- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1164

With EPS Growth And More, CGN Mining (HKG:1164) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like CGN Mining (HKG:1164). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for CGN Mining

How Fast Is CGN Mining Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, CGN Mining has achieved impressive annual EPS growth of 40%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

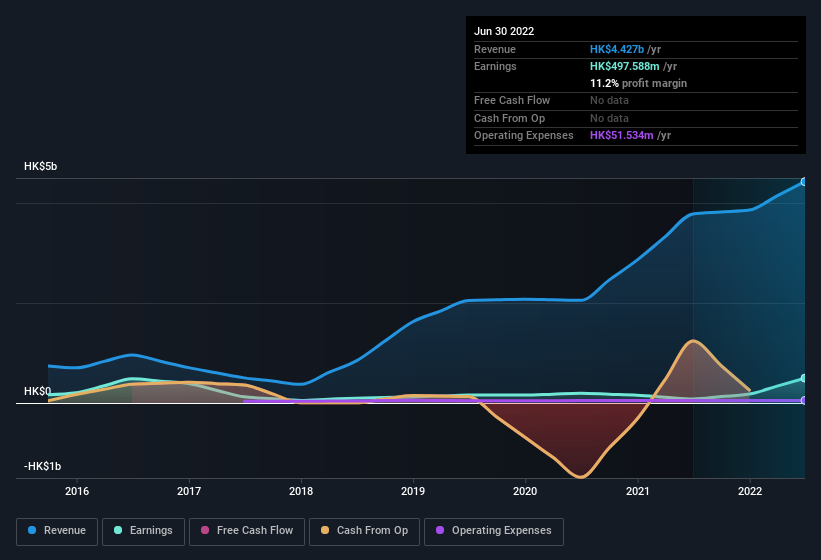

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note CGN Mining achieved similar EBIT margins to last year, revenue grew by a solid 17% to HK$4.4b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of CGN Mining's forecast profits?

Are CGN Mining Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. Our analysis has discovered that the median total compensation for the CEOs of companies like CGN Mining with market caps between HK$3.1b and HK$13b is about HK$4.4m.

The CEO of CGN Mining only received HK$950k in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does CGN Mining Deserve A Spot On Your Watchlist?

CGN Mining's earnings have taken off in quite an impressive fashion. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that CGN Mining has the hallmarks of a quality business; and that would make it well worth watching. You still need to take note of risks, for example - CGN Mining has 1 warning sign we think you should be aware of.

Although CGN Mining certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1164

CGN Mining

Engages in the development and trading of natural uranium resources to nuclear power plants.

High growth potential with low risk.

Market Insights

Community Narratives