- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3877

Investors Aren't Buying CSSC (Hong Kong) Shipping Company Limited's (HKG:3877) Earnings

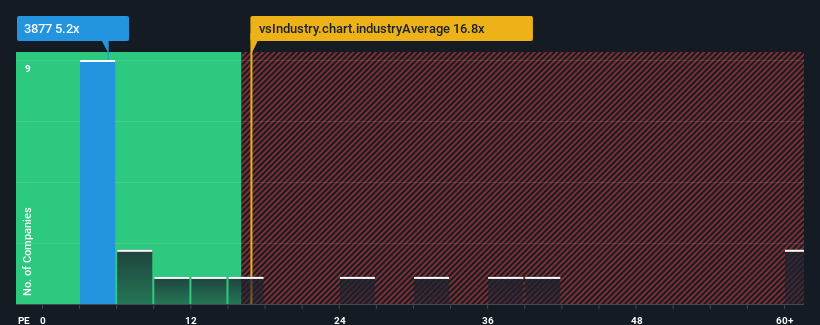

With a price-to-earnings (or "P/E") ratio of 5.2x CSSC (Hong Kong) Shipping Company Limited (HKG:3877) may be sending very bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 12x and even P/E's higher than 23x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, CSSC (Hong Kong) Shipping has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for CSSC (Hong Kong) Shipping

Is There Any Growth For CSSC (Hong Kong) Shipping?

The only time you'd be truly comfortable seeing a P/E as depressed as CSSC (Hong Kong) Shipping's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 10%. This was backed up an excellent period prior to see EPS up by 54% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 7.1% per year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 15% per annum growth forecast for the broader market.

With this information, we can see why CSSC (Hong Kong) Shipping is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of CSSC (Hong Kong) Shipping's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for CSSC (Hong Kong) Shipping that you need to be mindful of.

If you're unsure about the strength of CSSC (Hong Kong) Shipping's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3877

CSSC (Hong Kong) Shipping

Operates as a shipyard-affiliated leasing company in People Republic of China, Asia, the United States, and Europe.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026