- Hong Kong

- /

- Capital Markets

- /

- SEHK:6881

China Galaxy Securities Co., Ltd. (HKG:6881) Doing What It Can To Lift Shares

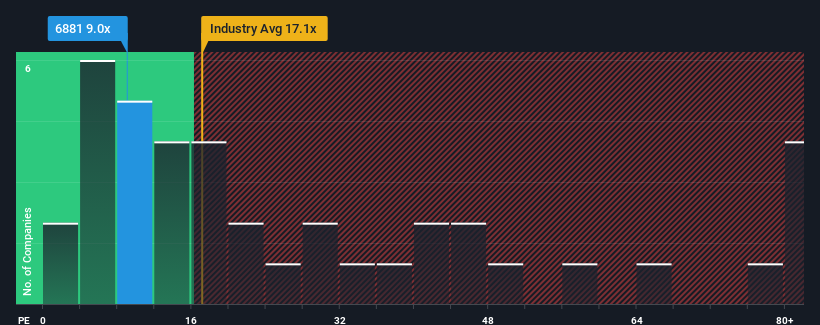

There wouldn't be many who think China Galaxy Securities Co., Ltd.'s (HKG:6881) price-to-earnings (or "P/E") ratio of 9x is worth a mention when the median P/E in Hong Kong is similar at about 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

China Galaxy Securities hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for China Galaxy Securities

What Are Growth Metrics Telling Us About The P/E?

China Galaxy Securities' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. This means it has also seen a slide in earnings over the longer-term as EPS is down 21% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 40% over the next year. With the market only predicted to deliver 22%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that China Galaxy Securities is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of China Galaxy Securities' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for China Galaxy Securities with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of China Galaxy Securities' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6881

China Galaxy Securities

Provides various financial services in the People’s Republic of China.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives