- Hong Kong

- /

- Capital Markets

- /

- SEHK:388

Hong Kong Exchanges and Clearing (SEHK:388) Valuation Revisited After Liquidity Reforms and Rising Chinese Tech Listing Interest

Reviewed by Simply Wall St

Hong Kong Exchanges and Clearing (SEHK:388) is back in focus as fresh listing interest from Chinese AI and chipmakers coincides with new liquidity friendly reforms, a mix that could subtly reshape its earnings profile.

See our latest analysis for Hong Kong Exchanges and Clearing.

The mix of new AI linked listings and liquidity reforms is landing against a backdrop where the latest HK$407 share price reflects a strong year to date share price return. However, the 3 year and 5 year total shareholder returns point to more moderate longer term compounding, suggesting momentum has recently rebuilt as investors reassess the exchange operator’s growth prospects.

If these reforms have you thinking more broadly about where capital could flow next, it might be worth exploring high growth tech and AI stocks as another way to find potential beneficiaries of the AI fundraising wave.

With earnings still compounding, new listing pipelines opening and the shares trading roughly 24 percent below consensus price targets, the key question is whether this is a genuine entry point or if the market is already pricing in the next growth leg.

Most Popular Narrative Narrative: 19.4% Undervalued

With Hong Kong Exchanges and Clearing last closing at HK$407 against a narrative fair value near HK$505, the valuation hinges on robust medium term earnings power.

Product diversification via successful expansion into derivatives, ETPs, commodities, fixed income, and ESG related offerings has created new recurring and higher margin revenue streams, reducing reliance on traditional cash equities and enhancing overall earnings stability.

Curious how modest revenue growth, fatter margins and a richer future earnings multiple can still add up to double digit upside Potential? Dig into the full narrative and see which long term assumptions really do the heavy lifting in that fair value estimate.

Result: Fair Value of HK$504.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained competition for China related IPOs and any tightening of cross border capital flows could quickly challenge those optimistic growth and valuation assumptions.

Find out about the key risks to this Hong Kong Exchanges and Clearing narrative.

Another Angle on Valuation

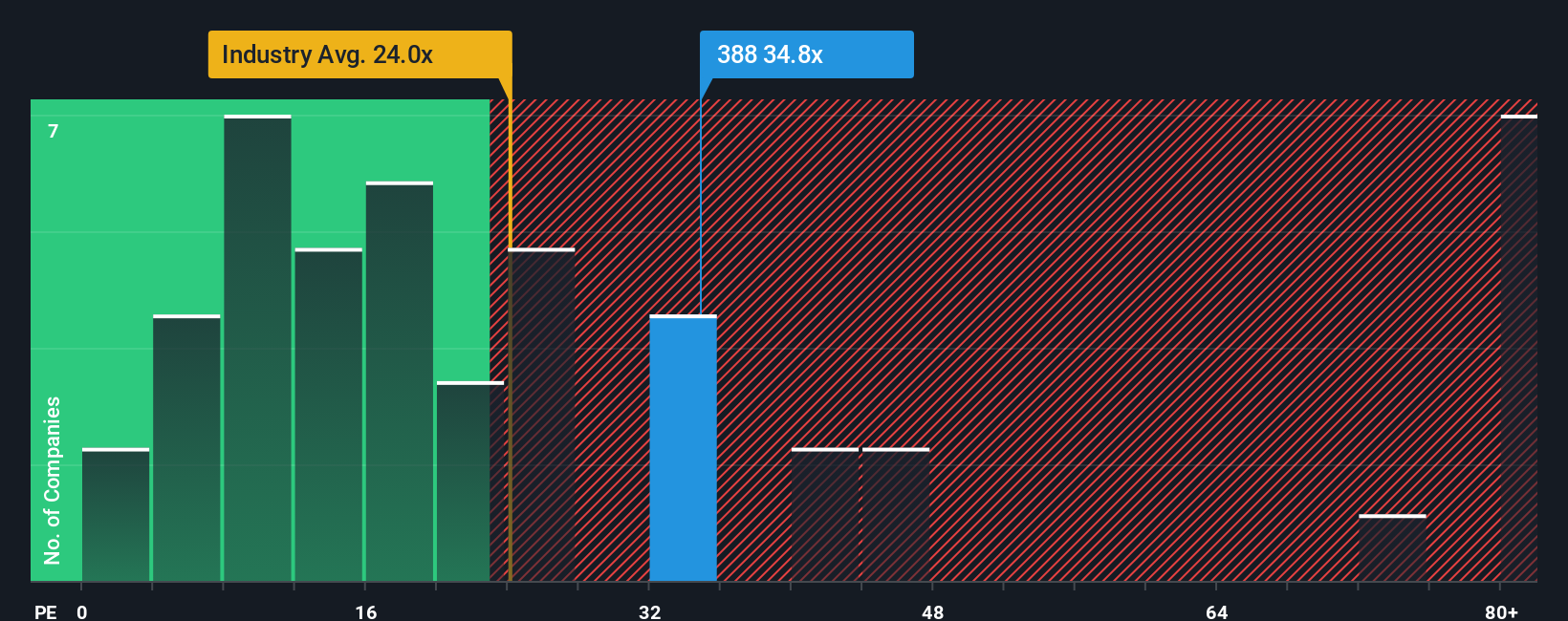

Against that optimistic narrative of fair value, a straight price to earnings lens looks far less forgiving. Hong Kong Exchanges and Clearing trades on about 29.9 times earnings, versus an industry average near 19.8 times and a fair ratio closer to 12 times, which implies meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hong Kong Exchanges and Clearing Narrative

If you see the story differently or want to lean on your own homework, you can quickly build a custom view in minutes with Do it your way.

A great starting point for your Hong Kong Exchanges and Clearing research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning targeted stock ideas in minutes with our powerful, filter rich Simply Wall Street Screener.

- Capture early stage upside by reviewing these 3625 penny stocks with strong financials. These combine smaller market caps with surprisingly resilient balance sheets and improving cash flow trends.

- Explore the AI theme by targeting these 25 AI penny stocks that are involved in machine learning, automation, and data infrastructure.

- Review these 914 undervalued stocks based on cash flows to find stocks where cash flow based valuations may indicate potential mispricing that some investors have not yet recognized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hong Kong Exchanges and Clearing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:388

Hong Kong Exchanges and Clearing

Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion