- Hong Kong

- /

- Capital Markets

- /

- SEHK:9636

JF Wealth Holdings' (HKG:9636) Dividend Will Be Reduced To CN¥0.22

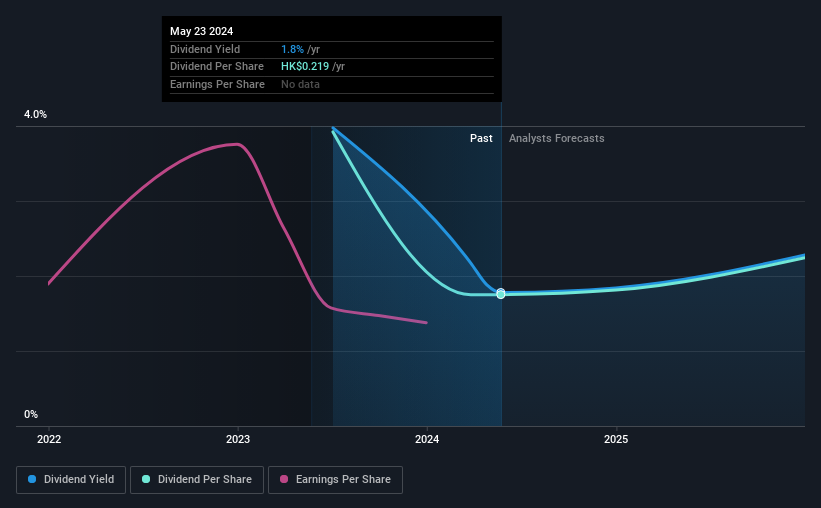

JF Wealth Holdings Ltd's (HKG:9636) dividend is being reduced from last year's payment covering the same period to CN¥0.22 on the 10th of July. This means that the annual payment is 1.8% of the current stock price, which is lower than what the rest of the industry is paying.

See our latest analysis for JF Wealth Holdings

JF Wealth Holdings' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Prior to this announcement, JF Wealth Holdings' dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Over the next year, EPS is forecast to expand by 25.1%. If the dividend continues along recent trends, we estimate the payout ratio will be 42%, which is in the range that makes us comfortable with the sustainability of the dividend.

JF Wealth Holdings Is Still Building Its Track Record

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. JF Wealth Holdings has seen EPS fall by 63% over the last 12 months. Decreases in earnings as large as this could start to put some pressure on the dividend if they are sustained for several years. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for JF Wealth Holdings that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9636

JF SmartInvest Holdings

An investment holding company, through its subsidiaries, provides online investment decision-making solution services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026