As global markets grapple with geopolitical tensions and consumer spending concerns, major U.S. indices have experienced volatility, with the S&P 500 reaching record highs before retreating due to various economic pressures. In such fluctuating conditions, investors often seek opportunities in diverse sectors, including penny stocks—a term that may seem outdated but still holds relevance for those interested in smaller or newer companies. These stocks can offer growth potential at lower price points when backed by strong financials and solid fundamentals, making them an intriguing option for investors looking to uncover hidden gems amidst market uncertainties.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.32 | MYR890.29M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.86 | HK$44.31B | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.22 | THB2.53B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.00 | £323.15M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £455.98M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.185 | £316.77M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £468.97M | ★★★★★★ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hamlet BioPharma (NGM:HAMLET B)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hamlet BioPharma AB (publ) is a Swedish company focused on developing drugs for cancer treatment and prevention, with a market cap of SEK687.64 million.

Operations: No revenue segments are reported for Hamlet BioPharma.

Market Cap: SEK687.64M

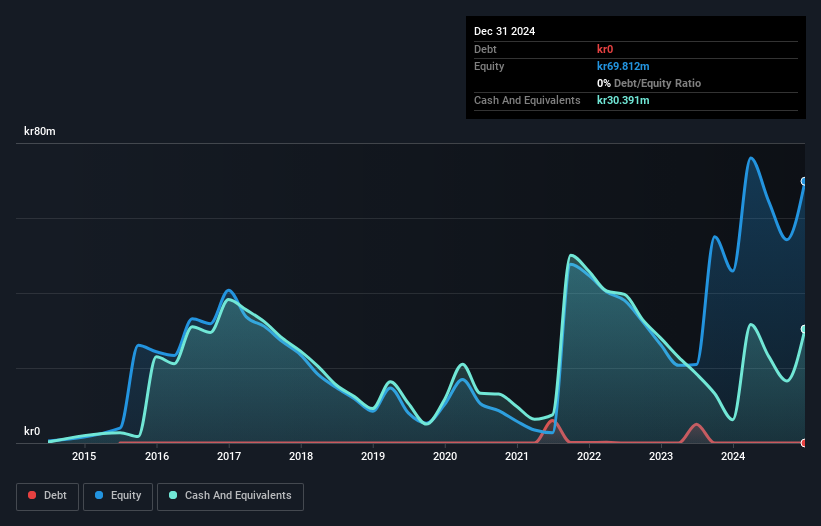

Hamlet BioPharma is a pre-revenue company in the biotech sector, with a market cap of SEK687.64 million and no significant revenue streams. The company faces financial challenges with less than a year of cash runway and has reported increasing losses over the past five years. Recent executive changes include Catharina Svanborg's appointment as CEO, which may impact strategic direction. Despite being debt-free and having experienced board members, Hamlet BioPharma's share price remains highly volatile, reflecting investor uncertainty amid ongoing drug development efforts and recent follow-on equity offerings to raise SEK26.79 million for operational funding.

- Unlock comprehensive insights into our analysis of Hamlet BioPharma stock in this financial health report.

- Explore historical data to track Hamlet BioPharma's performance over time in our past results report.

TradeGo FinTech (SEHK:8017)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TradeGo FinTech Limited is an investment holding company that offers integrated securities trading platform services to brokerage firms and their clients in Hong Kong and the People's Republic of China, with a market cap of HK$188.01 million.

Operations: The company's revenue is derived from services in Hong Kong, contributing HK$55.96 million, and the People's Republic of China, contributing HK$14.00 million.

Market Cap: HK$188.01M

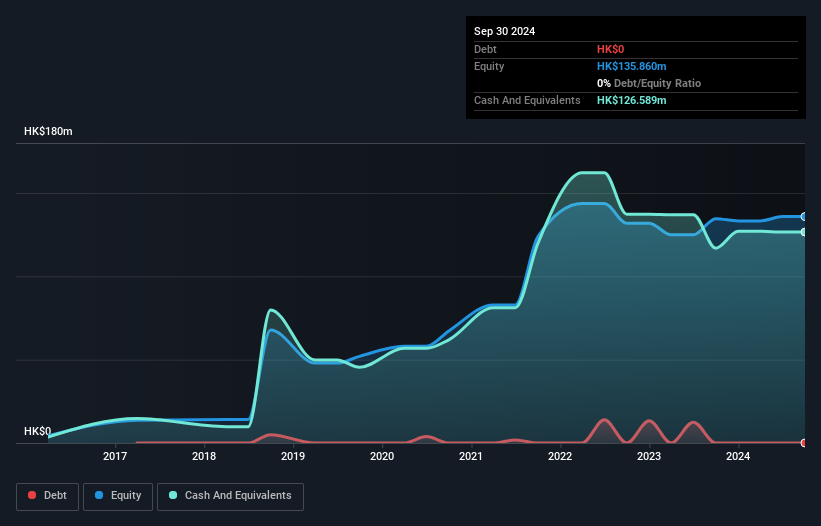

TradeGo FinTech Limited, with a market cap of HK$188.01 million, has integrated the DeepSeek-R1 model to enhance its smart trading services, potentially boosting its competitive edge in fintech. Despite stable weekly volatility and a debt-free status, the company faces challenges such as declining profit margins (currently 7.5% from 21.3% last year) and negative earnings growth (-69.8%) over the past year compared to industry averages. However, TradeGo's short-term assets significantly exceed liabilities, providing some financial stability amid these hurdles as it trades below estimated fair value by 47.3%.

- Click to explore a detailed breakdown of our findings in TradeGo FinTech's financial health report.

- Gain insights into TradeGo FinTech's past trends and performance with our report on the company's historical track record.

Buriram Sugar (SET:BRR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Buriram Sugar Public Company Limited, along with its subsidiaries, is involved in the production and distribution of sugar and molasses both in Thailand and internationally, with a market cap of THB3.72 billion.

Operations: The company generates revenue from three main segments: THB6.18 billion from sugar and molasses production and distribution, THB1.06 billion from agricultural product distribution, and THB851 million from electricity and steam production and distribution.

Market Cap: THB3.72B

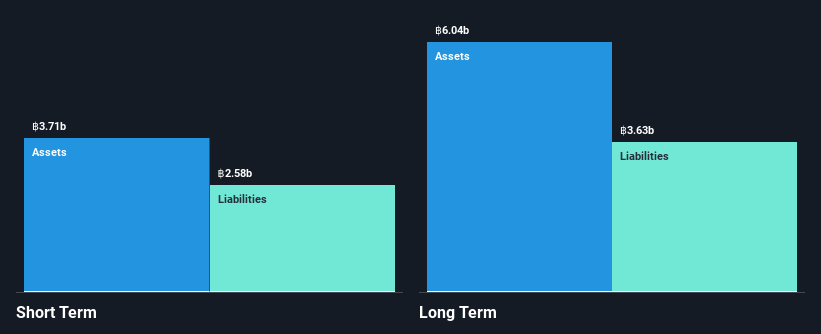

Buriram Sugar Public Company Limited, with a market cap of THB3.72 billion, has shown impressive earnings growth of 336.1% over the past year, surpassing industry averages. Despite its high net debt to equity ratio of 90.5%, the company's interest payments are well covered by EBIT at 9.2 times coverage and operating cash flow effectively covers debt at 20.2%. The management and board are experienced with average tenures of six and twelve years respectively, ensuring stability in leadership amidst recent executive changes. Trading below fair value by 16.3%, Buriram Sugar demonstrates both growth potential and financial challenges typical for stocks in this category.

- Jump into the full analysis health report here for a deeper understanding of Buriram Sugar.

- Review our historical performance report to gain insights into Buriram Sugar's track record.

Where To Now?

- Embark on your investment journey to our 5,705 Penny Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamlet BioPharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:HAMLET B

Hamlet BioPharma

Engages in the development of drugs for the treatment and prevention of cancer in Sweden.

Moderate with adequate balance sheet.

Market Insights

Community Narratives