- Hong Kong

- /

- Capital Markets

- /

- SEHK:388

Hong Kong Exchanges (SEHK:388): Evaluating Its Valuation After a Quiet Market Session

Reviewed by Simply Wall St

Hong Kong Exchanges and Clearing (SEHK:388) shares posted a mild move today, reflecting a quieter session for the wider Hong Kong market. Investors appear to be weighing recent trading activity while keeping an eye on longer-term performance trends.

See our latest analysis for Hong Kong Exchanges and Clearing.

After a robust start to the year, Hong Kong Exchanges and Clearing’s momentum has cooled in recent months. While the share price return has soared over 48% year-to-date, the 1-year total shareholder return of nearly 40% highlights how the longer-term growth story remains firmly intact, even as shorter periods have seen modest dips.

If you’re keen to see what other market leaders are attracting attention, now is an ideal moment to broaden your investing horizons by exploring fast growing stocks with high insider ownership.

But with shares now trading at a notable discount to analyst price targets, some investors are wondering if Hong Kong Exchanges and Clearing is now undervalued or if the market is simply factoring in all future growth already.

Most Popular Narrative: 14% Undervalued

The most widely followed narrative puts Hong Kong Exchanges and Clearing's fair value well above today's close, suggesting there are significant growth levers behind the price target.

Strategic investments in fintech, platform upgrades, and efficiency improvements, such as introducing severe weather trading, ongoing market microstructure enhancements, and studies into digital asset integration, should drive operational scalability and support long-term margin expansion.

Ready to uncover the strategy powering this aggressive valuation? The narrative centers on ambitious growth bets and margin expansion that could reshape future earnings, with bold projections you won’t want to miss. Dive in and see what’s fueling the analyst consensus.

Result: Fair Value of $494 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing competition from mainland exchanges and potential regulatory shifts could dampen new listings and long-term trading volumes for Hong Kong Exchanges and Clearing.

Find out about the key risks to this Hong Kong Exchanges and Clearing narrative.

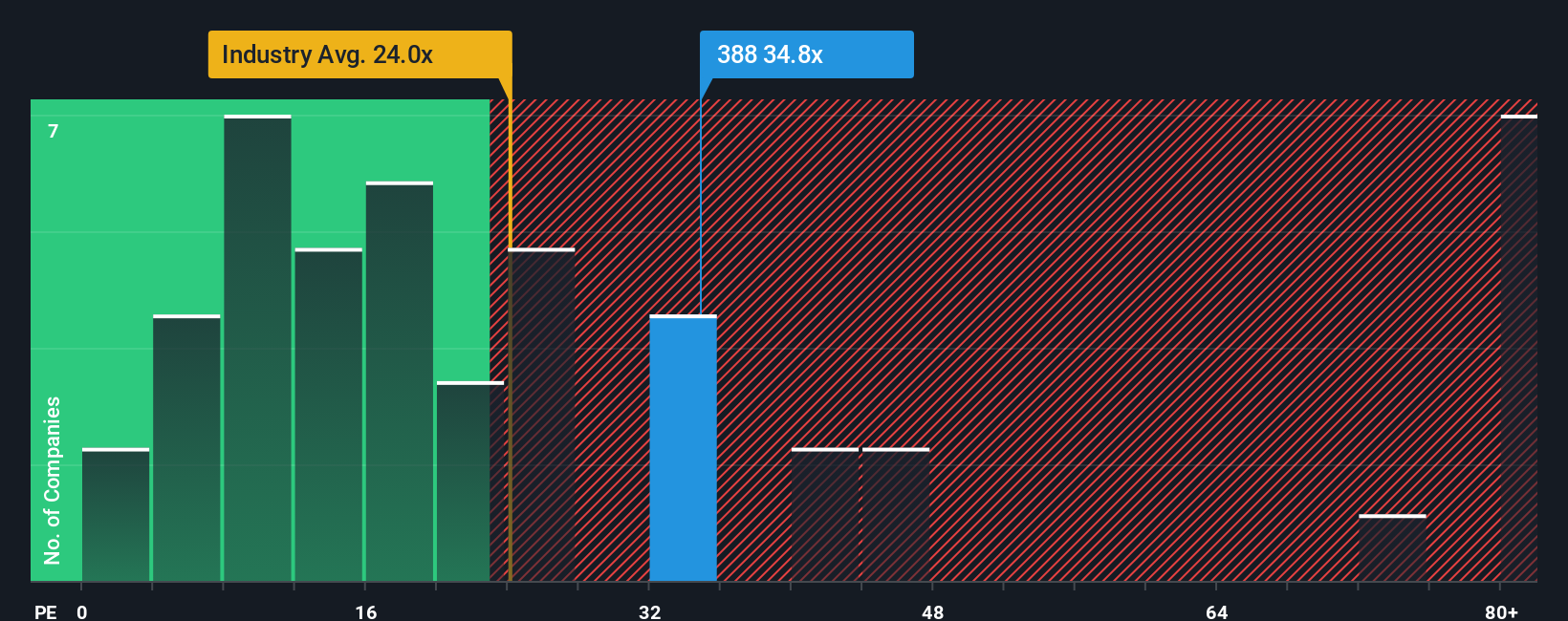

Another View: Multiples Suggest a Different Story

Looking at price-to-earnings compared to peers tells a different tale for Hong Kong Exchanges and Clearing. With a P/E ratio of 34.8x, it trades much higher than the industry average of 23.1x and the fair ratio of 15.7x. This could indicate that the stock might be overvalued on this basis. It raises questions about valuation risk if market sentiment shifts. Which measure will investors trust most as market conditions change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hong Kong Exchanges and Clearing Narrative

If you have your own perspective or want to dig deeper, it's quick and easy to analyze the data and craft your own unique view. Do it your way.

A great starting point for your Hong Kong Exchanges and Clearing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your investment options when unique opportunities are just a click away. The right screener could point you to tomorrow’s breakout stocks. Start your search with confidence and see what you could be missing.

- Capitalize on tomorrow's innovation by checking out these 27 quantum computing stocks, which drives advancements in quantum computing and shapes the next era of tech disruption.

- Boost your income stream by selecting these 17 dividend stocks with yields > 3%, offering yields above 3% and strengthening your portfolio with reliable payouts.

- Uncover fast-moving trends with these 27 AI penny stocks, as these companies revolutionize industries through artificial intelligence breakthroughs and bold new market approaches.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Exchanges and Clearing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:388

Hong Kong Exchanges and Clearing

Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives