- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3939

Undiscovered Gems In Hong Kong And 2 Other Promising Small Caps

Reviewed by Simply Wall St

In recent weeks, the Hong Kong market has mirrored global trends, with the Hang Seng Index experiencing a notable decline amid weak corporate earnings and economic data. Despite this backdrop, investors are increasingly looking towards small-cap stocks for potential opportunities as broader market sentiment remains cautious. Identifying promising stocks in such an environment requires a focus on companies with strong fundamentals, innovative business models, and resilience to economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| HBM Holdings | 52.89% | 66.59% | 31.70% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, an investment holding company with a market cap of HK$10.54 billion, engages in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group generates revenue primarily through the extraction and sale of coal products in China. The company has a market cap of HK$10.54 billion.

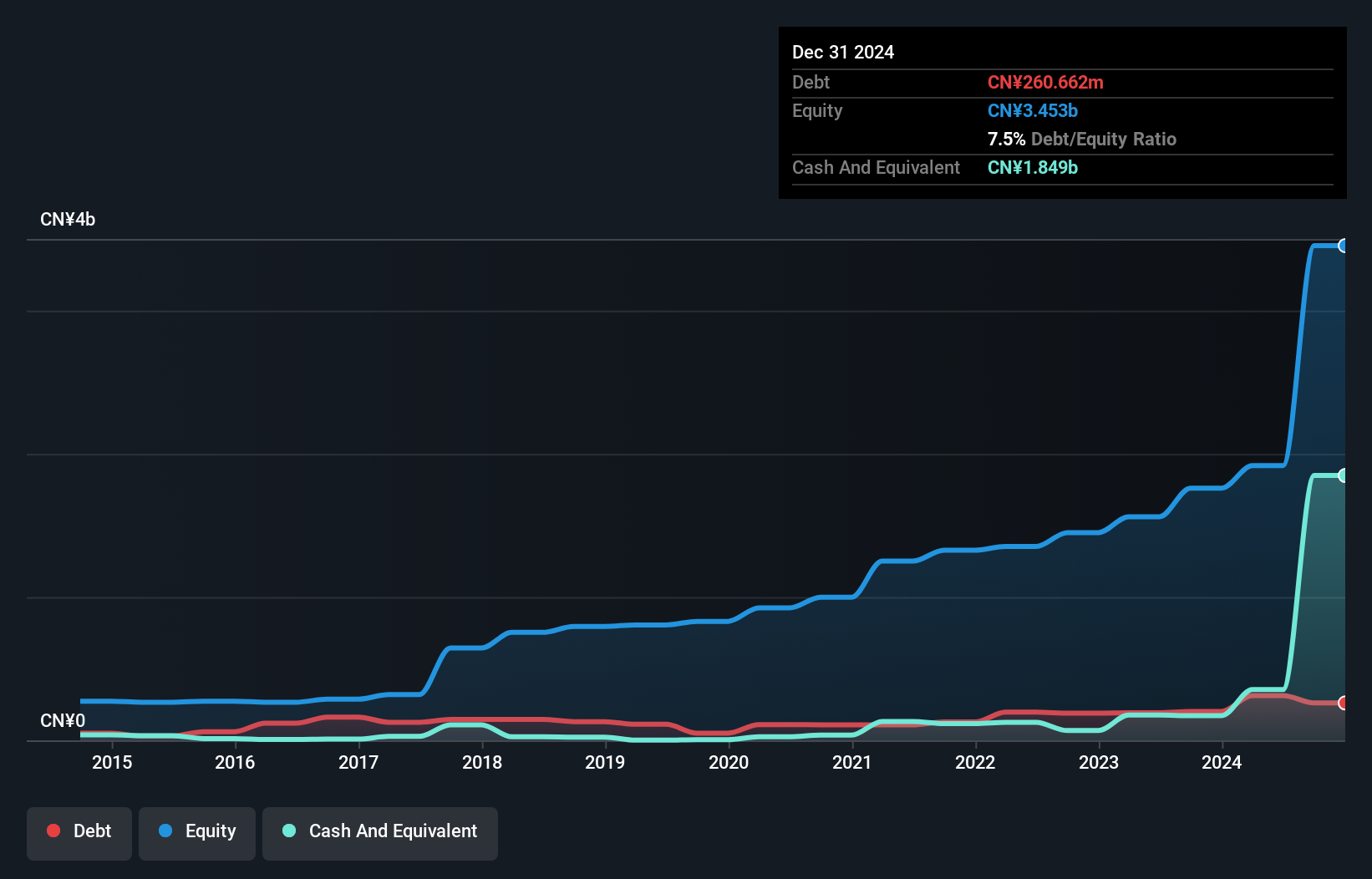

Kinetic Development Group has demonstrated impressive growth, with earnings rising 39.2% over the past year, significantly outpacing the Oil and Gas industry average of 4.6%. The company reported half-year sales of CNY 2.53 billion and net income of CNY 1.10 billion, both substantial increases from a year ago. Trading at 67% below its estimated fair value, Kinetic's debt to equity ratio has improved from 28.4% to a satisfactory 12.5% over five years, reflecting prudent financial management.

- Click here and access our complete health analysis report to understand the dynamics of Kinetic Development Group.

Learn about Kinetic Development Group's historical performance.

Wanguo International Mining Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo International Mining Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in the People’s Republic of China and Solomon Islands with a market cap of HK$7.28 billion.

Operations: The company generates revenue primarily from its Yifeng Project (CN¥749.25 million) and Solomon Project (CN¥912.63 million).

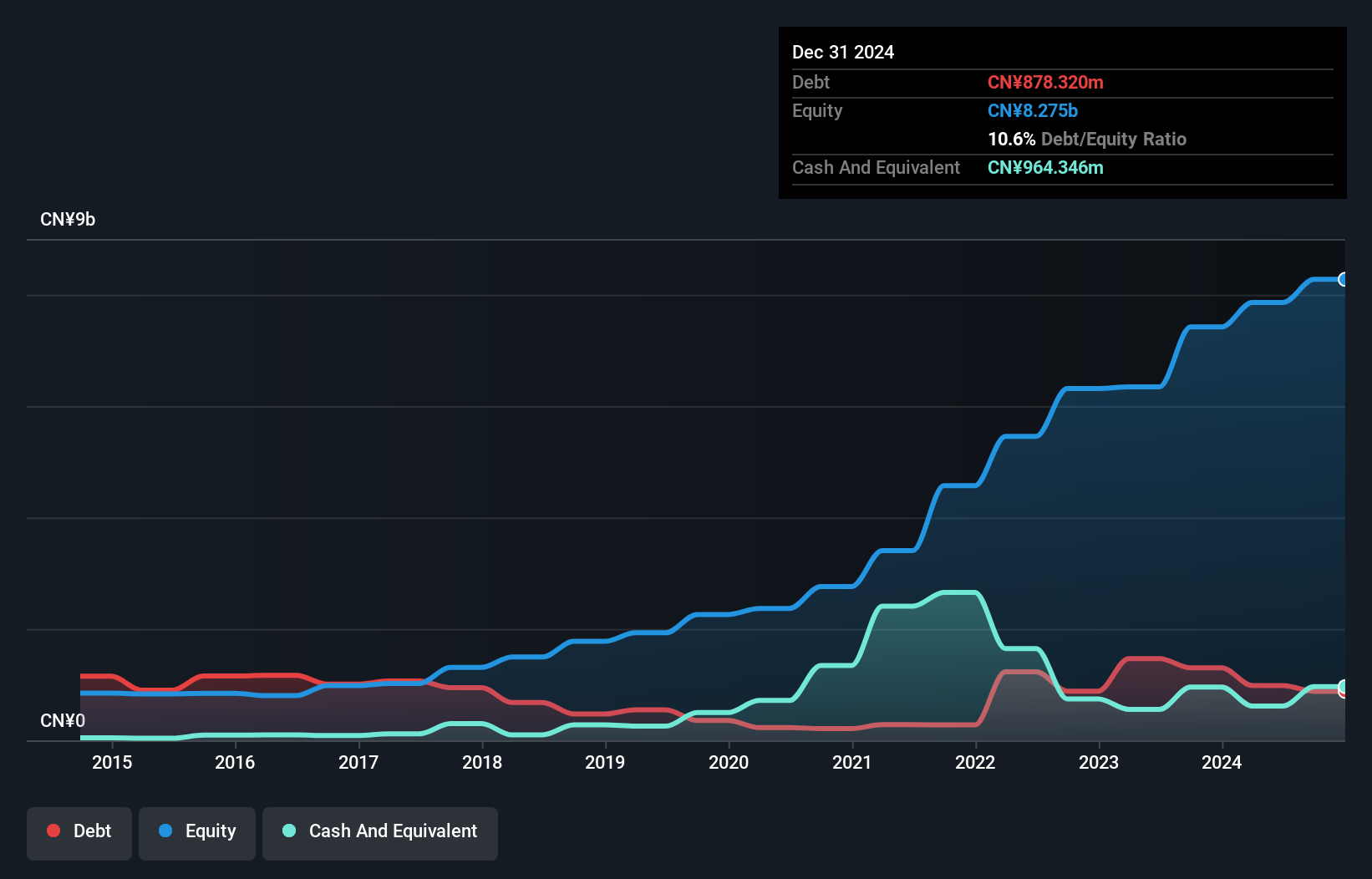

Wanguo Gold Group, formerly Wanguo International Mining Group, has shown robust performance with earnings growth of 89.9% over the past year, surpassing the Metals and Mining industry's 23.1%. The company reported sales of ¥927.86 million for H1 2024, up from ¥581.19 million a year ago, with net income rising to ¥254.27 million from ¥147.11 million in the same period. Additionally, its EBIT covers interest payments by an impressive 91 times, reflecting strong financial health and operational efficiency.

AGTech Holdings (SEHK:8279)

Simply Wall St Value Rating: ★★★★★★

Overview: AGTech Holdings Limited operates as an integrated technology and services company in the People’s Republic of China and Macau, with a market cap of HK$2.51 billion.

Operations: AGTech Holdings generates revenue primarily from its Lottery Operation (HK$248.76 million) and Electronic Payment and Related Services (HK$364.50 million).

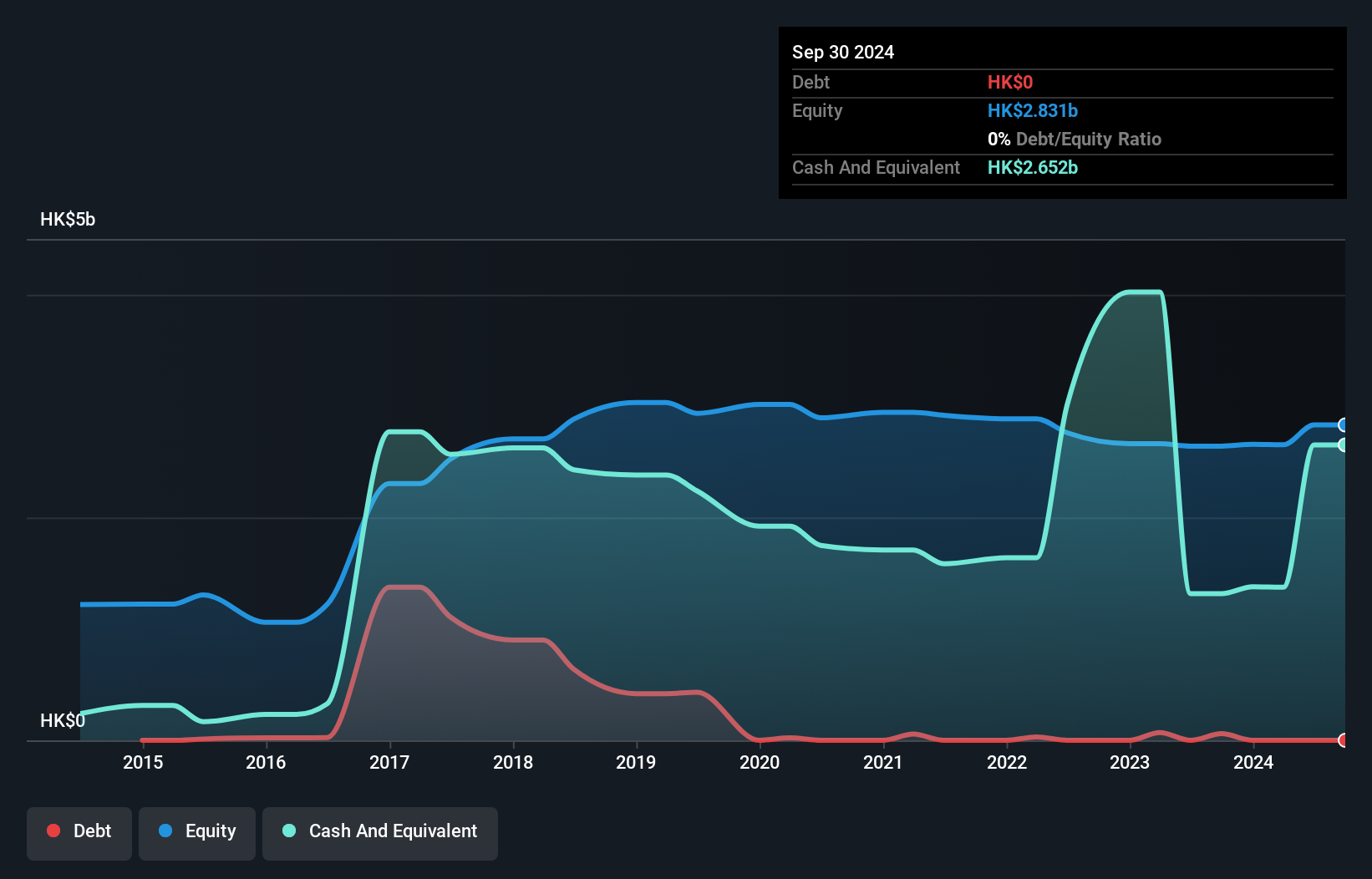

AGTech Holdings, a smaller player in Hong Kong's tech scene, recently reported sales of HK$766.58 million for the fifteen months ending March 2024, with net income at HK$31.86 million. The company has no debt and has seen its debt-to-equity ratio drop from 13.8% five years ago to zero now. Despite becoming profitable this year, its share price remains highly volatile over the past three months.

- Dive into the specifics of AGTech Holdings here with our thorough health report.

Understand AGTech Holdings' track record by examining our Past report.

Seize The Opportunity

- Reveal the 169 hidden gems among our SEHK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wanguo Gold Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3939

Wanguo Gold Group

An investment holding company, engages in mining, ore processing, and sale of concentrate products in the People’s Republic of China and Solomon Islands.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives