- Hong Kong

- /

- Capital Markets

- /

- SEHK:6881

Will China Galaxy Securities’ Governance Overhaul Strengthen Its Competitive Edge in a Changing Market (SEHK:6881)?

Reviewed by Sasha Jovanovic

- China Galaxy Securities Co., Ltd. announced it will propose amendments to its Articles of Association at its upcoming extraordinary general meeting, responding to major updates in China’s Company Law and sweeping regulatory reforms affecting corporate governance.

- This move reflects an effort to enhance operational transparency and modernize governance as regulatory frameworks evolve across China’s securities sector.

- We'll explore how these proposed governance changes could shape China Galaxy Securities' investment narrative at a time of heightened regulatory transformation.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is China Galaxy Securities' Investment Narrative?

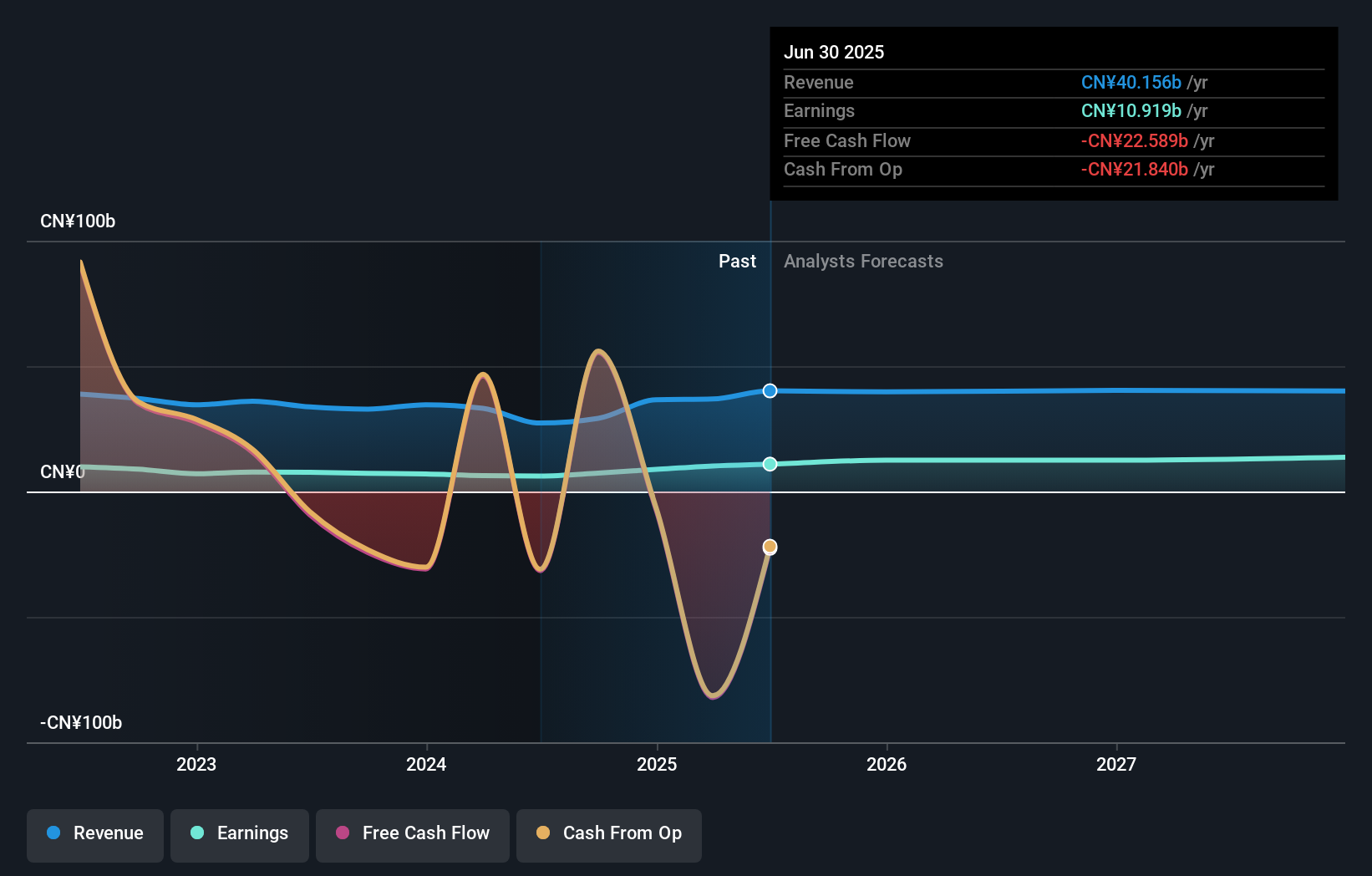

For anyone considering China Galaxy Securities as an investment, the big picture centers on shareholder confidence in its ability to implement regulatory-driven reforms while maintaining attractive returns and efficient operations. The newly proposed amendments to its Articles of Association, designed to align with sweeping changes in China’s Company Law and securities regulations, could be a pivotal moment, especially given the sector’s emphasis on governance and transparency. While such news reflects responsiveness to evolving compliance standards, the actual impact on key short-term catalysts, like Q3 2025 results and dividend stability, may prove limited unless governance changes trigger wider shifts in capital flows or investor sentiment. The company’s recent financial performance, board turnover, and already competitive valuation suggest that the largest near-term risks remain slower revenue growth and questions around board independence rather than immediate regulatory fallout. Recent price gains have largely tracked earnings growth, so investor focus might not shift dramatically unless the governance changes bring unexpected outcomes. However, board independence remains an issue that investors should keep on their radar.

China Galaxy Securities' shares have been on the rise but are still potentially undervalued by 7%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on China Galaxy Securities - why the stock might be worth just HK$11.79!

Build Your Own China Galaxy Securities Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Galaxy Securities research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Galaxy Securities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Galaxy Securities' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6881

China Galaxy Securities

Provides various financial services in the People’s Republic of China.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives