- Hong Kong

- /

- Capital Markets

- /

- SEHK:388

Have Recent Connect Scheme Changes Made HKEX Too Pricey for Investors in 2025?

Reviewed by Bailey Pemberton

If you’re eyeing Hong Kong Exchanges and Clearing (HKEX) and wondering what comes next, you’re not alone. This is the type of stock that draws in both long-term investors hunting for steady growth and active traders hoping for short-term moves. Over the past year, HKEX has delivered a 39.1% gain, with a 104.0% total return over three years. These figures catch the attention of any market watcher. However, the journey has not been a straight climb; the past month saw a dip of 3.6%, and the recent week declined by 0.6%. This raises the question of whether these pullbacks signal flagging momentum or are simply healthy pauses in a larger story.

Much of this activity has been influenced by regulatory developments and cross-border investment flows. Recent headlines, such as the further opening of the Connect schemes and policy signals from mainland China, have placed HKEX in the spotlight as a vital gateway market. This context is fueling a broader conversation about risk, opportunity, and whether the current price truly reflects future potential.

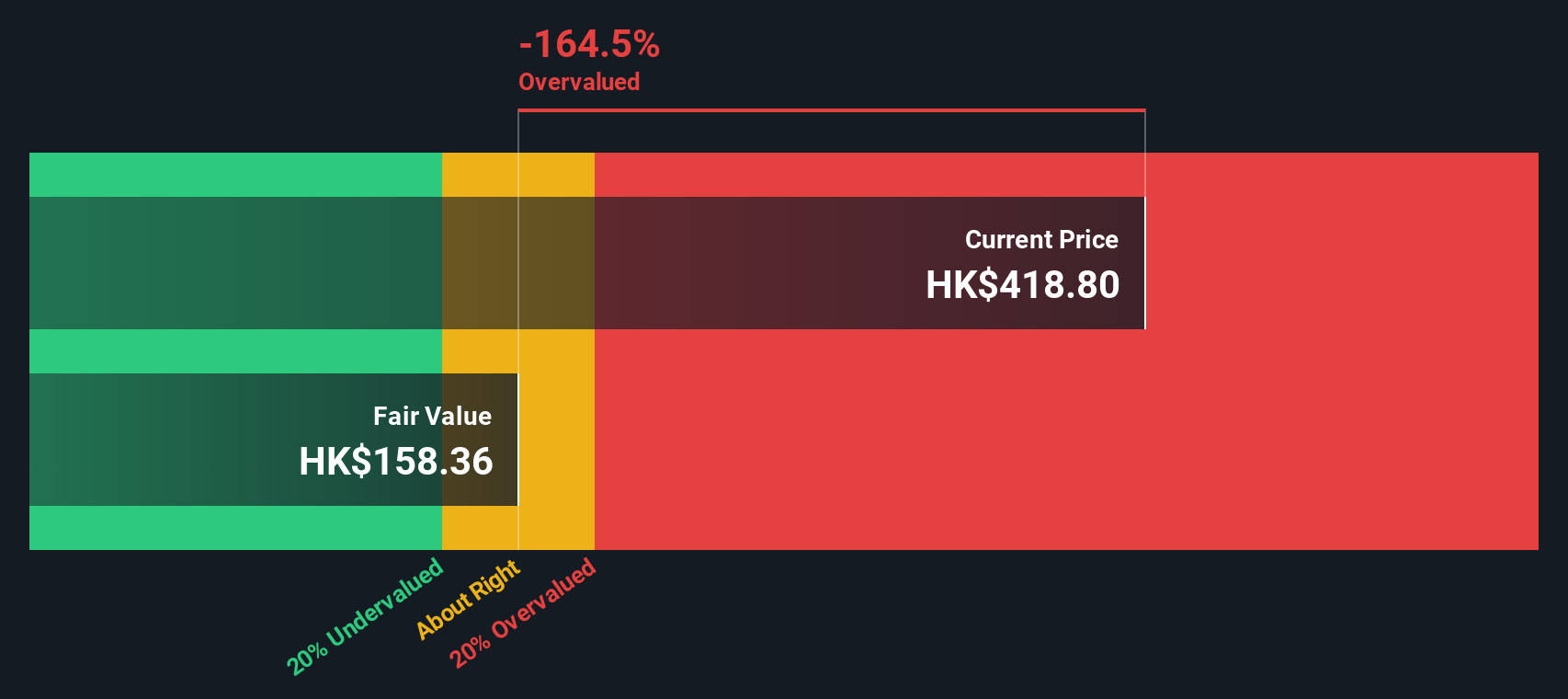

If you are looking for a quick answer from the numbers, HKEX scores a 0 on our value scorecard. According to our six standard valuation checks, the stock does not currently appear undervalued. However, that is only the starting point. Next, let’s explore the actual valuation approaches investors use and discuss a more insightful way to think about what HKEX is really worth.

Hong Kong Exchanges and Clearing scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hong Kong Exchanges and Clearing Excess Returns Analysis

The Excess Returns valuation approach measures how much profit a company generates in excess of its cost of equity. This method highlights whether a business is creating value above what investors could expect elsewhere given the risks involved. For Hong Kong Exchanges and Clearing, this model uses both current results and projections for key metrics.

- Book Value: HK$45.03 per share

- Stable EPS: HK$13.81 per share (Source: Weighted future Return on Equity estimates from 18 analysts.)

- Cost of Equity: HK$3.75 per share

- Excess Return: HK$10.06 per share

- Average Return on Equity: 29.99%

- Stable Book Value: HK$46.06 per share (Source: Weighted future Book Value estimates from 13 analysts.)

These numbers show HKEX has delivered strong and consistent returns above its cost of equity. However, the Excess Returns model calculates an intrinsic value much lower than the current market price. This suggests expectations may have run ahead of fundamentals. Specifically, the implied discount signals the stock is 82.7% overvalued using this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Hong Kong Exchanges and Clearing may be overvalued by 82.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hong Kong Exchanges and Clearing Price vs Earnings

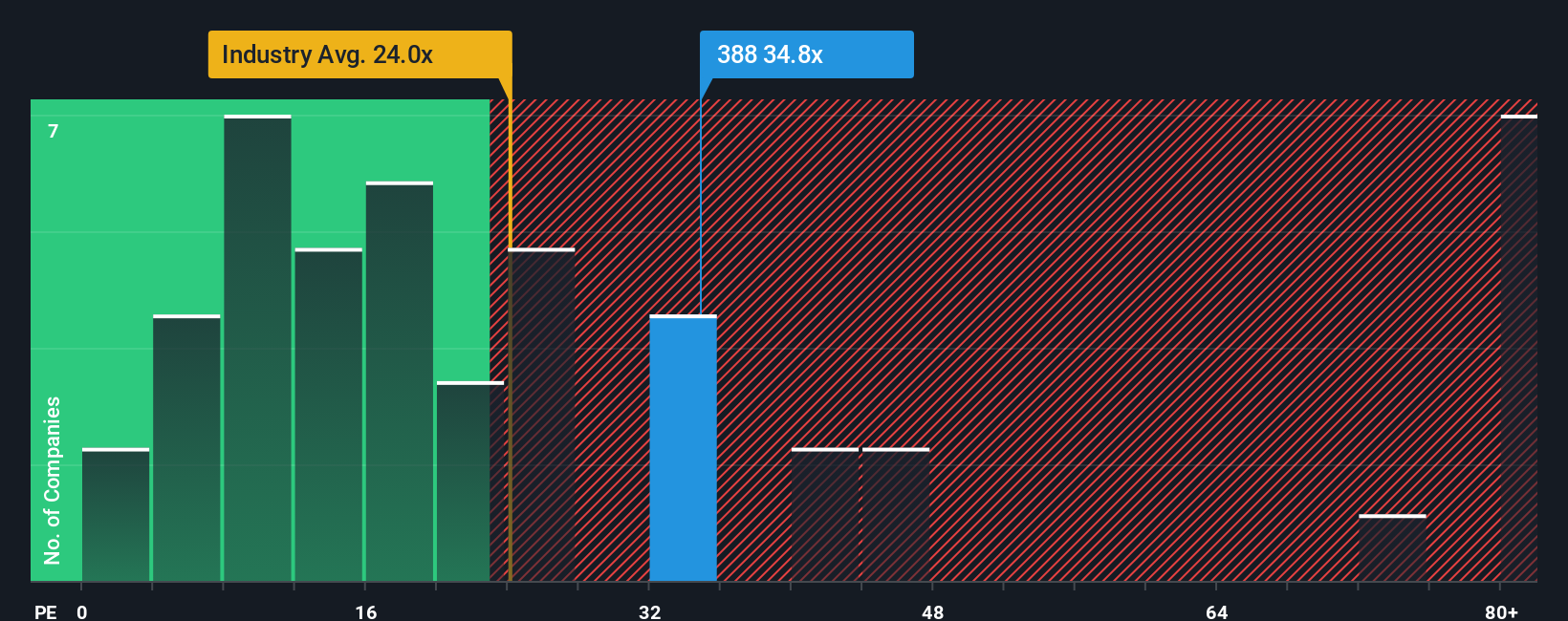

For profitable companies like Hong Kong Exchanges and Clearing, the Price-to-Earnings (PE) ratio is a widely used metric because it connects the market price directly to how much profit a company is generating for its shareholders. Investors often look to the PE ratio as a quick gauge of how expensive or cheap a stock appears relative to its profitability.

However, what counts as a “normal” or “fair” PE ratio depends on more than just profits. Growth expectations, risk profile, and the general mood in the market all influence whether a high PE is justified or a low PE is warranted. High-growth companies typically command higher PE ratios, while those facing uncertainties or slowdowns might trade at a discount.

Currently, Hong Kong Exchanges and Clearing trades at a PE of 34.5x. This is well above the industry average of 22.9x and the peer average of 13.7x. This suggests that investors have priced in significant growth or a quality premium. To get a more customized benchmark, Simply Wall St's “Fair Ratio” weighs key specifics such as HKEX’s earnings growth, industry dynamics, profit margins, size, and the risks in its operating environment. Unlike broad industry or peer averages, this Fair Ratio is tailored to HKEX’s own situation and comes in at 15.7x.

Comparing the Fair Ratio (15.7x) to the actual PE (34.5x), HKEX appears substantially overvalued on this metric. The current price suggests the market is paying a significant premium relative to what would be considered fair based on the company’s fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hong Kong Exchanges and Clearing Narrative

Earlier, we mentioned that there’s an even smarter way to think about valuation, so let’s introduce Narratives. A Narrative is your story or perspective on a company, going beyond plain numbers to link your view about its journey, your assumptions for fair value, future revenue, earnings, and margins, to a tangible financial forecast and a clear estimate of what it’s really worth.

Narratives make investing more dynamic and personal by helping you document your reasoning and see how your story stacks up against the latest data. This is all available in an easy-to-use tool on Simply Wall St’s Community page, trusted by millions of investors. With Narratives, you can make buy or sell decisions by directly comparing your calculated Fair Value with the current Price. Your Narrative automatically updates whenever fresh news or new earnings are released.

For example, two investors using Narratives for Hong Kong Exchanges and Clearing might reach very different conclusions. One expects the company’s revenue and profit margins to surge and sets an optimistic fair value of HK$542.0 per share, while another sees competitive risks limiting growth and assigns a much lower value around HK$340.0 per share. Narratives give you the confidence to act on your own informed, updated view, whatever your story may be.

Do you think there's more to the story for Hong Kong Exchanges and Clearing? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hong Kong Exchanges and Clearing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:388

Hong Kong Exchanges and Clearing

Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion