- Hong Kong

- /

- Capital Markets

- /

- SEHK:3678

Why We Think Holly Futures Co., Ltd.'s (HKG:3678) CEO Compensation Is Not Excessive At All

Shareholders may be wondering what CEO Jianqiu Zhou plans to do to improve the less than great performance at Holly Futures Co., Ltd. (HKG:3678) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 14 May 2021. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for Holly Futures

How Does Total Compensation For Jianqiu Zhou Compare With Other Companies In The Industry?

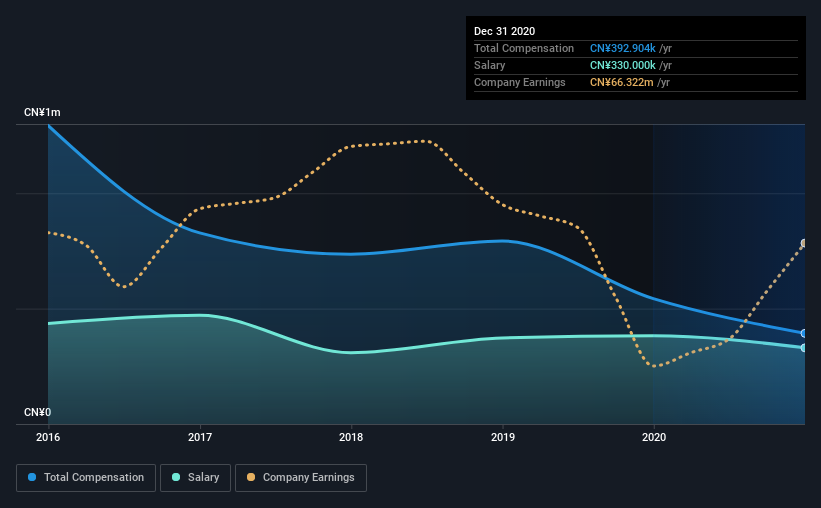

According to our data, Holly Futures Co., Ltd. has a market capitalization of HK$807m, and paid its CEO total annual compensation worth CN¥393k over the year to December 2020. That's a notable decrease of 28% on last year. We note that the salary portion, which stands at CN¥330.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥1.6m. That is to say, Jianqiu Zhou is paid under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥330k | CN¥382k | 84% |

| Other | CN¥63k | CN¥161k | 16% |

| Total Compensation | CN¥393k | CN¥543k | 100% |

On an industry level, around 85% of total compensation represents salary and 15% is other remuneration. Our data reveals that Holly Futures allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Holly Futures Co., Ltd.'s Growth Numbers

Holly Futures Co., Ltd. has reduced its earnings per share by 13% a year over the last three years. It achieved revenue growth of 143% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Holly Futures Co., Ltd. Been A Good Investment?

With a three year total loss of 26% for the shareholders, Holly Futures Co., Ltd. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The fact that shareholders have earned a negative share price return is certainly disconcerting. The fact that earnings growth has gone backwards could be a factor for the downward trend in the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 2 warning signs (and 1 which shouldn't be ignored) in Holly Futures we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Holly Futures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3678

Holly Futures

Operates as a futures company in Mainland China and Hong Kong.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives