- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1088

China Shenhua Energy (SEHK:1088) Revenue Growth Trails Market, Challenging Bullish Valuation Narratives

Reviewed by Simply Wall St

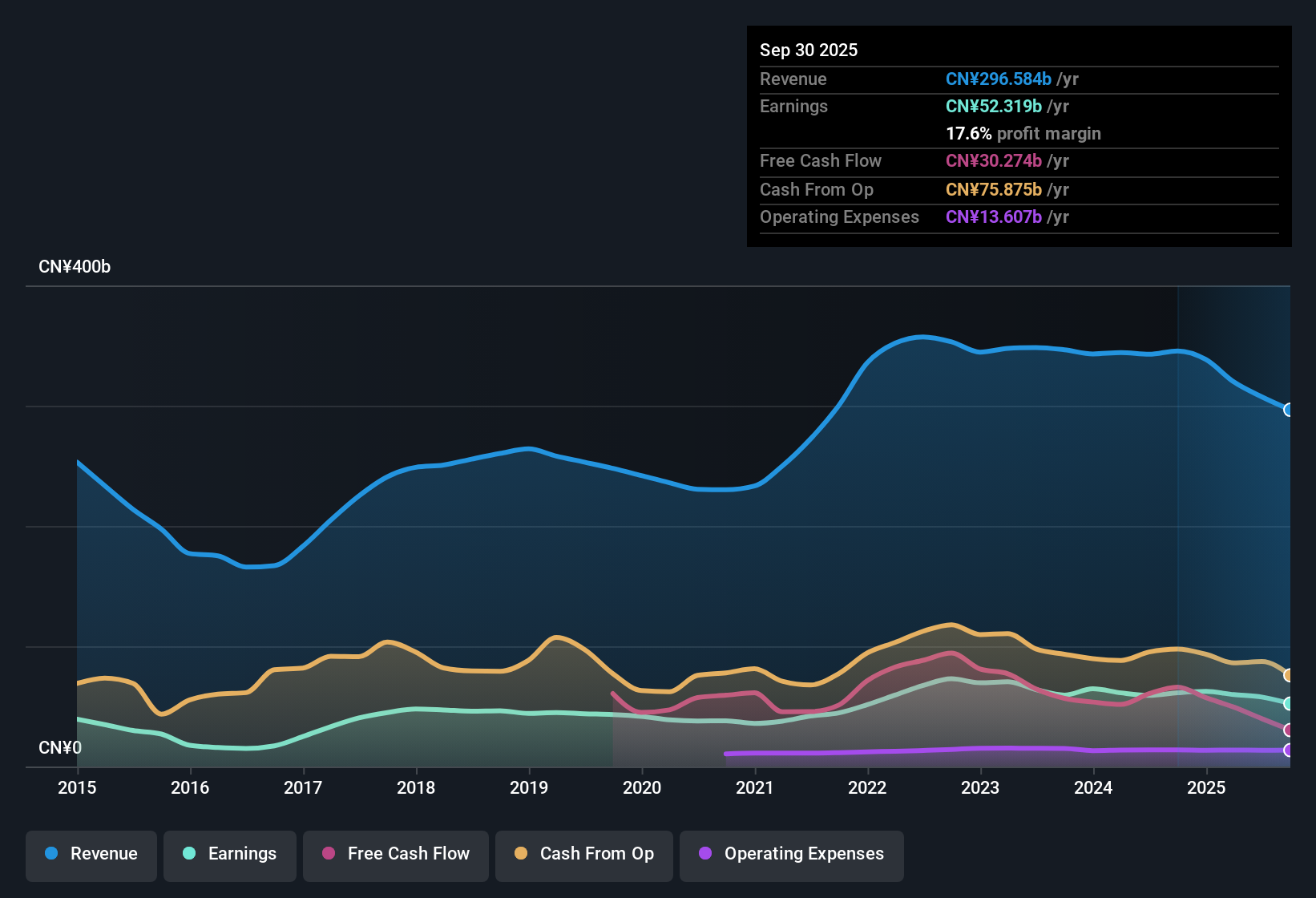

China Shenhua Energy (SEHK:1088) reported annual revenue growth of 1.5%, trailing behind the broader Hong Kong market’s 8.6% growth rate. EPS trends have come under pressure, with a 7% compound annual growth rate over five years giving way to negative earnings growth in the past year and forecasts pointing to a 1% annual decline over the next three years. Despite net profit margins holding steady at 17.6%, just shy of last year's 17.7%, the latest results highlight a challenging outlook and mixed investor sentiment as valuations remain in focus.

See our full analysis for China Shenhua Energy.The next section will put these earnings numbers up against the most widely followed narratives to see which market stories hold up, and which might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Strength Edges Out Peers

- China Shenhua’s net profit margin is 17.6%, slightly down from last year’s 17.7% but still robust compared to typical sector levels.

- While profit margins appear solid and support themes of operational reliability,

- stability at these levels highlights the company's ability to withstand sector volatility according to the prevailing market view,

- however, the marginal slip underlines that even sturdy operators are not immune to headwinds as revenue growth slows.

Valuation: Discount and Premium Coexist

- Shares are trading at HK$41.20, below the DCF fair value of HK$61.16, but command a high price-to-earnings ratio of 14.3x compared to the peer average of 9.1x.

- The current price gap supports investors drawn to value, yet,

- the premium P/E ratio versus peers challenges the view that China Shenhua is a straightforward bargain,

- showing that market pricing considers both the company's steady profits and the possibility of future declines.

Outlook: Growth Trends Reverse Course

- Earnings, which grew at a compound annual rate of 7% across five years, have now turned negative with a forecasted decline of 1% annually for the next three years.

- The shift from steady growth to anticipated declines raises concern over the company's long-term direction, as

- supporters point to historically strong earnings as a buffer,

- yet prevailing expectations for shrinking profits make it harder to ignore mounting risks to future performance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Shenhua Energy's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

China Shenhua’s consistent profits are under threat because declining earnings growth and a premium valuation cast doubt on future performance.

If you want more dependable opportunities, check out stable growth stocks screener (2095 results) to discover companies that have delivered steady growth and resilience across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1088

China Shenhua Energy

Engages in the production and sale of coal and power; railway, port, and shipping transportation; and coal-to-olefins businesses in the People’s Republic of China and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives