- Hong Kong

- /

- Capital Markets

- /

- SEHK:806

Why Investors Shouldn't Be Surprised By Value Partners Group Limited's (HKG:806) P/E

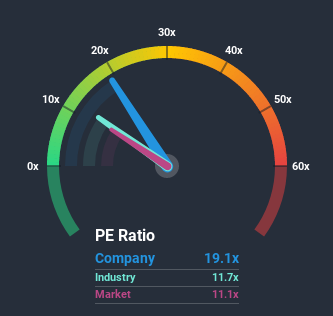

With a price-to-earnings (or "P/E") ratio of 19.1x Value Partners Group Limited (HKG:806) may be sending very bearish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios under 11x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Value Partners Group has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Value Partners Group

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Value Partners Group's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 36% last year. As a result, it also grew EPS by 10% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 30% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 19% per year, which is noticeably less attractive.

In light of this, it's understandable that Value Partners Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Value Partners Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Value Partners Group.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

When trading Value Partners Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:806

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives