- Hong Kong

- /

- Diversified Financial

- /

- SEHK:6069

Sheng Ye Capital (HKG:6069) Is Increasing Its Dividend To HK$0.063

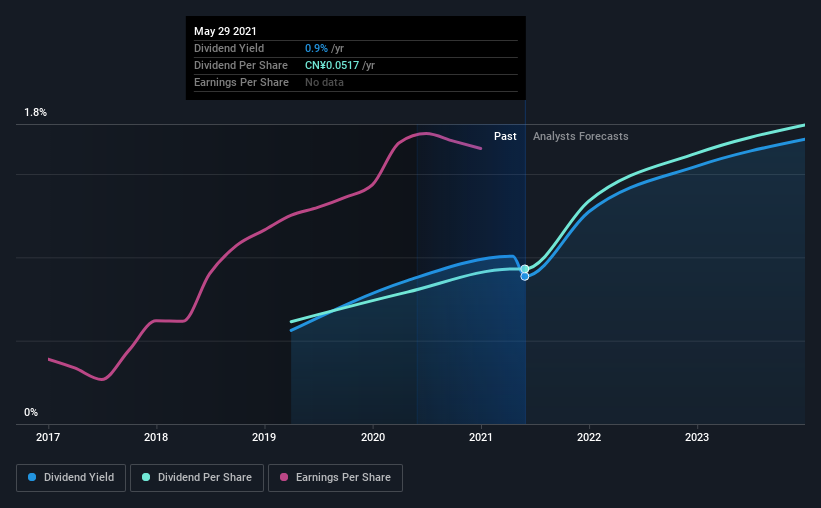

The board of Sheng Ye Capital Limited (HKG:6069) has announced that it will be increasing its dividend by 19% on the 30th of June to HK$0.063. Even though the dividend went up, the yield is still quite low at only 0.9%.

View our latest analysis for Sheng Ye Capital

Sheng Ye Capital's Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. However, Sheng Ye Capital's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, earnings per share is forecast to rise by 13.4% over the next year. If the dividend continues on this path, the payout ratio could be 18% by next year, which we think can be pretty sustainable going forward.

Sheng Ye Capital Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. Since 2019, the dividend has gone from CN¥0.034 to CN¥0.052. This works out to be a compound annual growth rate (CAGR) of approximately 23% a year over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. We are encouraged to see that Sheng Ye Capital has grown earnings per share at 39% per year over the past three years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

We Really Like Sheng Ye Capital's Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Sheng Ye Capital that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6069

SY Holdings Group

An investment holding company, provides supply chain technology and digital financing solutions for companies in the People’s Republic of China.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives