- China

- /

- Electronic Equipment and Components

- /

- SZSE:300445

Top 3 Stocks Estimated To Be Trading Below Fair Value In January 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing core U.S. inflation and robust bank earnings, major indices like the S&P 500 and Dow Jones have shown significant gains, with value stocks notably outperforming growth shares. In this environment of cautious optimism and potential rate adjustments, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer attractive valuations relative to their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Dongsung FineTec (KOSDAQ:A033500) | ₩18390.00 | ₩36681.91 | 49.9% |

| Avant Group (TSE:3836) | ¥1897.00 | ¥3776.87 | 49.8% |

| Thai Coconut (SET:COCOCO) | THB10.80 | THB21.59 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.70 | ₹2219.85 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.02 | 49.9% |

| Zhaojin Mining Industry (SEHK:1818) | HK$11.96 | HK$23.83 | 49.8% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩128700.00 | ₩257269.19 | 50% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5880.00 | ¥11700.97 | 49.7% |

Here's a peek at a few of the choices from the screener.

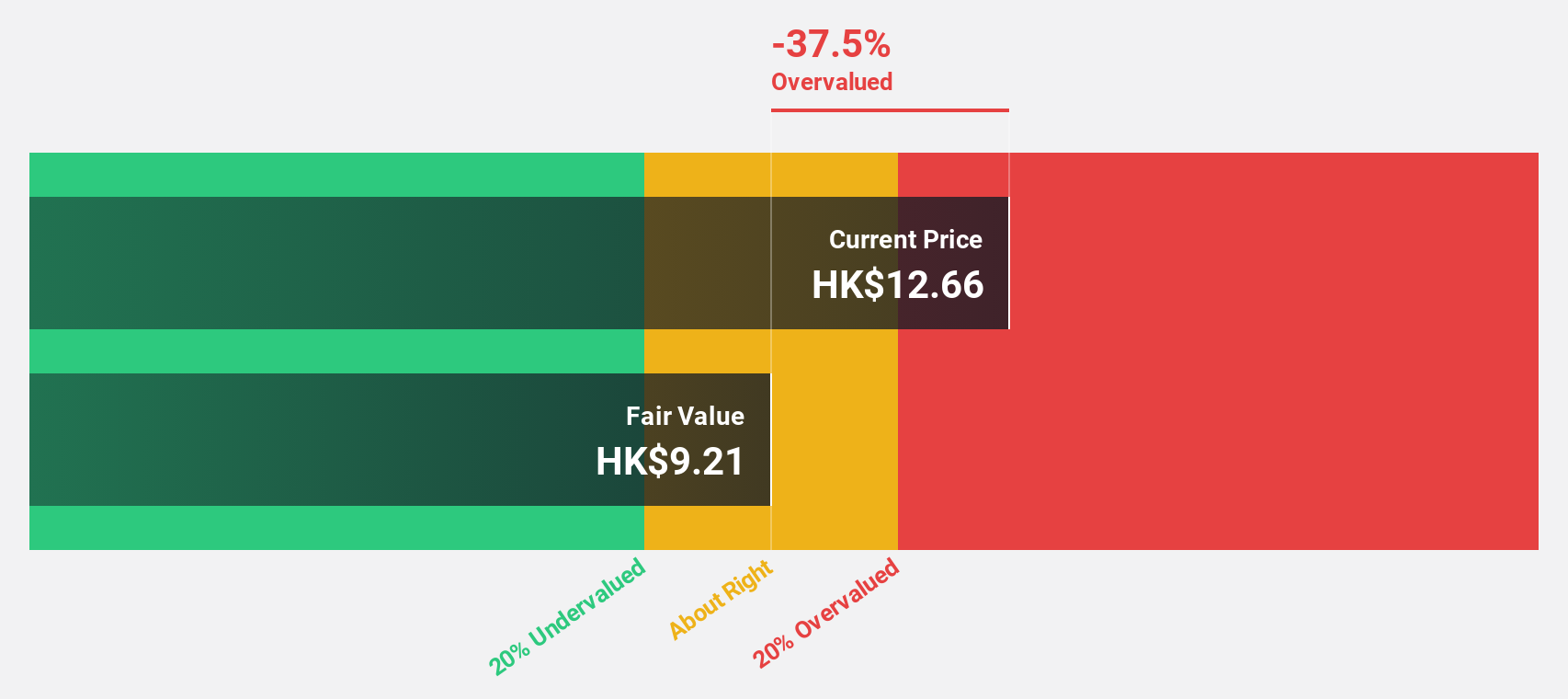

Yeahka (SEHK:9923)

Overview: Yeahka Limited, with a market cap of HK$3.38 billion, is an investment holding company that offers payment and business services to merchants and consumers in the People’s Republic of China.

Operations: The company generates revenue from its business services segment, amounting to CN¥3.47 billion.

Estimated Discount To Fair Value: 45%

Yeahka is trading at HK$7.98, significantly below its estimated fair value of HK$14.5, suggesting it may be undervalued based on cash flows. Despite a volatile share price and low profit margins, earnings are forecast to grow substantially over the next three years. Recent share repurchase plans could enhance net asset value per share. A recent follow-on equity offering raised HK$193.42 million, potentially strengthening Yeahka's financial position for future growth initiatives.

- In light of our recent growth report, it seems possible that Yeahka's financial performance will exceed current levels.

- Get an in-depth perspective on Yeahka's balance sheet by reading our health report here.

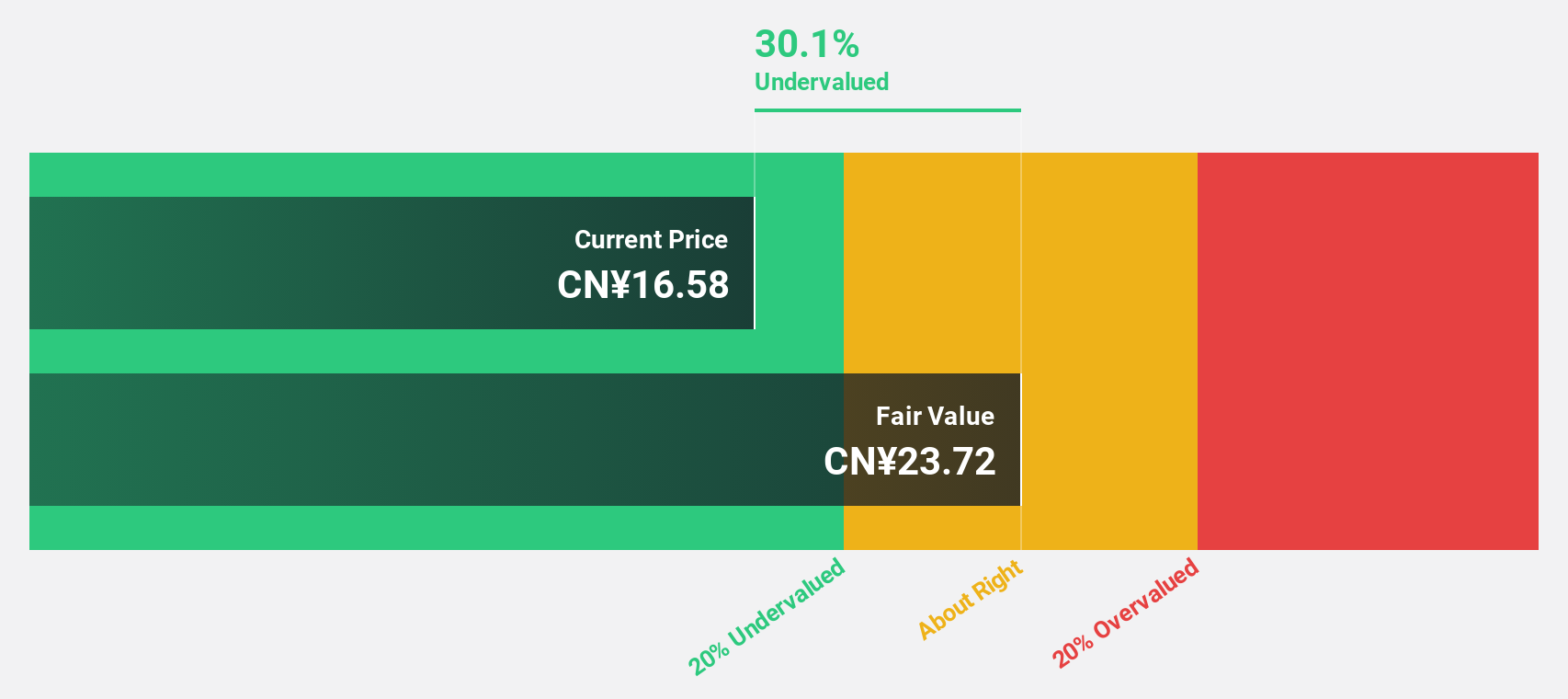

Beijing ConST Instruments Technology (SZSE:300445)

Overview: Beijing ConST Instruments Technology Inc. researches, develops, manufactures, and sells digital testing instruments and equipment both in China and internationally, with a market cap of CN¥3.59 billion.

Operations: Beijing ConST Instruments Technology Inc. generates revenue through the research, development, manufacturing, and sale of digital testing instruments and equipment in domestic and international markets.

Estimated Discount To Fair Value: 30%

Beijing ConST Instruments Technology is trading at CN¥17.13, below its estimated fair value of CN¥24.47, indicating potential undervaluation based on cash flows. The company reported increased revenue of CN¥358.21 million and net income of CN¥89.42 million for the nine months ended September 2024, reflecting strong performance with earnings growth of 47% over the past year. However, its return on equity is forecast to remain low at 14.1% in three years.

- Our expertly prepared growth report on Beijing ConST Instruments Technology implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Beijing ConST Instruments Technology with our detailed financial health report.

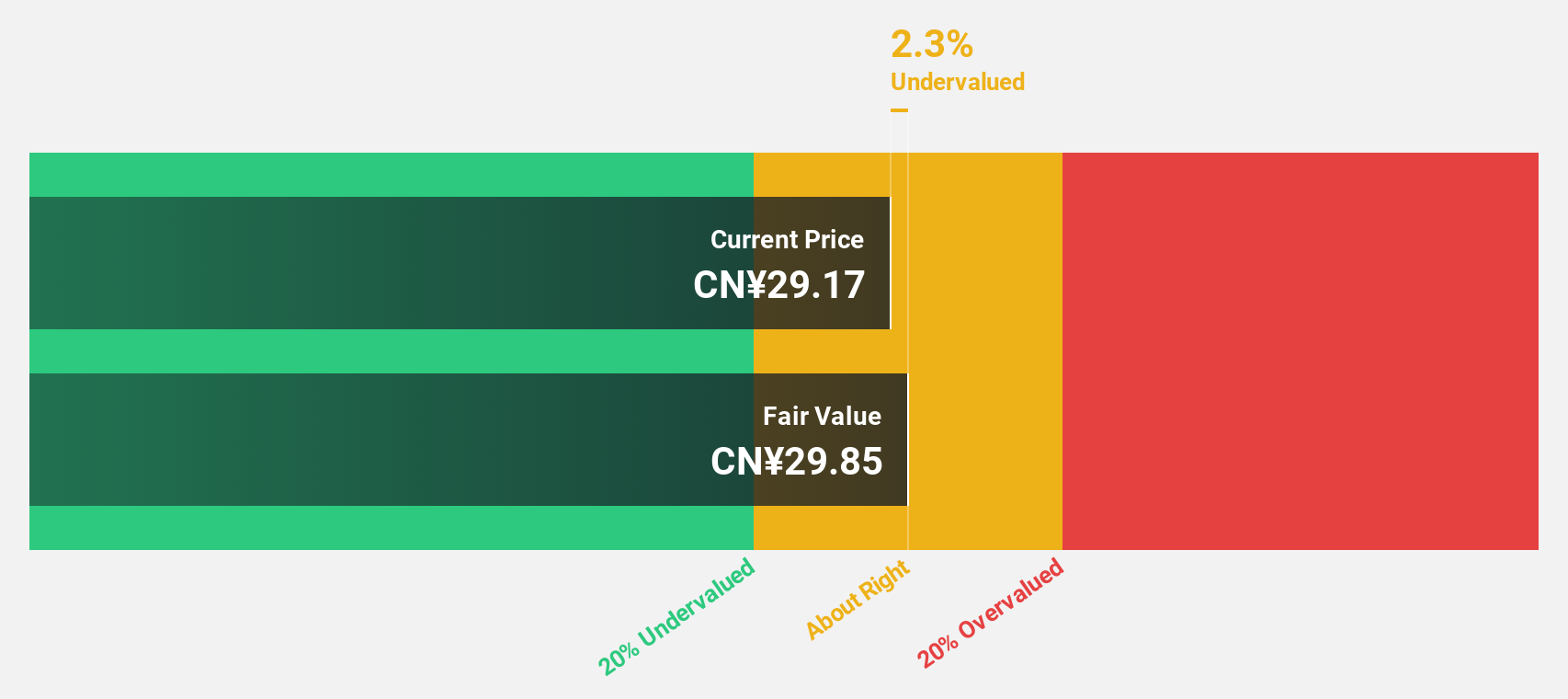

SonoScape Medical (SZSE:300633)

Overview: SonoScape Medical Corp. focuses on the research, development, production, and sale of medical diagnosis and treatment equipment both in China and internationally, with a market cap of CN¥11.73 billion.

Operations: The company's revenue from the medical device industry amounts to CN¥2.05 billion.

Estimated Discount To Fair Value: 31%

SonoScape Medical, trading at CN¥28.17, is significantly undervalued with a fair value estimate of CN¥40.84. While its earnings are projected to grow substantially at 54% annually, recent financials show a decline in net income to CN¥108.99 million from CN¥320.62 million year-on-year for the nine months ending September 2024, alongside reduced profit margins and revenue figures. Despite this, analysts anticipate a price increase of over 50%.

- The growth report we've compiled suggests that SonoScape Medical's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in SonoScape Medical's balance sheet health report.

Taking Advantage

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 871 more companies for you to explore.Click here to unveil our expertly curated list of 874 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing ConST Instruments Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300445

Beijing ConST Instruments Technology

Researches, develops, manufactures, and sells digital testing instruments and equipment in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives