- Hong Kong

- /

- Capital Markets

- /

- SEHK:290

Reflecting on China Fortune Financial Group's (HKG:290) Share Price Returns Over The Last Three Years

China Fortune Financial Group Limited (HKG:290) shareholders should be happy to see the share price up 15% in the last week. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 71% in the last three years. So it sure is nice to see a bit of an improvement. The thing to think about is whether the business has really turned around.

View our latest analysis for China Fortune Financial Group

China Fortune Financial Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, China Fortune Financial Group saw its revenue grow by 33% per year, compound. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 20% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

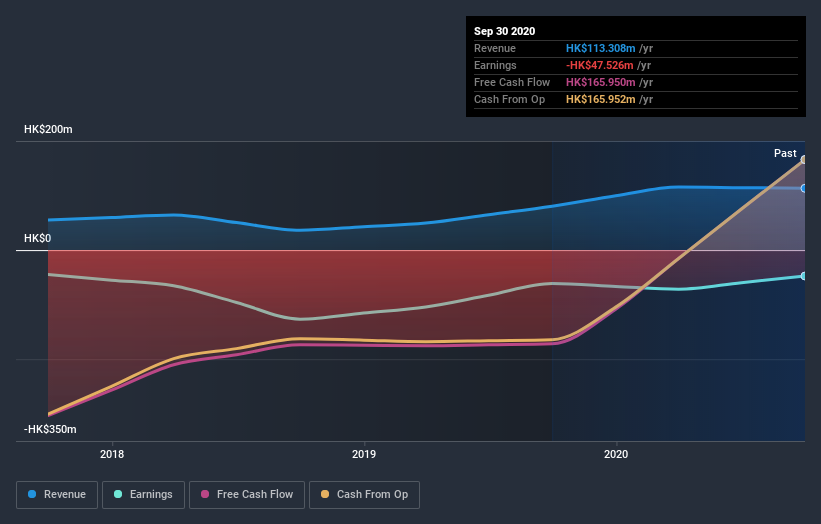

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in China Fortune Financial Group had a tough year, with a total loss of 14%, against a market gain of about 7.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 9% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for China Fortune Financial Group (1 is concerning) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading China Fortune Financial Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:290

GoFintech Quantum Innovation

An investment holding company, provides securities and insurance brokerage, equity investment, asset management, margin and corporate finance, money lending, and supply chain operation services in Hong Kong and the People’s Republic of China.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives