- Hong Kong

- /

- Capital Markets

- /

- SEHK:806

Value Partners Group (HKG:806) Is Reducing Its Dividend To HK$0.034

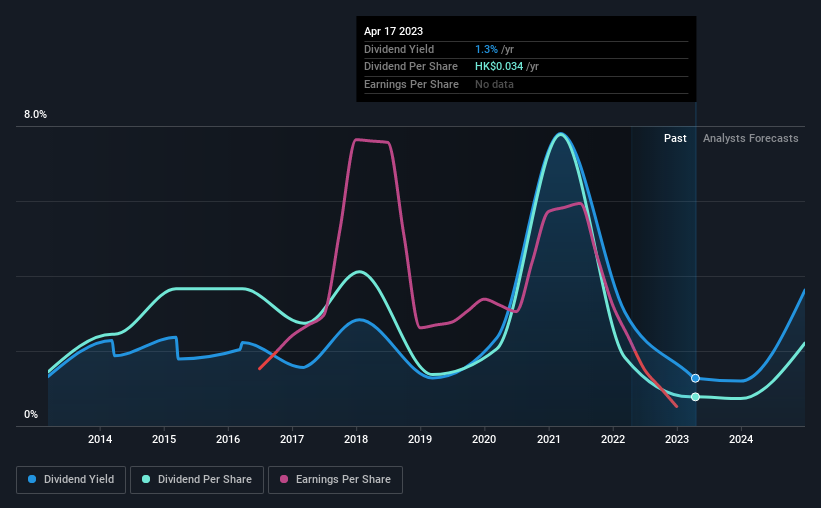

Value Partners Group Limited (HKG:806) is reducing its dividend from last year's comparable payment to HK$0.034 on the 25th of May. Based on this payment, the dividend yield will be 1.3%, which is lower than the average for the industry.

View our latest analysis for Value Partners Group

Value Partners Group's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Even though Value Partners Group is not generating a profit, it is still paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend extends its recent trend, estimates say the dividend could reach 1.3%, which we would be comfortable to see continuing.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of HK$0.063 in 2013 to the most recent total annual payment of HK$0.034. The dividend has shrunk at around 6.0% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Over the past five years, it looks as though Value Partners Group's EPS has declined at around 36% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Value Partners Group's Dividend Doesn't Look Great

To sum up, we don't like when dividends are cut, but in this case the dividend may have been too high to begin with. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. We don't think that this is a great candidate to be an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Are management backing themselves to deliver performance? Check their shareholdings in Value Partners Group in our latest insider ownership analysis. Is Value Partners Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:806

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives