- Hong Kong

- /

- Capital Markets

- /

- SEHK:863

OSL Group Limited's (HKG:863) Share Price Matching Investor Opinion

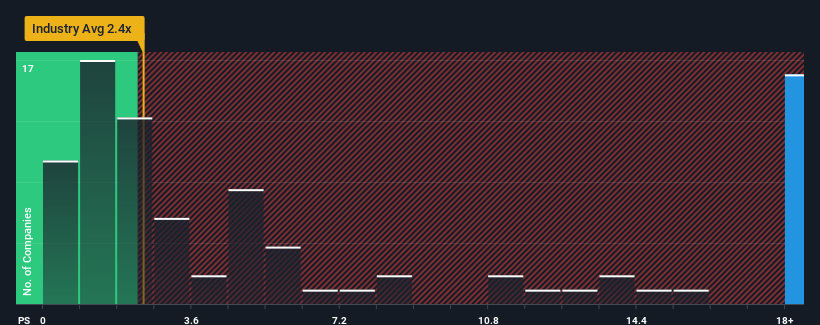

OSL Group Limited's (HKG:863) price-to-sales (or "P/S") ratio of 27.8x may look like a poor investment opportunity when you consider close to half the companies in the Capital Markets industry in Hong Kong have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for OSL Group

How Has OSL Group Performed Recently?

With revenue growth that's superior to most other companies of late, OSL Group has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think OSL Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like OSL Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 81% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 67% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 38%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that OSL Group's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On OSL Group's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into OSL Group shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware OSL Group is showing 4 warning signs in our investment analysis, and 1 of those can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:863

OSL Group

An investment holding company, engages in digital assets and blockchain platform business in Hong Kong, Australia, Japan, Singapore, and Mainland China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026