- Hong Kong

- /

- Capital Markets

- /

- SEHK:863

Subdued Growth No Barrier To BC Technology Group Limited (HKG:863) With Shares Advancing 79%

Despite an already strong run, BC Technology Group Limited (HKG:863) shares have been powering on, with a gain of 79% in the last thirty days. The annual gain comes to 194% following the latest surge, making investors sit up and take notice.

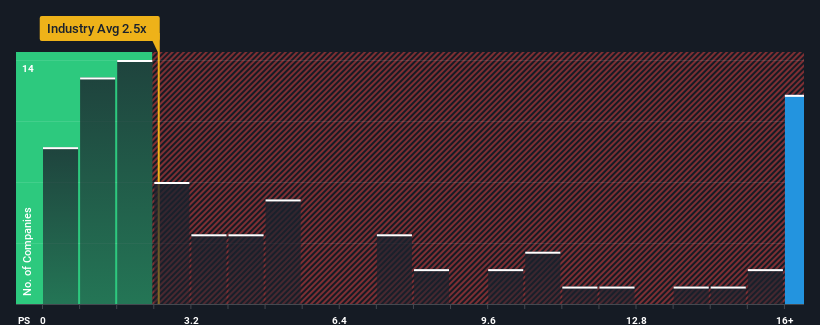

Since its price has surged higher, given around half the companies in Hong Kong's Capital Markets industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider BC Technology Group as a stock to avoid entirely with its 21.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for BC Technology Group

What Does BC Technology Group's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, BC Technology Group has been doing quite well of late. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think BC Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For BC Technology Group?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like BC Technology Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.1%. The solid recent performance means it was also able to grow revenue by 15% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 40% as estimated by the two analysts watching the company. That's shaping up to be similar to the 40% growth forecast for the broader industry.

With this information, we find it interesting that BC Technology Group is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does BC Technology Group's P/S Mean For Investors?

Shares in BC Technology Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given BC Technology Group's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with BC Technology Group (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:863

OSL Group

An investment holding company, engages in digital assets and blockchain platform business in Hong Kong, Australia, Japan, Singapore, and Mainland China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives