- Hong Kong

- /

- Capital Markets

- /

- SEHK:8365

Hatcher Group's (HKG:8365) growing losses don't faze investors as the stock rallies 11% this past week

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. While not every stock performs well, when investors win, they can win big. In the case of Hatcher Group Limited (HKG:8365), the share price is up an incredible 334% in the last year alone. It's up an even more impressive 820% over the last quarter. Zooming out, the stock is actually down 77% in the last three years.

Since the stock has added HK$38m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Hatcher Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Hatcher Group saw its revenue shrink by 32%. This is in stark contrast to the splendorous stock price, which has rocketed 334% since this time a year ago. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. While this gain looks like speculative buying to us, sometimes speculation pays off.

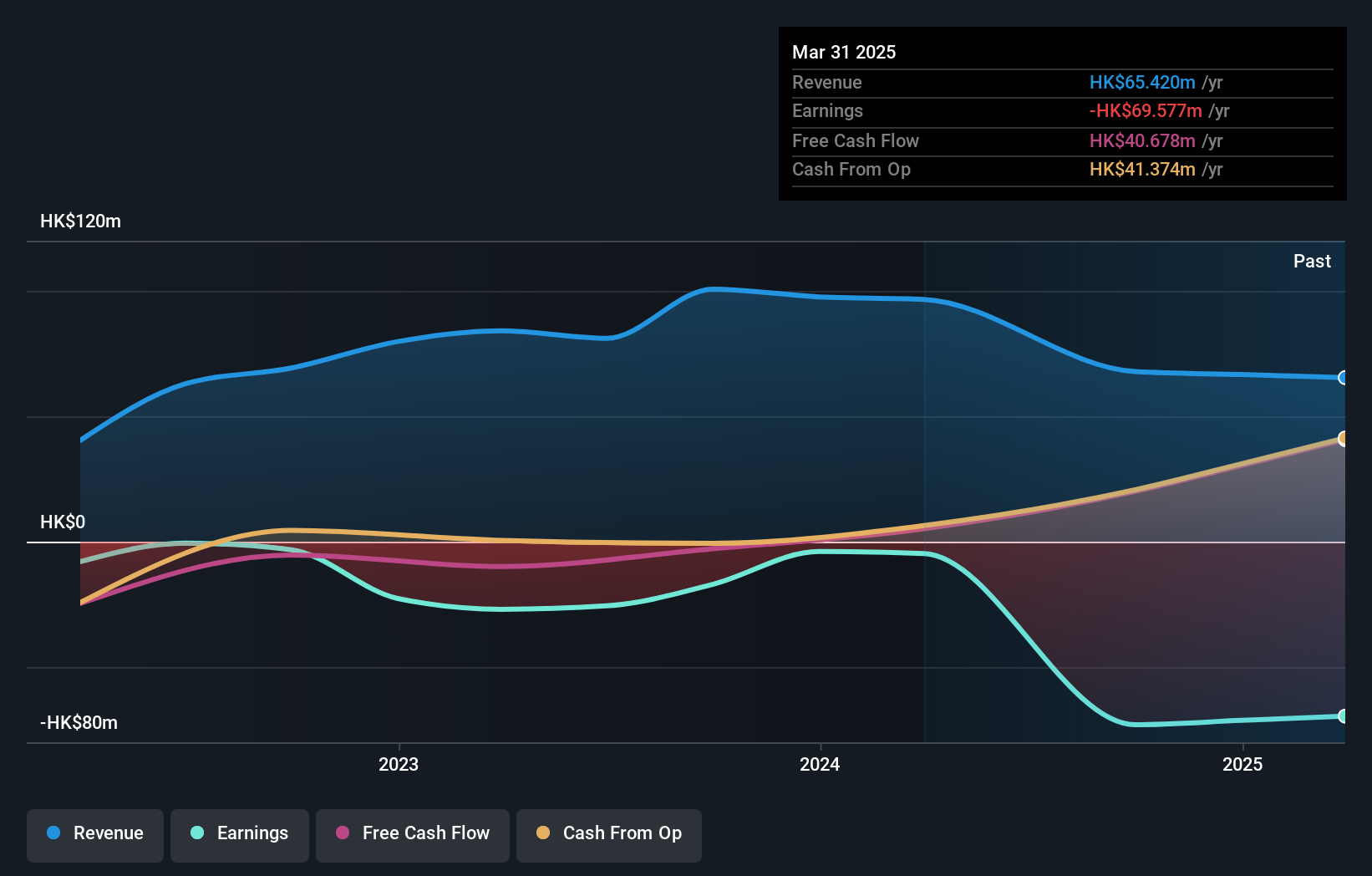

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Hatcher Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hatcher Group's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Hatcher Group's TSR of 504% for the 1 year exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Hatcher Group shareholders have received a total shareholder return of 504% over one year. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Hatcher Group (3 are potentially serious!) that you should be aware of before investing here.

Hatcher Group is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hatcher Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8365

Hatcher Group

An investment holding company, provides financial services in Hong Kong, the People's Republic of China, and Canada.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives