- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

SEHK's Top Picks For Estimated Undervalued Stocks In September 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, the Hong Kong stock market has shown resilience amidst fluctuating inflation data and evolving trade dynamics. With the Hang Seng Index experiencing modest declines, investors are increasingly on the lookout for undervalued opportunities that could offer significant potential for growth. In this context, identifying stocks that are trading below their intrinsic value can be particularly appealing. Here are three top picks from SEHK that may be considered undervalued in September 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.60 | HK$6.74 | 46.6% |

| WuXi XDC Cayman (SEHK:2268) | HK$20.00 | HK$39.28 | 49.1% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.20 | HK$56.15 | 49.8% |

| BYD (SEHK:1211) | HK$240.00 | HK$460.81 | 47.9% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.84 | HK$19.91 | 45.6% |

| Digital China Holdings (SEHK:861) | HK$3.23 | HK$6.10 | 47.1% |

| United Company RUSAL International (SEHK:486) | HK$2.28 | HK$4.25 | 46.3% |

| Akeso (SEHK:9926) | HK$71.60 | HK$133.26 | 46.3% |

| Innovent Biologics (SEHK:1801) | HK$44.20 | HK$80.34 | 45% |

| Jinke Smart Services Group (SEHK:9666) | HK$6.91 | HK$13.78 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

AAC Technologies Holdings (SEHK:2018)

Overview: AAC Technologies Holdings Inc. is an investment holding company that provides solutions for smart devices across various regions including Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe, with a market cap of HK$34.16 billion.

Operations: Revenue Segments (in millions of CN¥): Optics Products: 4068.18, Acoustics Products: 7635.95, Segment Adjustment: 1539.06, Sensor and Semiconductor Products: 920.28, Electromagnetic Drives and Precision Mechanics: 8283.63. AAC Technologies Holdings Inc.'s revenue is derived from optics products (CN¥4.07 billion), acoustics products (CN¥7.64 billion), sensor and semiconductor products (CN¥0.92 billion), and electromagnetic drives and precision mechanics (CN¥8.28 billion).

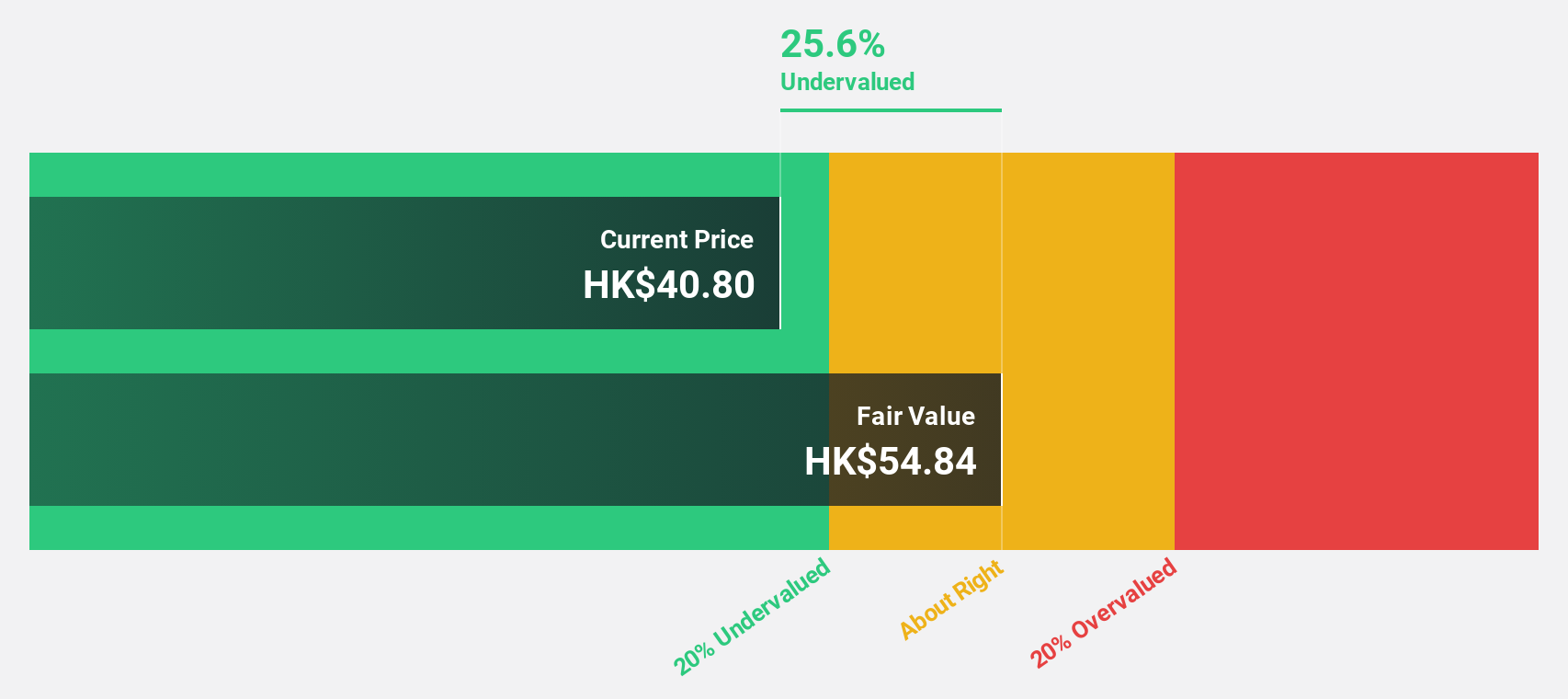

Estimated Discount To Fair Value: 19.1%

AAC Technologies Holdings is trading at HK$28.5, below its estimated fair value of HK$35.25, indicating it may be undervalued based on cash flows. The company's earnings grew by 81.3% over the past year and are forecast to grow significantly at 21% annually, outpacing the Hong Kong market's expected growth of 11.7%. Recent earnings reports show a substantial increase in net income to CNY 537.03 million for H1 2024 from CNY 150.3 million a year ago.

- Insights from our recent growth report point to a promising forecast for AAC Technologies Holdings' business outlook.

- Unlock comprehensive insights into our analysis of AAC Technologies Holdings stock in this financial health report.

China International Capital (SEHK:3908)

Overview: China International Capital Corporation Limited provides financial services in Mainland China and internationally with a market cap of HK$107.15 billion.

Operations: China International Capital Corporation Limited generates revenue from various segments, including FICC (CN¥9.82 billion), Equities (CN¥13.26 billion), Private Equity (CN¥23.80 billion), Asset Management (CN¥1.39 billion), Wealth Management (CN¥9.32 billion), and Investment Banking (CN¥2.38 billion).

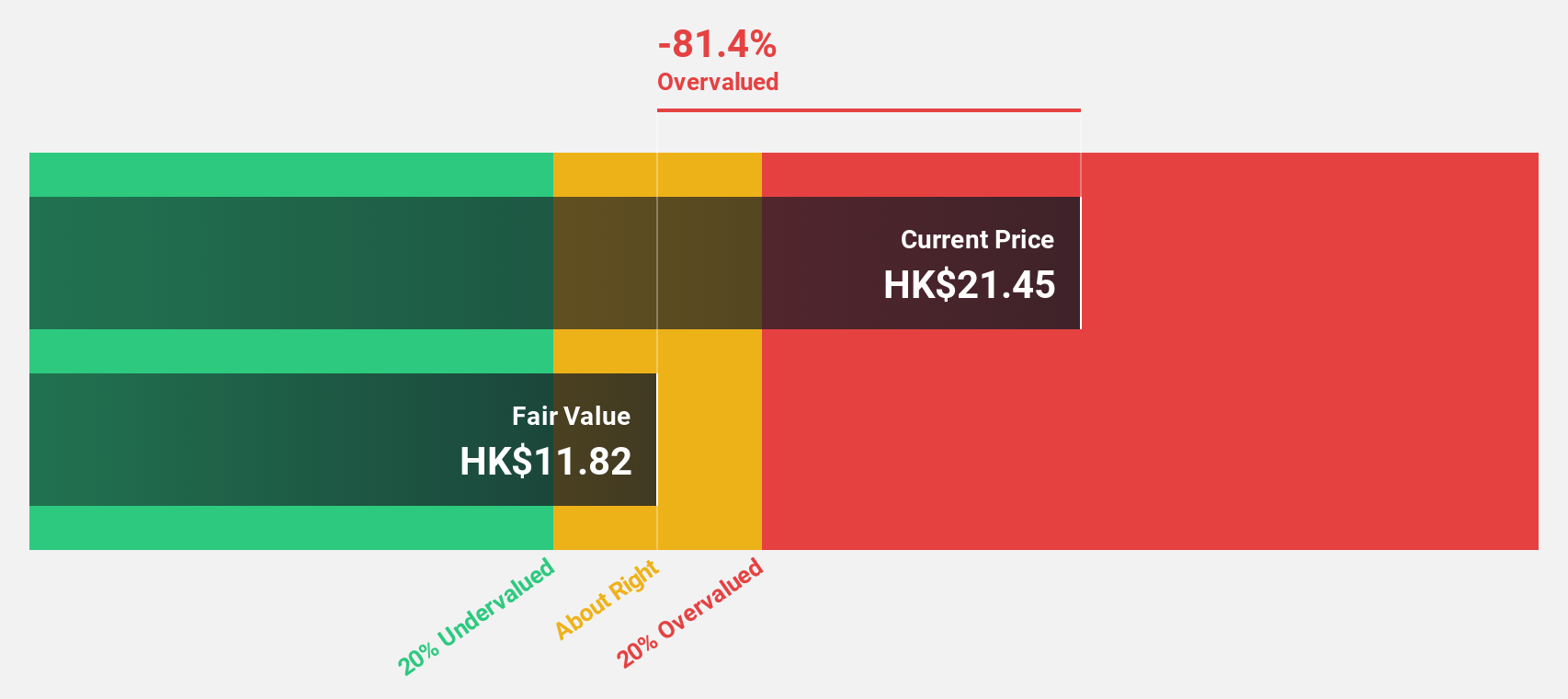

Estimated Discount To Fair Value: 10.4%

China International Capital Corporation is trading at HK$8.08, below its estimated fair value of HK$9.02, suggesting it may be undervalued based on cash flows. Despite a recent drop in revenue and net income for H1 2024, earnings are forecast to grow significantly at 22.4% annually, outpacing the Hong Kong market's expected growth of 11.7%. The company also proposed an interim dividend of RMB 0.9 per share for H1 2024.

- The growth report we've compiled suggests that China International Capital's future prospects could be on the up.

- Dive into the specifics of China International Capital here with our thorough financial health report.

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the apparel business in the People’s Republic of China with a market cap of HK$39.43 billion.

Operations: The company's revenue segments include Down Apparels (CN¥19.54 billion), Ladieswear Apparels (CN¥819.80 million), Diversified Apparels (CN¥235.33 million), and Original Equipment Manufacturing (OEM) Management (CN¥2.70 billion).

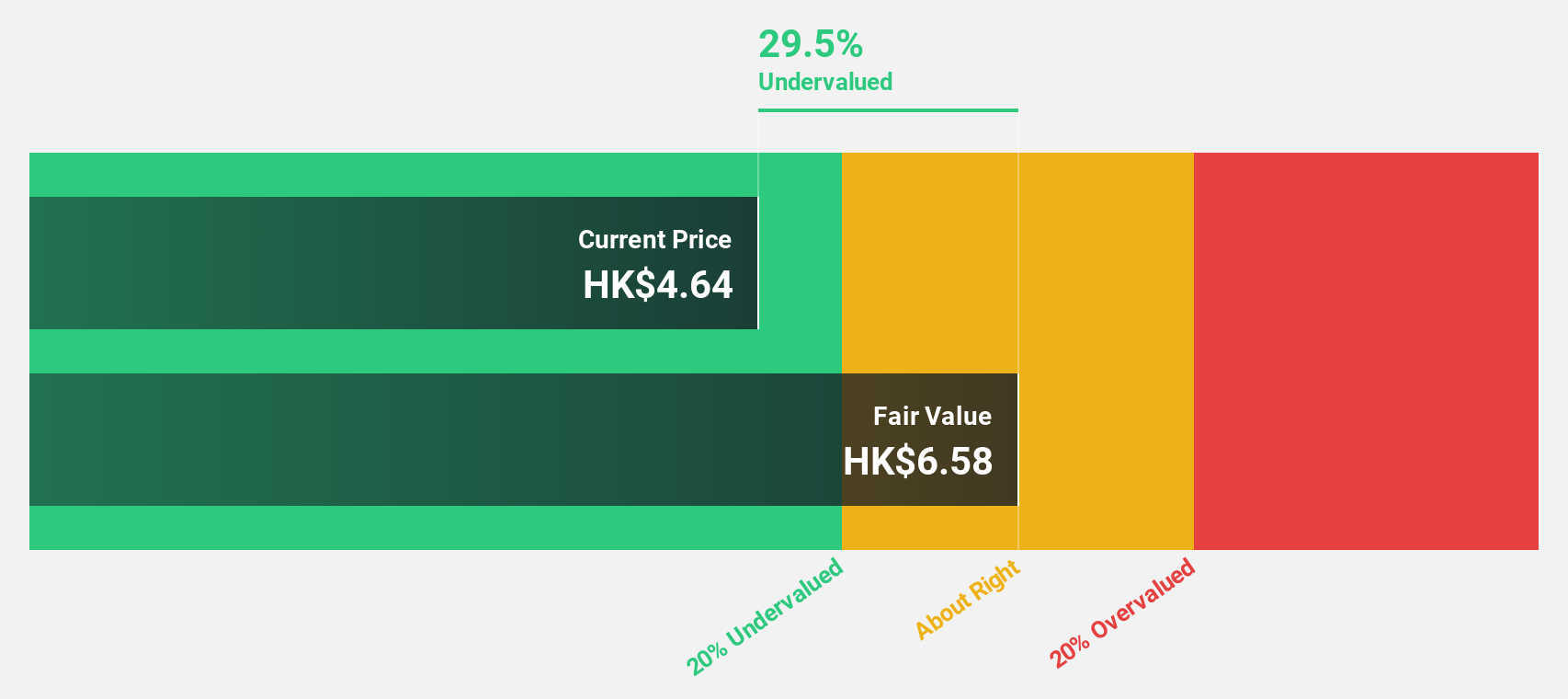

Estimated Discount To Fair Value: 46.6%

Bosideng International Holdings is trading at HK$3.6, significantly below its estimated fair value of HK$6.74, indicating potential undervaluation based on cash flows. The company reported strong earnings growth of 43.7% over the past year and forecasts suggest continued revenue growth at 11% annually, outpacing the Hong Kong market's 7.3%. Despite an unstable dividend track record, it recently approved a final dividend of HKD0.20 per share for FY2024, reflecting robust cash flow management.

- According our earnings growth report, there's an indication that Bosideng International Holdings might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Bosideng International Holdings.

Key Takeaways

- Gain an insight into the universe of 28 Undervalued SEHK Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides sensory experience solutions in Greater China, the United States, Europe, Other Asian countries, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives