- Hong Kong

- /

- Consumer Finance

- /

- SEHK:6878

Do Differ Group Holding's (HKG:6878) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Differ Group Holding (HKG:6878), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Differ Group Holding with the means to add long-term value to shareholders.

Check out our latest analysis for Differ Group Holding

Differ Group Holding's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Differ Group Holding managed to grow EPS by 4.3% per year, over three years. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

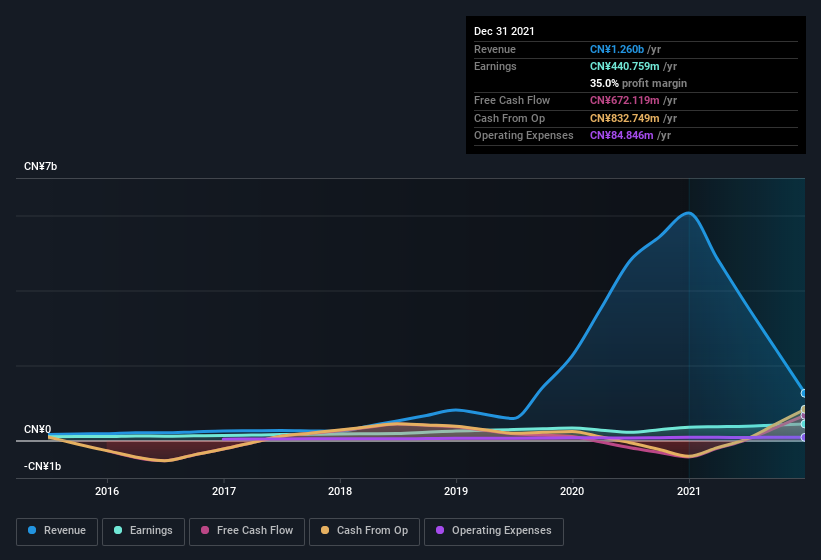

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Differ Group Holding's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While Differ Group Holding may have maintained EBIT margins over the last year, revenue has fallen. Suffice it to say that is not a great sign of growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Differ Group Holding's forecast profits?

Are Differ Group Holding Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping CN¥8.6m that the CEO & Executive Chairman, Chi Chung Ng spent acquiring shares. The average price of which was CN¥1.96 per share. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

On top of the insider buying, we can also see that Differ Group Holding insiders own a large chunk of the company. In fact, they own 58% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. CN¥8.6b This is an incredible endorsement from them.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Chi Chung Ng is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Differ Group Holding with market caps between CN¥6.7b and CN¥21b is about CN¥3.9m.

Differ Group Holding's CEO took home a total compensation package of CN¥525k in the year prior to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Differ Group Holding Deserve A Spot On Your Watchlist?

One positive for Differ Group Holding is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Differ Group Holding , and understanding it should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Differ Group Holding, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6878

Differ Group Auto

An investment holding company, provides various financial services in the People’s Republic of China.

Slight and slightly overvalued.

Market Insights

Community Narratives