Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives