- Singapore

- /

- Construction

- /

- SGX:5CF

Discover November 2025's Promising Asian Penny Stocks

Reviewed by Simply Wall St

As Asian markets continue to navigate a complex global landscape, investor optimism is buoyed by the performance of technology and AI-related sectors. Amidst this backdrop, penny stocks—often representing smaller or newer companies—remain an intriguing option for investors seeking affordability combined with growth potential. Despite their vintage-sounding name, these stocks hold relevance today as we explore several that stand out for their financial strength and potential opportunities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect Medical Health Management (SEHK:1830) | HK$1.40 | HK$1.76B | ✅ 2 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.07 | SGD433.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Cal-Comp Electronics (Thailand) (SET:CCET) | THB4.62 | THB48.28B | ✅ 4 ⚠️ 3 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.45 | SGD168.58M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 956 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Allied Group (SEHK:373)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allied Group Limited is an investment holding company involved in property investment and development, as well as financial services across Hong Kong, the People's Republic of China, Europe, and internationally, with a market cap of HK$7.45 billion.

Operations: The company's revenue is primarily derived from property development (HK$7.61 billion), consumer finance (HK$3.18 billion), healthcare services (HK$1.54 billion), property investment (HK$891.3 million), investment and finance activities (HK$715.1 million), property management (HK$376.5 million), and elderly care services (HK$249.3 million).

Market Cap: HK$7.45B

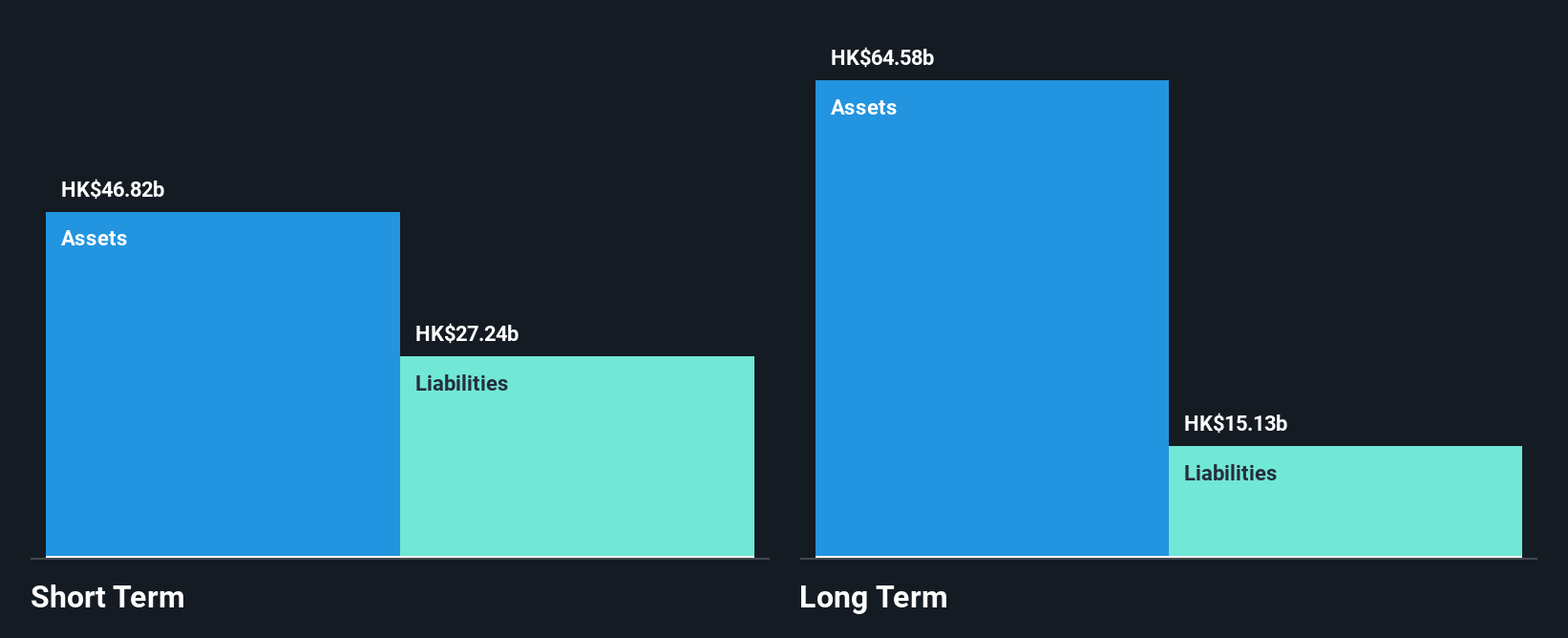

Allied Group has shown a significant reduction in its debt to equity ratio from 43.8% to 26.8% over the past five years, indicating improved financial stability. Its seasoned management and board, with average tenures of 13.9 and 22.7 years respectively, provide experienced leadership. The company has become profitable recently, although its earnings have declined by an average of 46% annually over the past five years, highlighting volatility in performance. With a market cap of HK$7.45 billion and diverse revenue streams primarily from property development and consumer finance, Allied Group's short-term assets significantly exceed both its short- and long-term liabilities.

- Unlock comprehensive insights into our analysis of Allied Group stock in this financial health report.

- Learn about Allied Group's historical performance here.

OKP Holdings (SGX:5CF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OKP Holdings Limited, with a market cap of SGD346.87 million, operates as a transport infrastructure and civil engineering company in Singapore and Australia.

Operations: The company's revenue is derived from Maintenance (SGD66.95 million), Construction (SGD151.86 million), and Rental Income (SGD4.83 million).

Market Cap: SGD346.87M

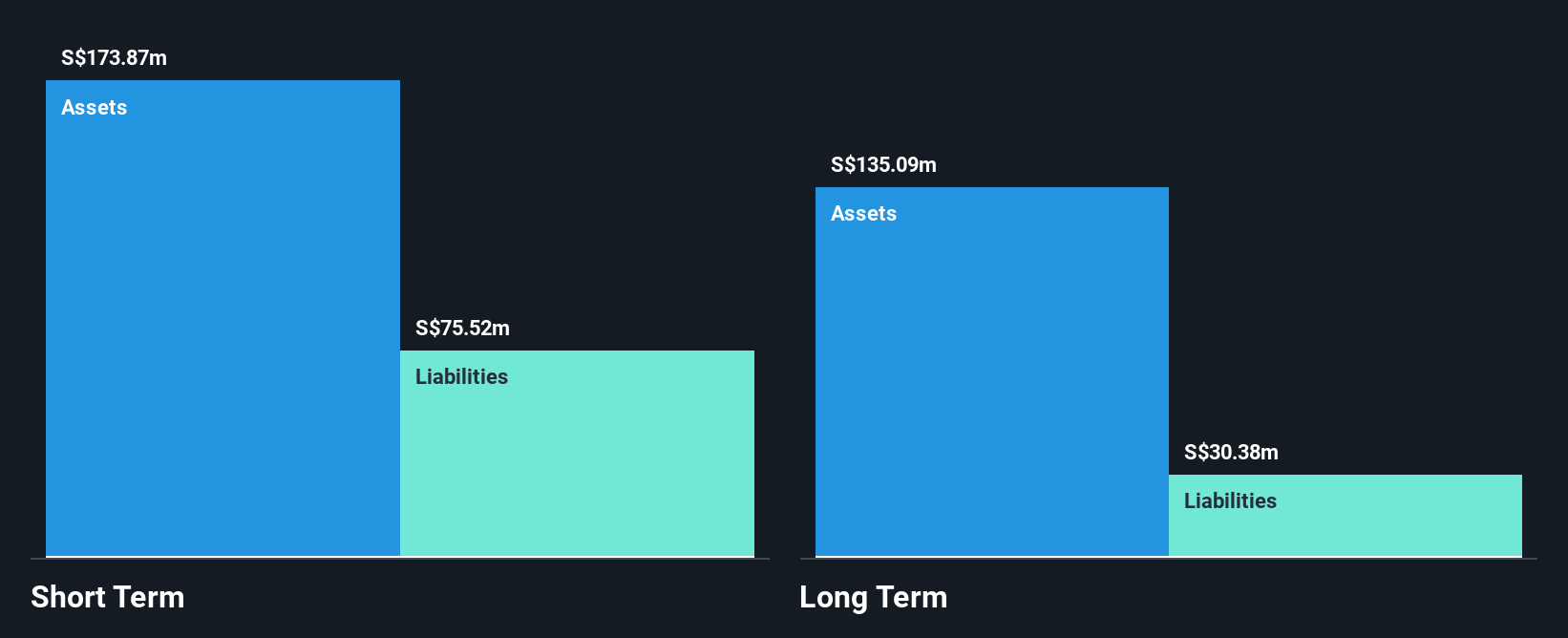

OKP Holdings has demonstrated robust financial health, with earnings growing by 95.9% over the past year, significantly outpacing the construction industry. Its net profit margins have improved to 19.3%, and its debt is well-covered by operating cash flow at 163%. The company benefits from a seasoned board and management team with average tenures of 23.7 and 33.8 years, respectively. Despite having more cash than total debt and trading below estimated fair value, OKP's return on equity remains low at 18.5%, and it has an unstable dividend track record which may concern some investors seeking consistent income streams.

- Click to explore a detailed breakdown of our findings in OKP Holdings' financial health report.

- Examine OKP Holdings' past performance report to understand how it has performed in prior years.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: V V Food & Beverage Co., Ltd operates in the research, development, production, and sale of soybean milk powder, plant protein beverages, dairy products, tea, and other products both in China and internationally with a market cap of CN¥5.76 billion.

Operations: V V Food & Beverage Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥5.76B

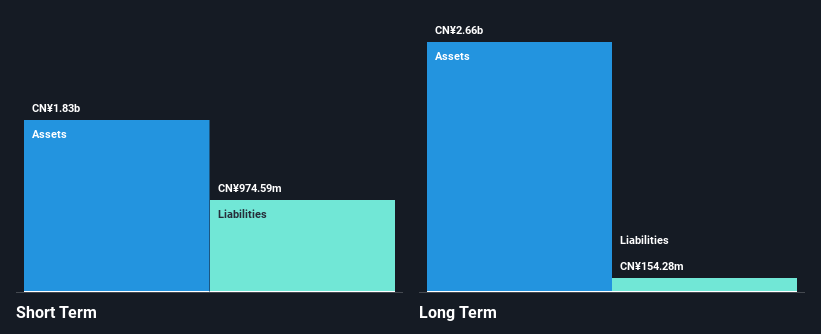

V V Food & Beverage Co., Ltd has shown financial resilience, with short-term assets of CN¥2.2 billion comfortably covering both short and long-term liabilities. The company's debt-to-equity ratio has significantly reduced to 7% over five years, and its operating cash flow covers debt well at 342.4%. Earnings have grown by 26.4% in the past year, surpassing industry averages, while net profit margins improved to 12.1%. Despite these positives, the company's return on equity is low at 11.3%, and it maintains an unstable dividend track record which may deter income-focused investors seeking stability.

- Click here and access our complete financial health analysis report to understand the dynamics of V V Food & BeverageLtd.

- Explore historical data to track V V Food & BeverageLtd's performance over time in our past results report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 956 Asian Penny Stocks here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5CF

OKP Holdings

Together with its subsidiary, operates as a transport infrastructure and civil engineering company in Singapore and Australia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026