- Hong Kong

- /

- Diversified Financial

- /

- SEHK:6069

How Much Did Sheng Ye Capital's(HKG:6069) Shareholders Earn From Share Price Movements Over The Last Three Years?

While it may not be enough for some shareholders, we think it is good to see the Sheng Ye Capital Limited (HKG:6069) share price up 27% in a single quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 18% in the last three years, significantly under-performing the market.

See our latest analysis for Sheng Ye Capital

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, Sheng Ye Capital actually managed to grow EPS by 87% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

With a rather small yield of just 0.8% we doubt that the stock's share price is based on its dividend. We note that, in three years, revenue has actually grown at a 46% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Sheng Ye Capital more closely, as sometimes stocks fall unfairly. This could present an opportunity.

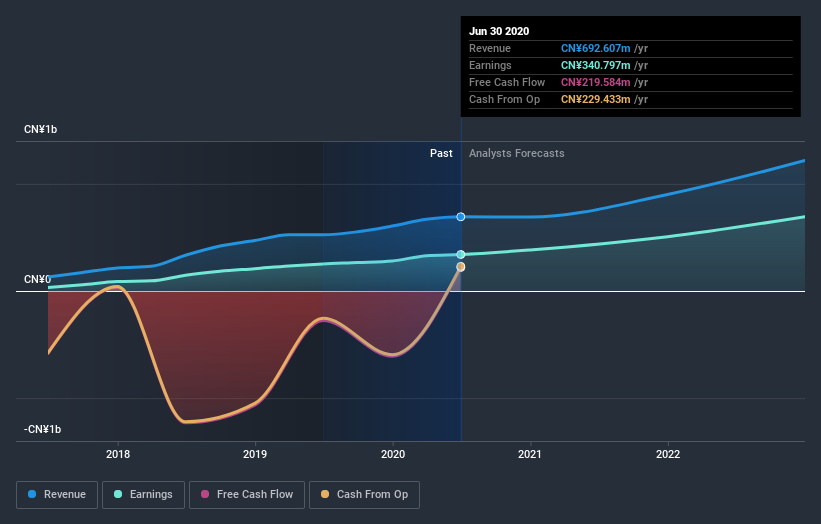

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Sheng Ye Capital will earn in the future (free profit forecasts).

A Different Perspective

Over the last year Sheng Ye Capital shareholders have received a TSR of 8.0%. It's always nice to make money but this return falls short of the market return which was about 43% for the year. On the bright side, that's certainly better than the yearly loss of about 5% endured over the last three years, implying that the company is doing better recently. We hope the turnaround in fortunes continues. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Sheng Ye Capital you should be aware of, and 1 of them is a bit concerning.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Sheng Ye Capital or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6069

SY Holdings Group

An investment holding company, provides supply chain technology and digital financing solutions for companies in the People’s Republic of China.

High growth potential with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.