- Hong Kong

- /

- Capital Markets

- /

- SEHK:3908

Could a Governance Overhaul at China International Capital (SEHK:3908) Shift Its Strategic Decision-Making Power?

Reviewed by Sasha Jovanovic

- China International Capital Corporation Limited has recently proposed the cancellation of its Supervisory Committee and related amendments to its Articles of Association, with these changes to be put to a shareholder vote at the upcoming AGM on October 31, 2025.

- This proposed governance shift marks a significant restructuring of the company's oversight mechanisms, a move that could reshape internal controls and future decision-making processes.

- We'll now consider how this planned change to the corporate governance structure may influence China International Capital's broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is China International Capital's Investment Narrative?

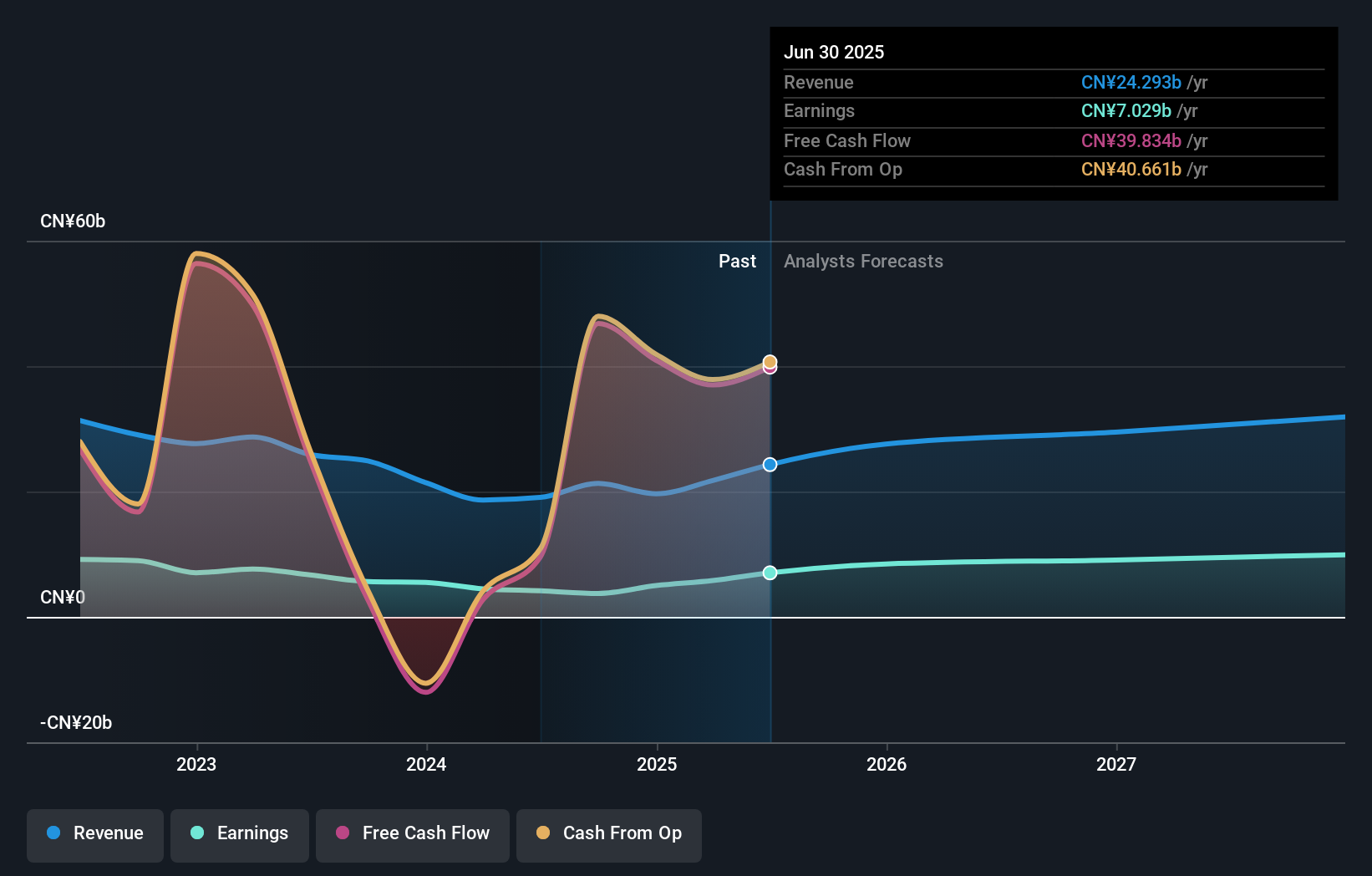

Any thesis for owning China International Capital stock rests on the belief that the company can continue delivering robust earnings growth and maintain its competitive edge in China’s capital markets, supported by stable governance and prudent risk controls. Recent company results showed sharp increases in both revenue and net income, outperforming the capital markets industry and the wider Hong Kong market, while the valuation remains relatively attractive compared to peers. However, the proposal to cancel the Supervisory Committee introduces fresh uncertainty. While it isn’t yet clear if this governance change will alter near-term catalysts like dividend approvals or operational momentum, it does introduce a new element into the risk profile that wasn’t there previously. Most investors will want to monitor upcoming shareholder responses and any signs that oversight or risk management standards may shift as a result of this restructuring.

But, in contrast to recent earnings momentum, governance risks are something investors should not overlook. China International Capital's shares are on the way up, but they could be overextended by 20%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on China International Capital - why the stock might be worth 17% less than the current price!

Build Your Own China International Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China International Capital research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free China International Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China International Capital's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3908

China International Capital

Provides financial services in Mainland China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives