As global markets react positively to the recent de-escalation in U.S.-China trade tensions, Asian stocks are seeing renewed interest from investors looking for growth opportunities. In this environment, companies with high insider ownership often stand out as they may indicate confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

Underneath we present a selection of stocks filtered out by our screen.

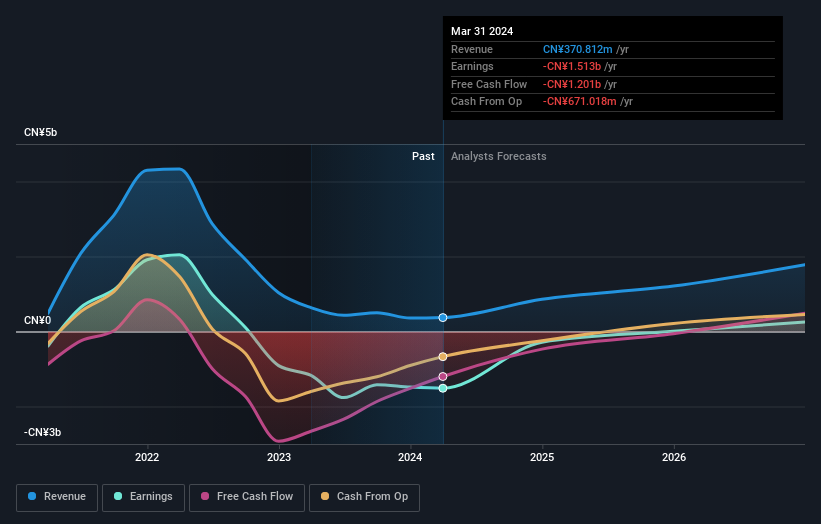

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. develops, manufactures, and commercializes vaccines in the People’s Republic of China, with a market cap of HK$12.06 billion.

Operations: The company generates revenue from its vaccine product research and development for human use, amounting to CN¥869.22 million.

Insider Ownership: 31.4%

CanSino Biologics is poised for significant growth, with earnings forecasted to increase by 158.69% annually and revenue expected to grow at 30.7% per year, surpassing the Hong Kong market average. Despite trading well below its estimated fair value, the company's return on equity is projected to remain low at 9.1%. Recent developments include a Phase I trial approval in Indonesia for an innovative inhaled tuberculosis vaccine and a strategic collaboration in Saudi Arabia for vaccine commercialization, enhancing its global footprint.

- Take a closer look at CanSino Biologics' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that CanSino Biologics is priced lower than what may be justified by its financials.

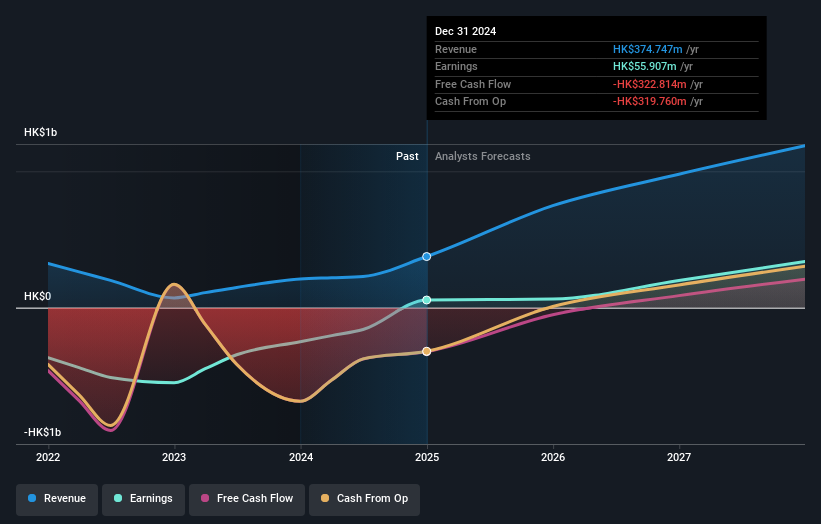

OSL Group (SEHK:863)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OSL Group Limited is an investment holding company that operates in the digital assets and blockchain platform sector across Hong Kong, Australia, Japan, Singapore, and Mainland China with a market cap of HK$7.90 billion.

Operations: The company generates revenue of HK$374.75 million from its digital assets and blockchain platform business across several key markets, including Hong Kong, Australia, Japan, Singapore, and Mainland China.

Insider Ownership: 33.8%

OSL Group is set for robust growth, with revenue projected to rise by 32.5% annually, outpacing the Hong Kong market. Earnings are expected to increase significantly at 60% per year. The company recently launched OSL Wealth, a platform for managing crypto assets, leveraging Hong Kong's financial hub status. Despite becoming profitable this year with sales reaching HK$374.75 million and net income of HK$47.65 million, its future return on equity remains modest at 19.6%.

- Click here to discover the nuances of OSL Group with our detailed analytical future growth report.

- The valuation report we've compiled suggests that OSL Group's current price could be inflated.

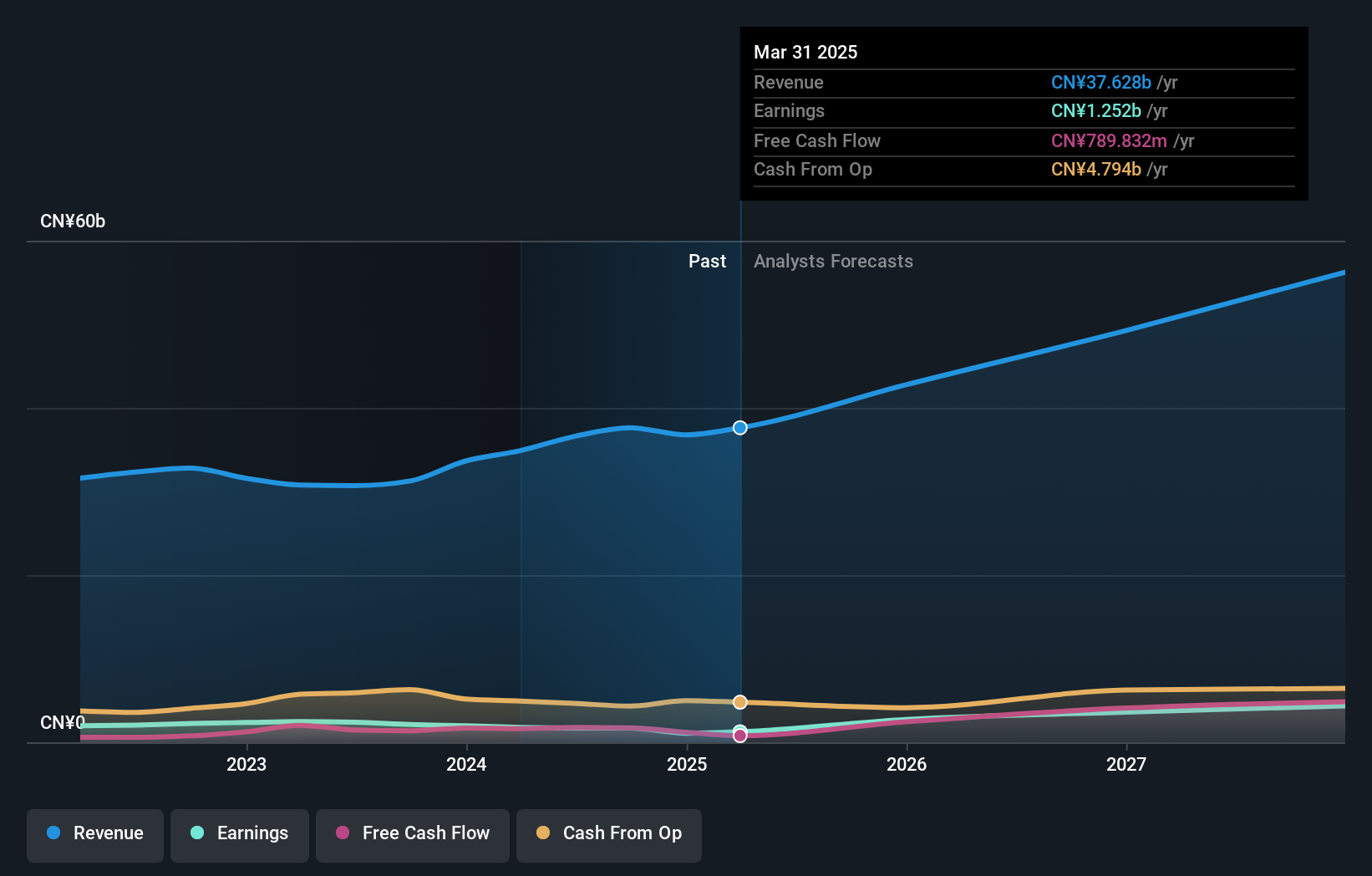

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. operates in the precision manufacturing industry with a market cap of CN¥50.03 billion.

Operations: The company generates revenue from various segments in the precision manufacturing industry, with total revenues detailed in millions of CN¥.

Insider Ownership: 28.6%

Suzhou Dongshan Precision Manufacturing's recent buyback of 4.2 million shares for CNY 100.08 million highlights its commitment to shareholder value, though insider ownership details over the past three months are unavailable. Despite a volatile share price and profit margins declining from 5.1% to 3.3%, earnings are forecasted to grow significantly at 36.5% annually, surpassing market expectations, while revenue growth is projected at a slower pace of 14.2%.

- Click to explore a detailed breakdown of our findings in Suzhou Dongshan Precision Manufacturing's earnings growth report.

- Our valuation report unveils the possibility Suzhou Dongshan Precision Manufacturing's shares may be trading at a discount.

Key Takeaways

- Click this link to deep-dive into the 621 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6185

CanSino Biologics

Develops, manufactures, and commercializes vaccines in the People’s Republic of China.

High growth potential and good value.

Market Insights

Community Narratives