- Hong Kong

- /

- Consumer Finance

- /

- SEHK:373

Allied Group Limited's (HKG:373) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

- Allied Group to hold its Annual General Meeting on 30th of May

- CEO Seng-Hui Lee's total compensation includes salary of HK$8.88m

- The total compensation is 851% higher than the average for the industry

- Allied Group's EPS declined by 72% over the past three years while total shareholder loss over the past three years was 46%

The results at Allied Group Limited (HKG:373) have been quite disappointing recently and CEO Seng-Hui Lee bears some responsibility for this. At the upcoming AGM on 30th of May, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

Check out our latest analysis for Allied Group

How Does Total Compensation For Seng-Hui Lee Compare With Other Companies In The Industry?

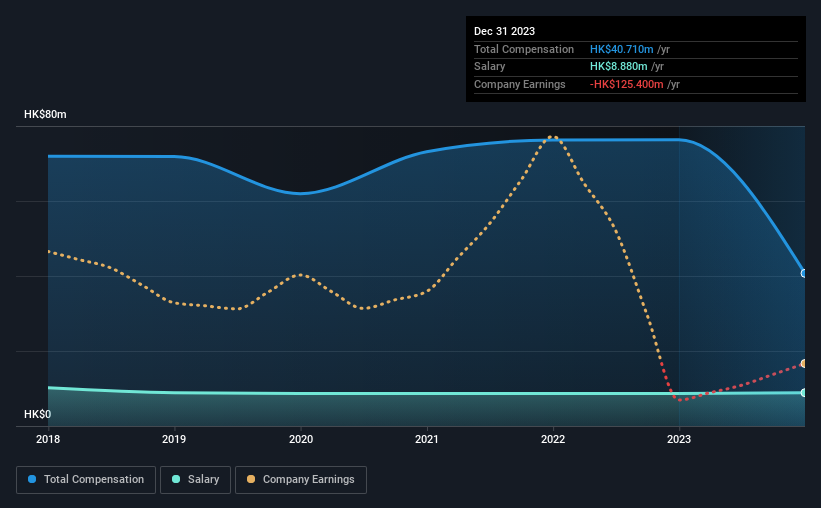

At the time of writing, our data shows that Allied Group Limited has a market capitalization of HK$5.3b, and reported total annual CEO compensation of HK$41m for the year to December 2023. That's a notable decrease of 47% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$8.9m.

On examining similar-sized companies in the Hong Kong Consumer Finance industry with market capitalizations between HK$3.1b and HK$12b, we discovered that the median CEO total compensation of that group was HK$4.3m. Accordingly, our analysis reveals that Allied Group Limited pays Seng-Hui Lee north of the industry median. Moreover, Seng-Hui Lee also holds HK$697k worth of Allied Group stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$8.9m | HK$8.7m | 22% |

| Other | HK$32m | HK$68m | 78% |

| Total Compensation | HK$41m | HK$76m | 100% |

Talking in terms of the industry, salary represented approximately 78% of total compensation out of all the companies we analyzed, while other remuneration made up 22% of the pie. In Allied Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Allied Group Limited's Growth

Over the last three years, Allied Group Limited has shrunk its earnings per share by 72% per year. It saw its revenue drop 31% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Allied Group Limited Been A Good Investment?

With a total shareholder return of -46% over three years, Allied Group Limited shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Allied Group that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:373

Allied Group

An investment holding company, engages in the property investment and development, and financial service businesses in Hong Kong, the People's Republic of China, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success